Yes, there is a way, sweetrain.

We can use the Class tracking feature in QuickBooks Desktop. Doing so will help you create only one invoice to record all the lessons for daily sales.

First, let's turn on the feature:

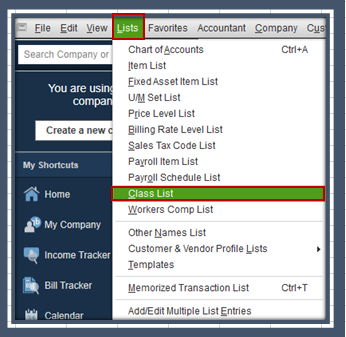

- Go to the Lists menu, then select Class List.

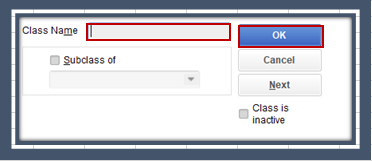

- From the Class drop-down menu, select New.

- Enter the lesson as the class name.

- Click OK to add it.

Then, make sure the Class column is turned on in the invoice template:

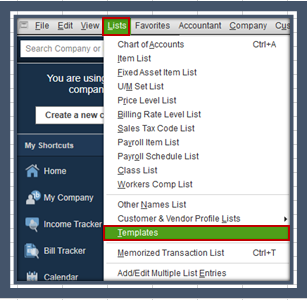

- From the Lists menu, select Templates.

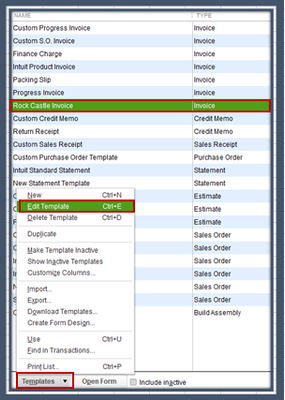

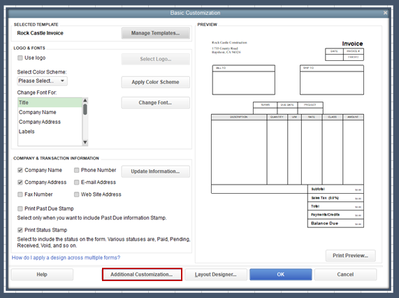

- Click the invoice template you want to use, then click the Templates drop-down menu. Select Edit Template

- Choose Additional Customization.

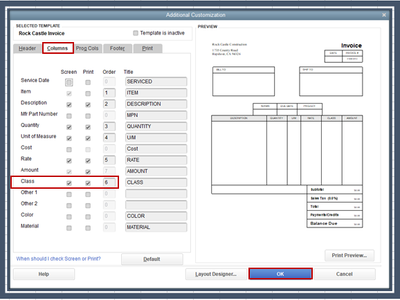

- Go to Columns, then place a checkmark beside Class.

- Once done, click OK twice.

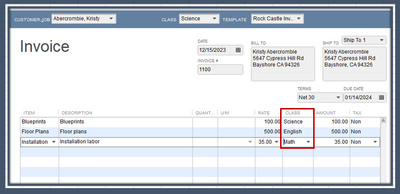

Once done, you can create an invoice and select the classes you want to include in the transaction. For visual reference, I've added a screenshot below.

If you have any other concerns or questions about managing your transactions, please don't hesitate to add a comment below. I'll be glad to help you out.