Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

Buy nowWhat expense are you trying to enter? And I'm not sure what you mean by manual entry. Here are a couple of examples that may be along the lines of what you're asking....

If you go into a store and buy a notebook with your Credit Card: You'd go to your Credit Card account; enter the store Name (if it's not an existing Vendor, QBs will ask you to enter it); enter the Amount; enter Office Supplies as the Expense Account. And it may not been needed in a simple purchase like this, but don't over look the Memo field so weeks or months later when your Acct. asks what was X purchase for.

If you took a Taxi and paid Cash: Open your Cash account; enter the Name (I use a generic Other Name of Taxi/Car Service); enter the Amount; enter Travel (or what ever your accountant wants) as the Expense Account; enter the client or reason in the Memo field.

Sorry if that's not what you're looking for. Give us some more specifics and we'll see what we can do to help.

How do you do it in Desktop Pro Plus 2021?

Do what in 2021? Did you have a specific question?

My original post is very generic, depends what you're trying to do. But what I posted is part of what I do in QB2021. There are Vendor Invoice entries, Register entries as I mentioned before, Client Invoices you send out to get paid. Lots of different parts to QBs.

If you are brand new to QBs, you might want to watch some of the may videos out there on how QBs works. Then come back with specific questions that you're not sure about doing. A "How To" manual is not really easy to do on this or any forum.

You've come to the right place, @gpwelding.

You can either write a check or record a credit card transaction to add your expenses manually to QuickBooks Desktop Pro Plus 2021. I can guide you on how to do it.

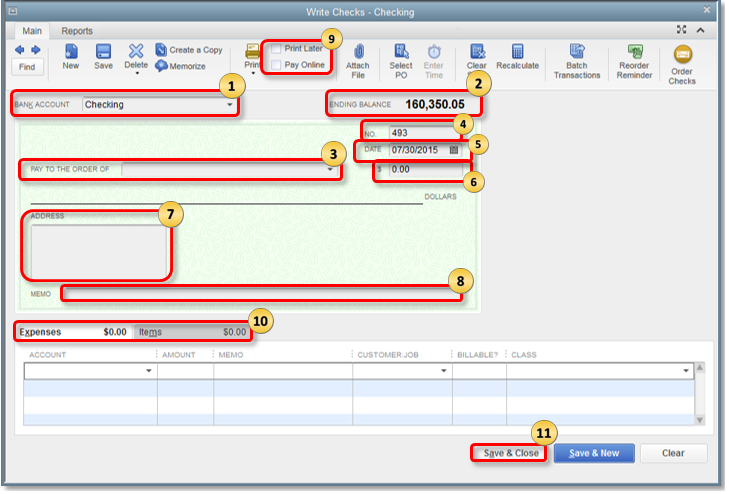

Here's how to write a check:

You can read through this article for more insights about the process: Create, modify, and print checks.

However, if you used your credit card in purchasing or paying your transaction, you can record your credit card charges. Here's how:

You can refer to this article for more detailed steps: Set up, use, and pay credit card accounts.

Get back to us here if you have other questions about managing your expenses in QuickBooks. I'm just a few clicks away.

How do I add a cash expense in quickbooks desktop pro plus 2021? I was able to do that in quickbooks online but the desktop does not have a place to add cash expense at least one I can find?

Hi there, gpwelding.

Unlike the online version, QuickBooks Desktop does not have an Expense transaction that you can use to record cash-based expenses. As a work around, you can create a petty cash acount. Then, use it when creating a check. Here's how:

Once done, use this petty cash account in the Bank Account field when recording the expense through the Write Checks feature.

You'll also want to check this article for guidance on how you can track your cash flow in the program: Track Your Cash Flow In QuickBooks Desktop.

Please don't hesitate to reach out to us again or add another reply if you need more help when recording your transactions.

Interesting....

I said the same thing a while ago. But I don't see my post.

Thank you, I am not liking Quickbooks Desktop, I think online worked better for our company, but the boss hates paying the $40 monthly for the online QuickBooks.

Don't give up to soon... There are a lot of shortcomings to QBO. Keep asking your questions and the QB staff or the rest of us will get things worked out.

So were you able to find or did you add a Cash Account? If you don't use the Home window, there is a button in the menu bar. This may be on the left side of the QB's window (default) or it may be across the top (where a lot of people move it). In the Home window you should see a Account Balances on the Right.... Is there a Cash Account (could be Cash On Hand or some other "Cash" related name)?

If not... as mentioned before, you can easily create one (just like you'd have to create it in QBO if it's not in your Chart of Accounts). Also in the Home window there is a Company section and there should be a Chart of Accounts icon. Click on that icon (or just hit Ctrl/A) and the Chart of Accounts will open.

You can then enter a opening balance for however much Cash you have on hand HOWEVER, make sure you have your Tax Accountant review this initial entry at some point to make sure it is correctly entered and does not mess up your books at tax time.

Once that's done, when you can register all of your Cash payments though this account.

If you do not usually use a Cash Account. Make sure that money added into cash either track back to Income from a customer/client or you show a transfer from your Bank (e.g. Checking) into this account if you did take the money out of the bank.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here