Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi there, @rohitkurup.

I’m here to help and share information about invoice status in QuickBooks Online.

When receiving payment in QuickBooks Online, if you chose to deposit the payments under the Undeposited funds account then this is the reason why the status of your invoice was showing as paid but not deposited.

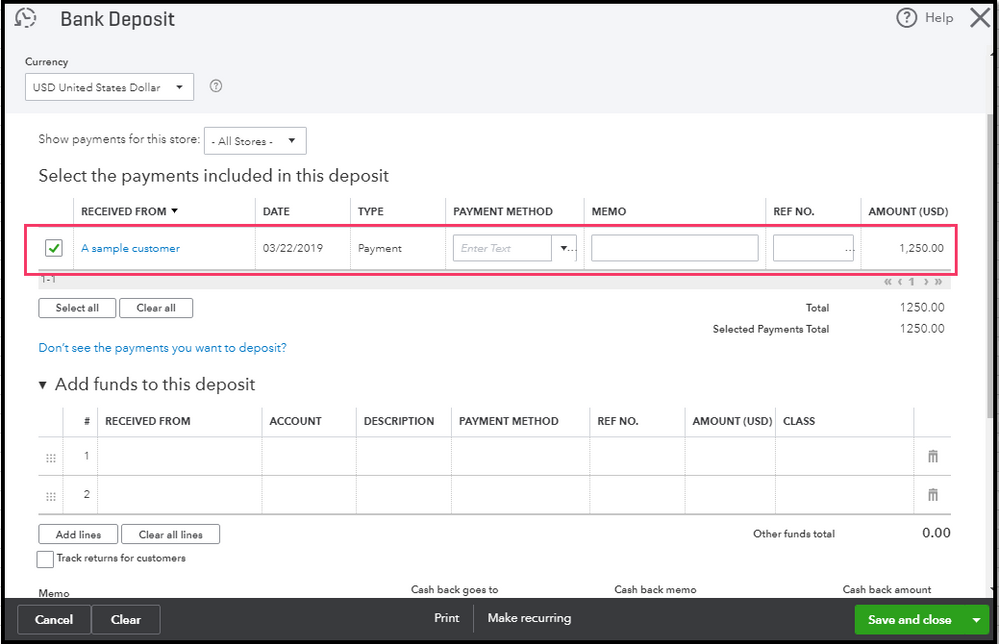

To change the status to deposited, then you may need to do Bank Deposit.

Here’s how:

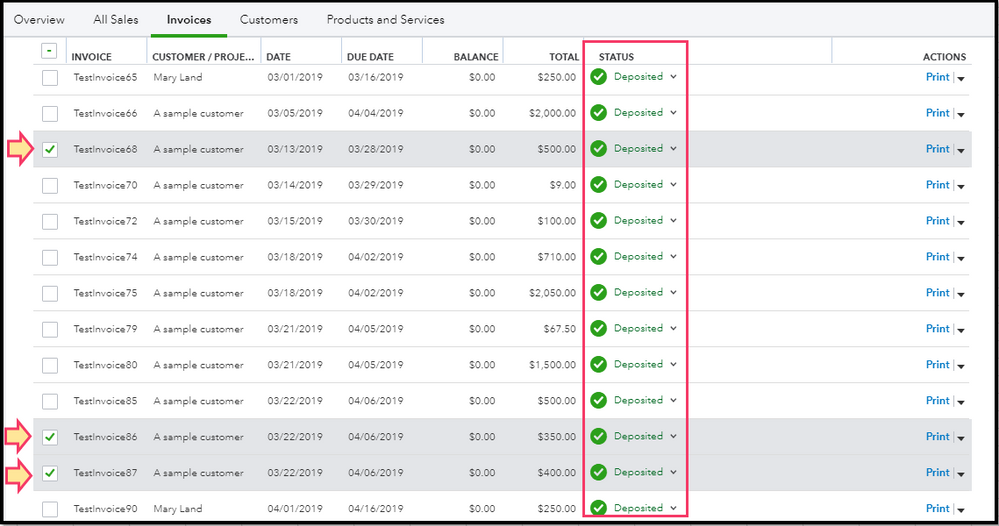

Once done, go back to the Invoices page and the status should now change to Deposited.

Also, here are some helpful articles that you can check on for future reference about receiving invoice payment in QuickBooks Online:

That should do it!

Feel free to post again or leave a comment below should you have additional questions. I'm always here to help. Take care!

Hello,

I've recorded money as a deposit that should have been received for an outstanding invoice in the month of December and I've reconciled the account for that month. How can I now show that invoice as paid? I have to money, I just didn't record it properly.

Hello tabaileyx2,

We can update the deposit and change it the account to Accounts Receivable. Then, link this deposit to the outstanding invoice. This way it will resolve the issue and won't mess up your reconciliation report since we're not changing any amount. Let's get this started.

Here's how to edit the deposit:

To link the deposit:

Run the A/R Summary report again to see if there's still an outstanding invoice. Let us know if you need anything else.

Thank you

We're glad that your concern was addressed, tabaileyx2.

We always strive our best to serve our customers well.

You can drop by anytime in the Community. Have a great one!

I am having the same issue with several payments. Every one of the invoices that have "Paid (Not Deposited)" were paid online and the payment WAS deposited in my bank account. But I can not find a way to get it to drop the "Not Deposited" designation.

I get - "Paid via QuickBooks Payments: Payment ID xxxxxxx"

And "Your money is on the way. You should see a deposit on 10/03/2018. Deposit: $XXX.XX | Method Bank Transfer | Fee: $X.XX"

When I check Deposits I get:

Thanks for reaching out to us here in the Intuit Community, @PaulTim,

The Paid (Not deposited) status means the payment isn't posted in your bank in QuickBooks Online. You'll need to manually deposit the payment in the system to change the status to "Deposited".

Let me guide you through on how to accomplish this:

Once done, let's check the status of the transactions through the Sales page.

Here' how:

This answers your concern for today about the invoice status.

To learn more with making bank deposits, you can read through here: How to Record Bank Deposits in QuickBooks Online.

Should you have need anything else about QuickBooks, don't hesitate to leave a comment below. I'm always around whenever you need help.

This is the most confusing and stupid process I have ever had to work with. When the deposits come in via a bank upload and match the invoice, why do I then have to go to the bank and select the deposit in undeposited funds? QB has already marked the invoice paid. It marked it paid because the payment came in automatically through bank feeds so now what? If I go to the bank and "deposit" the payments it will record the deposit twice since it's already recorded in my bank feeds. Please tell me how to pseudo deposit funds without having duplicate deposits or invoices?

Good day, Caroleann.

Let me help share some steps and information regarding paid invoices and deposits via QuickBooks Online.

To answer your question, yes you're right, QuickBooks marked the invoices as paid and deposited once matched to your payments or deposits from the bank feeds. Since the invoices are already matched to your deposits from the bank feeds, you can delete the pseudo deposit funds that are manually recorded in QuickBooks to avoid duplicates.

To delete the pseudo deposit funds, here's how:

The following articles will help guide you more in managing bank feeds transactions in QuickBooks:

Fill me in if you have additional questions about invoices and deposits in QuickBooks Online. I'll be around to help.

Can I just change it by clicking on the invoice payment and just change from unreported funds to the account it was deposited into?

Can this also be done by changing deposit to and changing from undeposited funds to the bank it was deposited into? I just don't want to affect reconciliation s.

If when I change from undeposited funds to the bank account payment was deposited to and then click save and close and an alert saying " The transaction you ared editing is linked to others. Are you sure you want to modify it?, and I click yes will it change my reconciliations?

Hello there, @533076076. I'm here to provide you information on deposits in QuickBooks Online.

Before making changes to your books, I recommend consulting with your accountant. They would give the best advice on how to keep your books.

To get your deposits to your invoices, you'll have to move them from the register to match. First, you'll have to undo the reconcile on the transaction. Secondly, you can match the deposit to the invoice. Lastly, manually reconcile the transaction. Here's a video that shows you how to do this step-by-step.

If you have further questions, please reach back out. I'm always here to help.

This is another big fail in QBO. I use your merchant service to make the deposit, the deposit goes directly to to the bank tagged to the QBO invoice. Yet it shows up as "Not Deposited"? And now you want me to go through all this added PITA effort to change something you have a software design flaw in in your system? You do not even have a simple fix? A tag the undeposited, and hit deposited? When attempting your instructions, they do not work either. Such a convoluted mess.

I had the same issue. So frustrating, but I think I figured it out. Give this a go:

-Go to banking and go to "reviewed". Please find the payment in question and "undo" it so that it goes back into your "for review section". Please write down on a piece of paper/remember the date of that payment. Leave that as is and we will come back to it.

-Go to your invoices section and find the invoice. Then click the downwards arrow on the right next to the word "print" and click "view/edit"

-On the right it says "paid status", under this can you see blue writing that says "1 payment" and then in black writing "made on .....", please click the blue writing and then click the blue date.

-Here the payment you received in your bank account comes up, for some unknown reason, I think it may be a glitch, but it says on the left under "payment date" the wrong date to when it actually was deposited. Now that date I asked you to write down before, put in that date instead. Click save and close.

-Go back to your "for review" tab and the payment now should have a match. Click "match".

-Go back into your "income section" on your report and it now should be fixed and there should only be one payment there for that amount/ or go back onto your invoice page and it should now say Deposited.

Hope this helps!

Good afternoon,

Iv only been messing my books up for a year and half and thought i had a grasp on QB and was doing well. I now having an issue with deposits showing up in customers invoices showing overdue and it is causing a credit somehow.

Let me provide you some information on why this is happening so we can fix this,

Vital Signs.

You'll want to make sure that a sales receipt is entered to match the deposit. If you have created an invoice, ensure that you've entered the payment to successfully match both transactions and prevent messing up your books.

You can undo or exclude the deposit transaction downloaded in QuickBooks Online (QBO) if you haven't entered any receipt. You can follow these steps on how to do it:

In addition, please know that deposits added directly to the income account don't have a sale attached or this doesn't show up in the sales and customer transaction list.

For reference, you can review and categorize downloaded transactions in QBO.

Let me know if you have any questions about the process. The Community has always your back if you need further assistance.

I have a couple of invoices that were paid with multiple payments that are showing "Paid" but not showing "Deposited". How can I see which payments are not aligned with a deposit to my bank account?

Good afternoon, @northiowatrader.

Thanks for joining in on this thread. I've got you covered.

I can show you how to see which payments aren't aligned with a deposit to your bank account. All you need to do is start to create a bank deposit, and then you'll see the payments that need to be deposited from there. Don't worry. It only takes a few easy steps.

It's that easy. For more details, check out this article about recording bank deposits.

These details should allow you to see which payments don't align with a deposit yet. If you have any trouble along the way, feel free to ask. I'm only a few clicks away if you need me. Bye for now!

We have a customer that accidentally paid their invoice with their credit card twice using QBO. The first payment was deposited and has appeared as a credit in our bank account. The second one says the invoice was paid, not deposited (Both payments were made within a couple minutes of each other) and the payment has not shown up in our bank account.

When I look at the invoice for this customer, it says payment was declined. We want to make sure that the customer gets their money back (or verify that the second payment was indeed declined, and she isn't being charged twice), but we don't want to cancel anything and the payment we had deposited gets refunded back to the customer. The second payment is appearing in this customers account as a credit to her. What do we do? Thank you!

Let me help you handle the duplicate credit card payment in QuickBooks Online (QBO), JennaHollingworth2.

If the card is charged twice, we'll have to refund the customer's credit card. Let me show you how:

Then, create an invoice by following the steps below:

Once done, link the invoice to the payment in QBO. Here's how:

Feel free to visit our Sales and customers page for more insights about managing your company's income and customers.

I'd like to know how you get on after trying the steps as I want to ensure this is resolved for you. Just leave a comment below and I'll get back to you. Take care always.

Hello,

I am confused on why I have to create a new 'bank deposit' in QBO. When I go to my chart of accounts and look at the checking account, I can see where the most recent deposit is. (It reflects in both the quickbooks balance, and also the bank balance. But from what I'm reading, it seems that I have to add another bank deposit so it takes out of the 'paid-not deposited' section? That seems like double dipping to me. Is there something I am missing, or doing wrong? If I am manually adding the deposit it looks to me like I am saying we got twice the money?

Please advise.

Hi there, beacon1111.

Thank you for visiting the QuickBooks Community. Let me discuss further information on how payments and deposits work in QuickBooks Online. I'll ensure that your transactions are recorded correctly and that no double entries occur.

When you record invoice payments, the system usually assigned the entry as an Undeposited Funds account. This is to hold invoice payments and sales receipts you want to combine and It’s like the lockbox (or drawer) you keep payments in before taking them to the bank. It also serves as the default Deposit To account when you receive payments or enter a sales receipt. You can open this article to see further details: What’s the Undeposited Funds account?.

Then, the Paid (Not deposited) status appears after recording the invoice payment which means isn't posted yet in your bank in QuickBooks. This is to make sure that the payment is being reviewed first. You'll have to manually deposit the payment in the system to change the status to "Deposited". Please keep in mind that doing so will not result in a duplicate transaction in the program, instead, the payment will now be deposited to the correct account.

Lastly, you may refer to this article to see steps on how you can reconcile your accounts to avoid any discrepancies: Reconcile an account in QuickBooks Online.

Please don't hesitate to click the Reply button if you have other questions about how deposits work in QuickBooks. I'm always here to lend a hand, beacon1111. Have a good one!

This explanation is close, except in my case, the invoice is off by the QBO fees taken to process the incoming payment, therefore it will not match. The fees taken were on the original payment date when received. Curious if I can apply that first and reduce the invoice, then change the payment deposit date and process the "match"?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here