Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSometimes we have to reissue a check to a vendor but need to maintain the original check for reporting purposes because we're a grant funded. We enter a journal entry to debit the bank and credit AP. Then we cut the new check and select AP as the account for the line item. This creates an unapplied cash payment expenditure. Do I need to create a bill and match it to the Journal Entry and the original check?

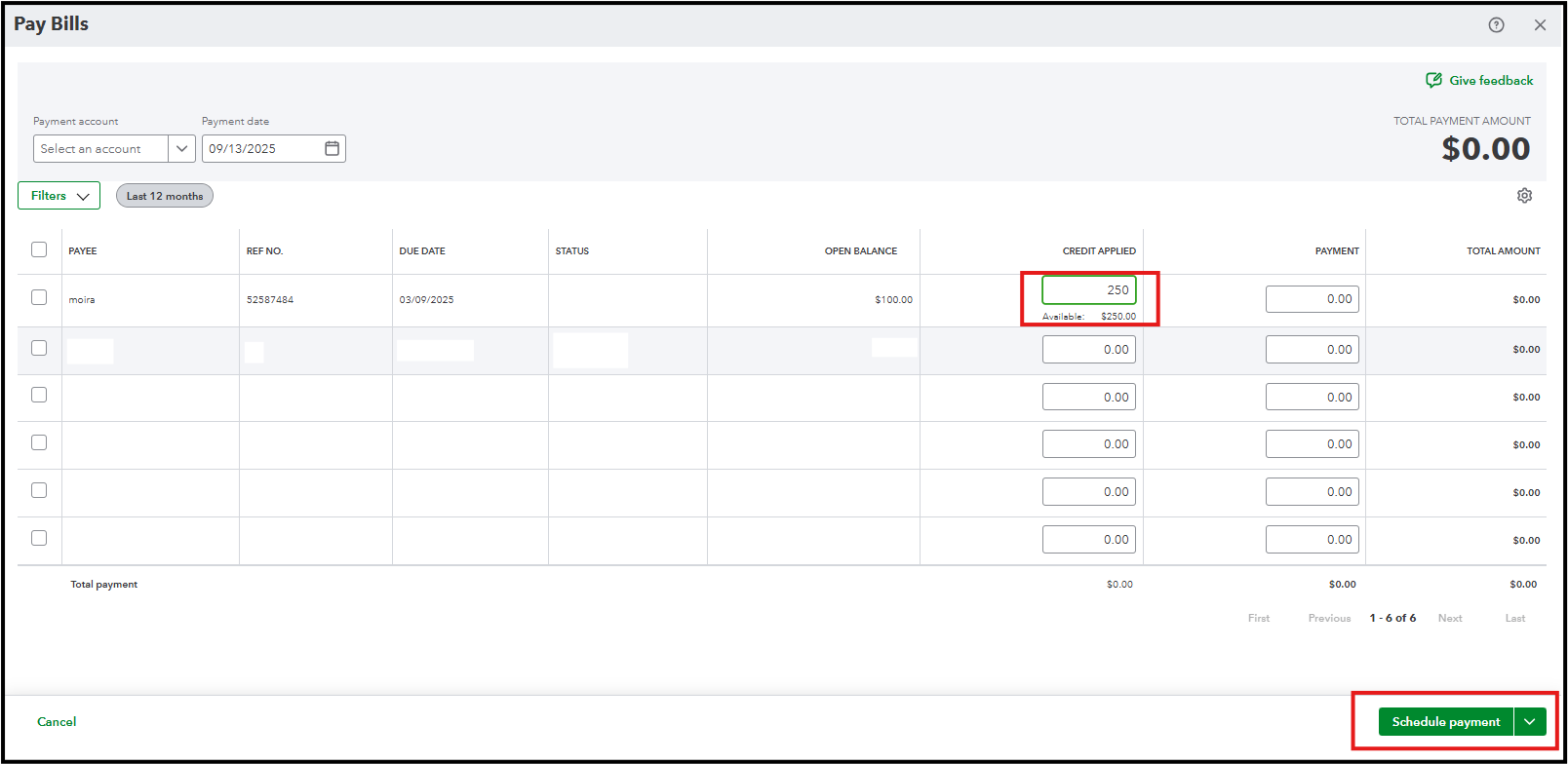

Since you've already issued a check that offset the remaining balance of your vendor's bill, we need to apply those payments to the remaining balance, @BrynS.

Here's how:

Please make sure that there will be no remaining balance in the total remaining amount.

Feel free to let us know how things go or if you have any more questions. We are here to help, so don't hesitate to reach out.

Post the deposit credit to a bank Clearing Account (set one up if you don't have one), not A/P, when making the JE. Posting it to A/P is what's causing the Unapplied Cash Payment Expense. After posting the deposit to the bank Clearing Account, re-issue the vendor check and assign the bank Clearing Account to it. That way, the original bill and bill payment (check) maintain their original dates, which is proper for cash basis reporting, and the deposit and new check are run through the Clearing Account, netting to zero.

Interesting. When you refer to posting the deposit, do you mean the initial correcting journal entry? Typically I will do a journal entry that debits the bank and credits AP. So instead I would credit the clearing account and then cut the new check from the clearing account, not the main bank account?

Forgot to mention that your deposit that credits A/P should show up as a bill when you go to Pay Bills. Also, the re-issued check that was assigned A/P should show up as a vendor credit. As long as the re-issued check is dated the same as the deposit, and you apply the A/P credit created by the deposit to the A/P debit created by the re-issued check, you shouldn't see an Unapplied Cash Payment Expense in your P&L.

"Interesting. When you refer to posting the deposit, do you mean the initial correcting journal entry?"

Yes, correct. BTW, you can create a deposit in QBO instead of a JE. You may already know this but JEs don't show on many reports.

"So instead I would credit the clearing account and then cut the new check from the clearing account, not the main bank account?"

No, you still issue the new check from the main bank account because that needs to offset the correcting JE that debited the main bank account. The correcting JE (deposit) debits the main bank account and credits the Clearing Account. The new check debits the Clearing Account (now nets to $0) and credits your main bank account. The next time you reconcile, clear the lost check against the correcting JE and clear the new check when it actually clears.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here