Hello, mark. I've got the steps to handle overpayments.

In QuickBooks Online (QBO), there is a way to use customer credit as payment for vendor bills. We can set up a clearing account to move the balances accurately, which we will use for the Journal entry. To proceed, I highly suggest seeking an accountant to further assist you with completing this process.

To set up this account, we can:

- Go to Settings ⚙ then select Chart of accounts.

- Choose New to create a new account.

- Under the Account Type dropdown menu, select Bank or Equity.

- Under the Detail Type dropdown menu, click Cash on hand.

- Enter the account name. (ex. Barter Bank Account)

- Hit Save

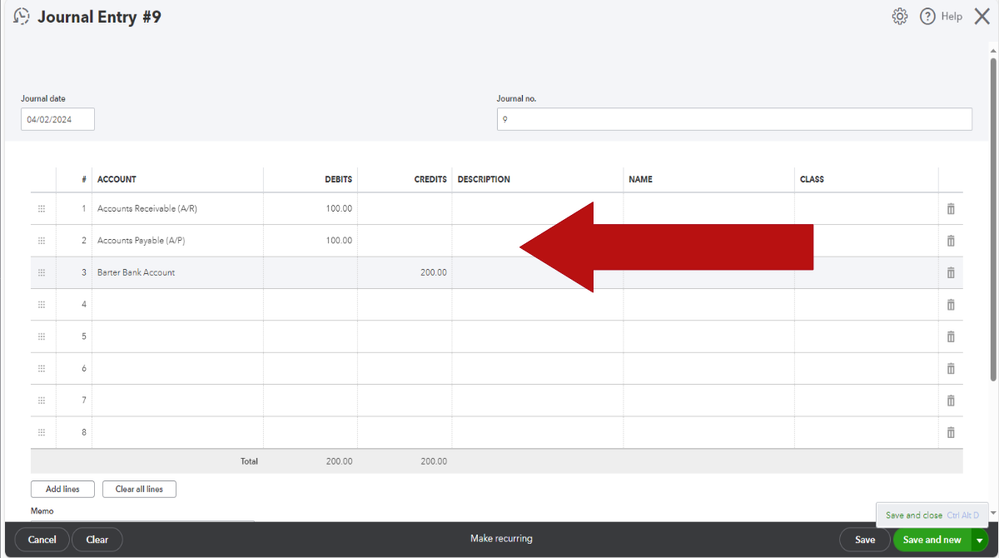

Afterward, we can create a Journal entry to offset the customer credit and vendor bill. Let me show you how:

- Debit the Account Receivable (A/R) and choose the specific customer.

- Debit the Account Payables (A/P) and select the vendor.

- Credit the clearing account and enter the total amount for the A/P and A/R.

- Then, click Save and close from the dropdown menu.

Once done, we can link the Journal entries to the customer credit through Receive payment and the vendor bill via Pay bills.

I have included helpful resources on recording deposits and how you can refund your customer in QBO:

I'm still ready to assist if you have further concerns with managing overpayments and credits in QBO. Keep safe!