Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello and welcome to the Community, mgm1323.

It would be my pleasure to help you record the ACH payment for the bill in QuickBooks Online.

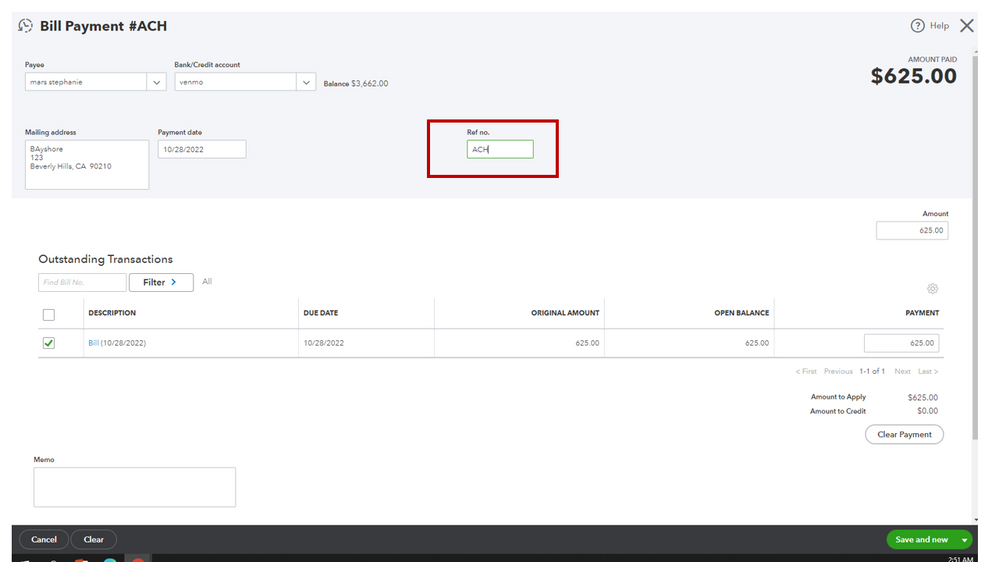

We can record the bill payment to an open bill by performing the normal process. However, you'll need to add a note on the Ref no. field instead of adding a number.

Here's how:

For more information for recording the bill payment made through ACH, you can visit the article I recommend on this:

Record a bill payment processed online, via EFT, ATM, or debit card.

Please don't hesitate to let me know if you need further assistance with the payment process. I'll be sure to get back to you.

I did the listed process but the amount still remain in Account Payable account after post payment? What is the process to remove it from A/P and posted as expense etc.?

Good to see you here, mauser3.

When you processed a bill payment, the transaction will not be removed from A/P account. Instead, it will only decrease the A/P balance.

To make sure that you successfully processed the payment:

You can also open your A/P account and search the bill. From the DUE DATE column, make sure it shows Paid.

You can use the same article about recording a bill payment for your future reference.

For other concerns, please reply again to this thread.

Hi,

I don't seem to have the option "Make Payment" to select for step #5. Would you further assist me?

I appreciate you following up on my colleague's solution and informing us of the result, HazelJ.

I'm here to assist and guide you through the process of recording a bill payment. Let's use the Mark as paid button and open the bill payment to enter the payment method in the Ref no. field.

When paying bills within the form in QuickBooks Online (QBO), click the Mark as paid button. This function is similar to the Make Payment function where you can manage payments. Also, it will take you to the Bill Payment screen.

Here's how:

You can read this article for detailed instructions on other ways to track bill payments in QBO: Record a bill payment by EFT, ATM card, or debit card.

We also compiled resources to help customers with vendor-related tasks like paying bills, processing supplier credits, and creating purchase orders, to name a few: Self-help guide. They're arranged according to topics, so you'll be able to find the article easily.

Keep in touch if you have other questions about managing your suppliers' transactions or any other QBO concerns. I'll be delighted to answer them for you. Enjoy the rest of the day.

What about if you want to post the ACH already deducted in your account but there is no invoice : for example FSA payments.You just want to make sure the expense is paid ,bank account credited but no invoice..

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here