Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI'll walk you through recording those refunds in Quickbooks Self-Employed, sbosshardt.

Here are the outlined steps:

For more information on how to add transactions in QBSE, please refer to this article: Manually add transactions in QuickBooks Self-Employed

I'm also adding these links about categories in QBSE:

If I can be of any additional assistance, please add a comment below. Thanks!

Hi GlinneteC,

This advice is too generic:

"Browse the Select a category menu and choose the best option to organize your transaction. "

Let's just consider the state tax refund use case for now.

If I choose the "State Tax" category, QuickBooks Self-Employed will always treat the transaction as an expense. Even if I put a "+" or "-" sign next to the amount I am entering. So I can't choose "State Tax" for a state tax refund check.

I can't choose "Business Income" because it isn't income. A tax refund check is not taxable income (and if I chose "Business Income", QBSE would treat it that way).

Thanks for the clarification, @sbosshardt.

I also appreciate you sharing your thoughts about this. To record a refund in your QuickBooks Self-Employed (QBSE) account, you can tag it as Personal.

Then, for Tax payments, State and Federal are usually tagged as Business as these are both company expenses. To tag the transactions, you can simply follow these steps:

On the other hand, if you connected your bank and downloaded the refund transaction. You can manually change the category as Personal.

Let me add these resources to learn more in handling your taxes in QBSE:

You're always welcome to post here anytime you have other concerns. Our door is always open to help you.

By tagging a transaction as personal, I don't see how that offsets the original expense. For example, I received a $50 insurance premium refund. How does the original insurance expense get reduced or offset by $50. Marking it as a personal transaction as recommended above would take it out of the P&L calculations, would it not? The effect would be expenses being overstated. This can't be right.

Thanks for joining this thread, nn308.

In QBSE, there are two ways on how to track your refund. As mentioned by @JasroV, you can tag it as Personal. Another way is to exclude it since you’re not receiving or spending anything from your account.

This process will offset the amount received or have been credited back to your client. You can run the Profit and Loss Report to compare and check the accuracy of your data.

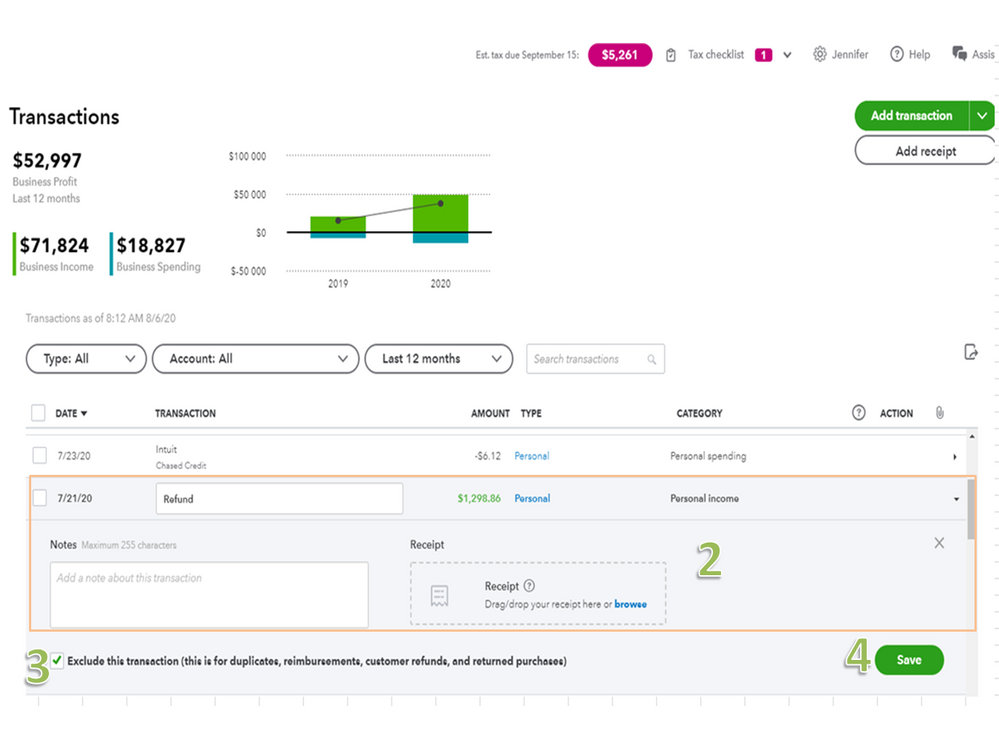

To exclude:

For future reference, these guides provide an overview of how to classify transactions and how they show up on the financial reports.

If you have additional questions or clarifications, don’t hesitate to go back to this thread. I’m always ready to answer them for you. Have a good one.

As @nn308 mentioned:

Marking it as a personal transaction as recommended above would take it out of the P&L calculations, would it not? The effect would be expenses being overstated. This can't be right.

It seems to me that your recommendation doesn't resolve their concern:

3. Tick the Exclude this transaction (this is for duplicates, reimbursements, customer refunds, and returned purchases) box.

Per the documentation on "Exclude this transaction":

QuickBooks won't include excluded transactions as part of your tax calculations or financial reports. Or you can delete transactions you've added manually. Here's how to delete or exclude a transaction.

It seems to me that Quickbooks Self-Employed is still missing important functionality here. Fortunately for me, I don't rely on QuickBooks financial reports or for getting my taxes done, since I go to a professional tax preparer who uses her own system. I simply print out the transaction log to take to her, along with my concerns and questions.

Refunds, when you return something, not State or Fed Refunds are categorized as income.

A simple way of looking it is, a reduction of your deductions.

When you return something, you get the money back, which means that the money you spent on the original transaction gets refunded to you, EI you never spent it in the first place.

you Make $100 in taxable income

you spend $100 in taxable income on job supplies

your taxable income becomes $0.

IF how ever you return part of or the whole transaction, that refund becomes taxable income.

EI you return 1/4 of the order and get $25 back

that means you only spent $75 on the transaction - Job Supplies and you still

have $25 of the original income.

The point the original poster is trying to make is that we should not be paying taxes on a refund. Excluding the refund means QuickBooks is overstating the expense. So QuickBooks has not provided a solution. The solution should be that QuickBooks needs to provide for a way to record refunds.

Thank you for joining this thread concerning recording or categorizing refund transactions in QuickBooks Self-Employed (QBSE), @Anonymous.

QBSE offers two categories in categorizing transactions, you can put it on the Business if the transaction was for business, or select Personal for personal. If the transactions were both, you can Split this to categorize amounts into their respective category.

The application is designed for simple accounting that helps track self-employed business income and spending all year long. Regarding categorizing refunds, an expense-reimbursed income is income. Thus, we can tag this one as personal income, and another way to do it is to exclude it since there’s no money in or out of your account.

These are the following steps to proceed:

Furthermore, learn how you can review and download transactions from your account. Thus, you can go over to your reports menu and run financial reports by referring to this article: Export transactions and get reports in QuickBooks Self-Employed.

I’m always here to help if you have other concerns about QBSE. The Community is available 24/7 whenever you have questions about managing bank transactions. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here