Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowAfter getting some great help on using classes, I have added some new accounts to reorganize the hierarchy of my accounts (from a predecessor). A bookkeeper support session showed me how to use the Reclassify Transactions functionality. However, after our session ended I noticed that the NEW accounts (no transactions yet) did not display on the left pane. What is the best way to get them to appear as I have already finished my March 2024 reconciliation? I thought about entering a $0.00 deposit or expense into each of them and then later deleting them. Another option I thought of is to enter a few of my April 2024 transactions into these new accounts and then I think they will show up. I also wondered if there is some setting that would allow accounts with no transactions and/or $0.00 balances to appear. As a relatively new QBO user, I would greatly appreciate any advice on the best way to do this as I want to reclassify my Jan thru Mar 2024 transactions to the correct account, and add the new class designations at the same time once I can see the new accounts in the listing and dropdowns.

Thank you.

Paul

Hello there.

Let me share some information about the reclassify transactions page that is not showing the new account added with no transactions yet.

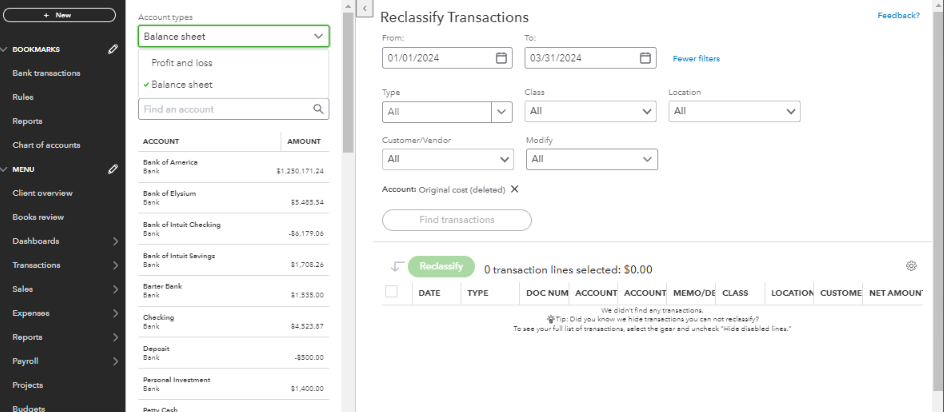

In the Reclassify Transaction page, the accounts that show in the left panel depend on the Account types you choose.

If you choose Profit & Loss, the income and expense accounts will show. If you choose the Balance Sheet, liabilities and assets accounts will show. It doesn't matter if it has transactions or none. See the screenshot below for the sample:

Additionally, you can review your client's books to clean up the account, fix incomplete transactions, reconcile, and wrap this up before closing the books.

Let me know if you have questions about reclassifying the transactions page. I'm always here to help. Have a great day.

Thank you, Ethel, for your reply. I forgot to mention that the organization that I do the bookkeeping for is a not-for-profit. With Classes enabled there is no P&L by Classes...not sure if that makes the difference or not.

Paul

Hey, @lewandpd, how's it going?

You are correct, QuickBooks Online does not provide a built-in Profit and Loss (P&L) report by class. However, you can track income and expenses by classes for a not-for-profit organization by turning on the feature and assigning classes to transactions in QuickBooks Online. Here's how:

Once done, you can create classes for different parts of your business or company to set up your class list.

By following these steps, you can effectively track income and expenses by classes for your not-for-profit organization in QuickBooks Online, even if there is no standard P&L report specifically designed for classes.

Additionally, you can use these articles as references related to your goal:

Moreover, you can also enter non-inventory products and services so you can add them to your sales forms. I've added this article for you to get more insights and information on this: Set up and track your inventory in QuickBooks Online.

Please let me know if you have further questions about not-for-profit transaction-related concerns in QuickBooks Online. I'm always here to help. Have a great rest of the day!

Thank you, VoltF, for the information you provided. In the end, I did have to enter some transactions assigned to the account categories I could not see, and then they became visible. Paul

In behalf of my colleague, you're always welcome, @lewandpd!

I'm glad to know that your issue has already resolved. I appreciate you taking the time to provide us update about this.

If you have any other QuickBooks issues, please post them here. We are always ready and willing to assist. Have a fantastic day and success with your business!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here