Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowOf course, we have some resources, @gagvfoundation.

I know how Nonprofit businesses hold an important place in our society. QuickBooks have features and functionalities that can make your navigation experience efficient.

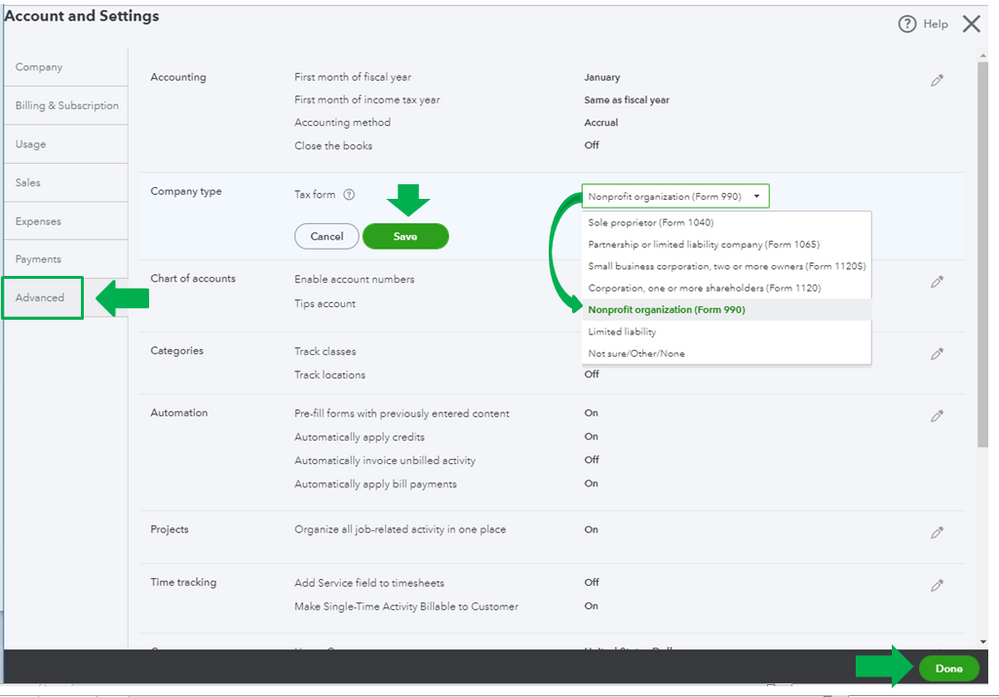

QuickBooks provides simple, step-by-step instructions for customizing the program to suit nonprofit organizations. You’ll have to ensure you configure your QuickBooks Online account to nonprofit to better fit your organization's needs.

Let me show you how:

I’ve attached articles here to learn more about Nonprofit Organizations in QuickBooks and how to manage transactions:

Let me know if you need additional information by leaving a comment below. I'm always around whenever you need help.

You may find many materials provided by Techsoup on Youtube.

Where do I find the simple, step-by-step instructions for customizing the program to suit nonprofit organizations provided by Quickbooks? Beyond flipping the toggle to non-profit. What classes should be setup, how best to track programs for form 990 filing, what accounts are needed in the chart of accounts, especially equity accounts for fund accounting required for nonprofits.

Small nonprofit needing help with monthly money and keeping up with spending.

Okay working on 501,3c

Hi there, @Warren0104.

I want to ensure that your question is addressed appropriately. What specific concern or assistance do you need with 501(c)(3)? Any further information will assist me in providing the best information and solutions possible.

I will eagerly await your response. Thanks, and keep safe always.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here