Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi, John.

It's nice to have you here on the Community page. I'm here to help you delete your customer's banking information in QuickBooks Online (QBO).

You have two options to delete the customer's bank information in QuickBooks. First, replace the number with a non-transacting card number. Second, merge the customer to the customer account without credit card details. At this time, deleting the bank or credit card information for customers is not yet an option in QBO, you can only edit them.

Here's how to replace the bank information with a non-transacting card number.

The changes will overwrite your customer's saved bank details.

On the other hand, here's how you can merge the information with another customer.

For more tips about handling your sales and customer's transactions in QuickBooks, you can open the topics from this link:

If you have any other follow-up questions about handling your customers in QuickBooks, please let me know by adding a comment below. I'm more than happy to help. Have a good one!

Why on earth would you not be able to remove bank account information for a customer? Why would you (quickbooks) want to store bank account information that is not appropriate for the customer? This can only lead to a potential compromise of more information than is necessary. This is something that should be rectified quickly. I cannot imagine it is that hard.

Hi there, @MelissaLM. I'll guide you how to remove the customer's bank information in QuickBooks Online.

An option to hide a customer's bank details is to replace them with a dummy account or non-transacting card number since deleting them is not yet available in QuickBooks.

consider these steps below:

Your customer's saved bank details will be deleted by the updates.

Alternatively, I added this article for your future reference:

Hit reply if you need additional help. Have a great day!

I have found the only way around this is to click the add/edit button then add the new one to override the saved account.

However, as of late March or early April 2022, the bank info field no longer shows in the Customer Edit screen under "Payments" tab when you select the QuickBooks Bank Payment option. You can create a Receive Payment & enter the banking info there then click the box to save for future use and the delete the payment w/o processing, unless you need to pay it. Hope this helps!

My client only wants to pay by check. Unfortunately, I still have the ACH information in and somehow with a late payment, and ACH transaction was initiated, which caused their accounts to dispute. I am trying to remove this but I cannot. I tried entering the credit card information as recommended earlier in this chain, and I get the error Invalid Credit card number.

Please advise so I can avoid this mistake again in the future.

Thank you.

Hello, VCSLLC. I can provide you with some details on how you can handle a dispute customer's payments in QuickBooks Online.

Bank transfer payments can fail because of incorrect bank info or insufficient funds. So you'll need to make you've checked all the information before proceeding to the final steps in managing customer payments.

I'll show you how to handle this situation to keep your books in order. Let's start by locating where the failed payment in QuickBooks.

Here's how:

After then, you'll want to create a service item to track the rejected bank transfer then name it "Rejected bank transfer" and enter "Bank transfer payment received rejected by the bank" for the description page. Then, select the bank account you deposited it or you can select the Undeposited funds if it's not deposited yet.

Once done creating a service item, you may create an invoice to record the rejected payment. Recording it this way keeps your income and A/R accounts accurate. See the steps below:

For the succeeding process, please refer to this article for more detailed steps: Handle a rejected or failed bank transfer payment.

Furthermore, if you want to just pay by check and to avoid the same thing happened if the future, you'll want to uncheck the online payments option in the invoice. You can refer to the screenshot below:

However, if the issue persists you'll need to reach out to our Technical Support team so they can check further about the issue and provide you with some workaround or the resolution process.

You can always count on me if you need more help you managing your customer payments or other banking concerns in QuickBooks. Stay safe!

Where to begin.

1. There no Payment and Billing tab. But if scroll down, there's a Payments sections. But seems like it's only for credit cards.

2. I want to change the customers ACH bank information. But based on the number of hours I've spent, this never happens;)

Anyway, if someone could tell me how to change a customers bank information, that would be great. But I'm guessing it will be another hour or so on hold listening to music is in my future;)

Rod

Hi,

Thank you for posting here in the Community space. Allow me to chime in and help you update the customer's bank information for ACH transfers in QuickBooks Online.

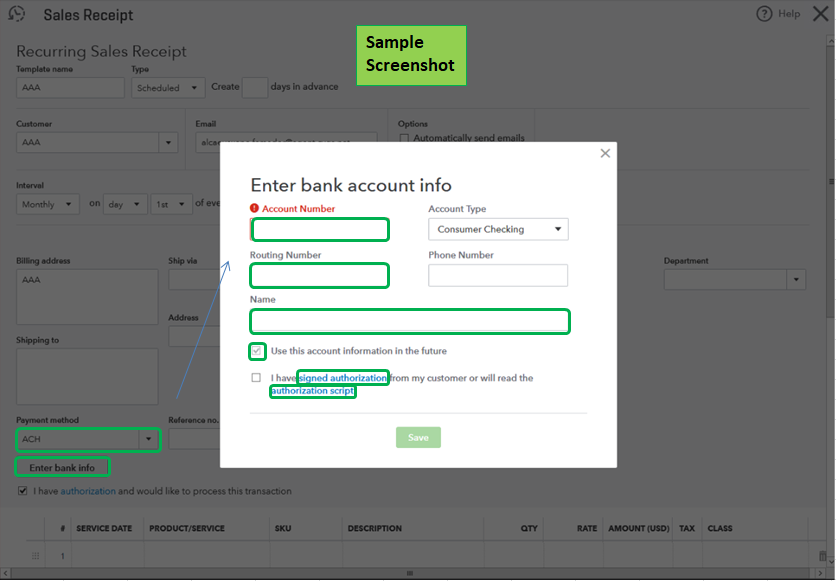

The Payments section under the account settings is only for your Merchant information. If you need to update your customer's ACH details, do it directly on the sales receipt or invoice.

Here's how:

If you're unable to update the details, reach out to our Payments Support Team. They'll be able to help you further in updating the payment information in QuickBooks.

I've attached an article for more details about Autopay, like how to set up the feature both for card and ACH transactions: Set up Autopay for recurring invoices in QuickBooks Online.

Leave a comment below if you have other concerns regarding processing customer payments in QuickBooks. The Community and I will be around to help you.

Hi AlcaeusF,

Thanks for getting back to me. I tried the procedure below...

This seems to work, until I pressed the "Save and Close" button. Then I get the "Something not quite right" error.

A better way for QB Online to handle this would be...

Much like a payment request, QB would send an email to the customer requesting them to change their bank information. The customer enters the new bank info and presses "Save", QB inserts a new bank record that joins to the customer ID. QB also sets the new bank record to the default. An audit trail and history are preserved.

This way, I don't have to ask the customer to send me their new routing and bank account numbers.

Rod

I will be looking to delete banking information up transfer of admin privileges. I can only replace it, and if the customers want to give it to new admin....I want them to choose to do so. So how do I actually delete banking information...?

I can see how convenient it is to have a way to delete your customers' banking information, S4lly. Let me share some alternatives to aid your concern.

You're correct that you only have the option to replace it or merge it with a new customer account without banking details in QuickBooks Online (QBO). Since you don't want to replace the information, you'll want to merge it with a new customer.

Let me show you how:

While this feature is unavailable, I recommend sending your feedback to our Product Development Team so they can review it and consider implementing it in the future. Here's how:

Also, see this article if you need further guidance with transferring the administrator access to another user: Change the primary admin user in QuickBooks Online.

Additionally, you can check out this article to review the recorded sales transactions and their statuses in the Sales menu: View sales transactions.

If you have further questions about managing your customers in QBO, just let me know by leaving a comment below. I'm always here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here