I'd like to welcome you here in the Community, sstefaniak88. I see that you have a question about recording tax payments in QuickBooks Online.

Allow me to guide you through in the most simple and easy way. Here's what you need to do:

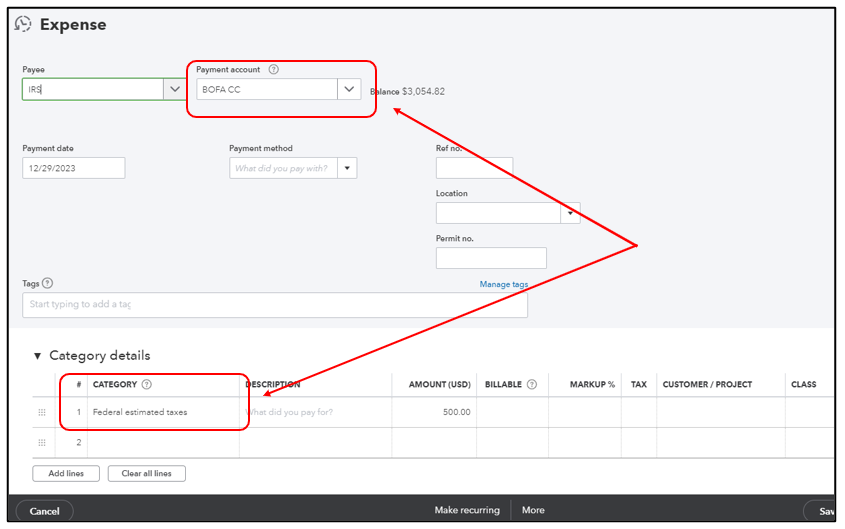

- Click the + New button and select Expense.

- Select your credit card account in the drop-down list for Payment account.

- Choose Federal estimated taxes under the Category column.

- Enter all the other details of the tax payment.

- Click Save and close.

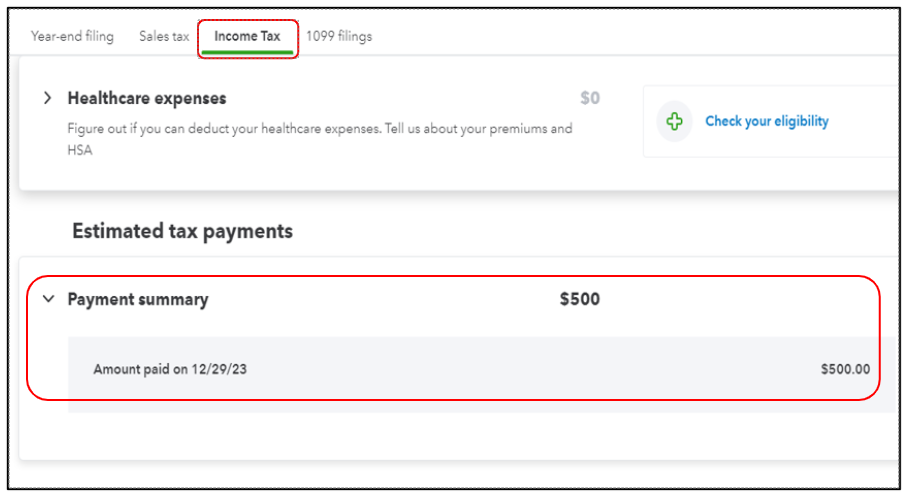

After saving the transaction, it would automatically show up under the Estimated tax payments summary in the Income tax section.

Please see this article for more details about tracking estimated taxes and income in QBO: Automatically Estimate Your Income Tax In QuickBooks Online.

I also understand that filing taxes can be daunting at times. Just in case you need some extra guidance and information, I'll share this article with you: Get Ready To File Taxes On Self-employed Income In QuickBooks Online And QuickBooks Solopreneur.

If you have any follow-up questions or need additional assistance, please don't hesitate to ask, sstefaniak88. We're here to help you every step of the way. Feel free to reply to this message or ask me any questions you may have. Have a great day!