It's nice to see you here in the Community, @SSA1860. I'd be delighted to provide insights about handling these entries in QuickBooks Online (QBO).

You'll want to set up and pay this as an owner's draw account to record this appropriately. It is an equity account that QuickBooks uses to track withdrawals of the company's assets to pay an owner.

If you haven't already, you'll have to create an equity account first and make sure to choose Equity or Owners Equity as the type of account.

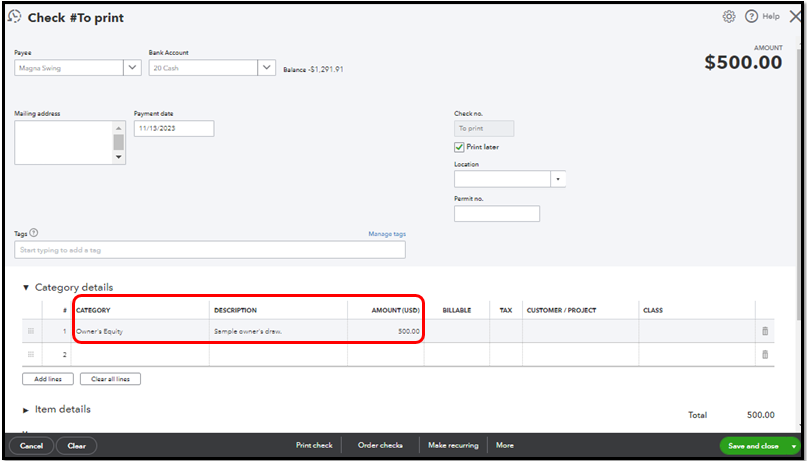

After that, create a regular check in QuickBooks when you are ready to pay the owner and ensure it affects the Owners Equity account you created.

Furthermore, you can generate a journal entry to pay it back through the retained earnings. However, I recommend seeking help from your accountant to ensure you'll be guided on what are the correct accounts to use. They'll also ensure that your books are accurate and avoid messing up the data.

For more guidance about JE's, refer to this article: Create journal entries in QuickBooks Online.

Additionally, check out this article for guides that can help you manage your year-end tasks, taxes, and balances: Year-end guide for QuickBooks Online.

We're always around if you have follow-up questions about recording an owner's withdrawal and payments in QBO. Just leave a comment below, and we'll get back to you. Have a great day!