Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Welcome aboard to the Community, kendaley.

In QBO, you can copy an estimate to a purchase order and then to a bill. Check out this article for additional information: Copy an estimate to a purchase order.

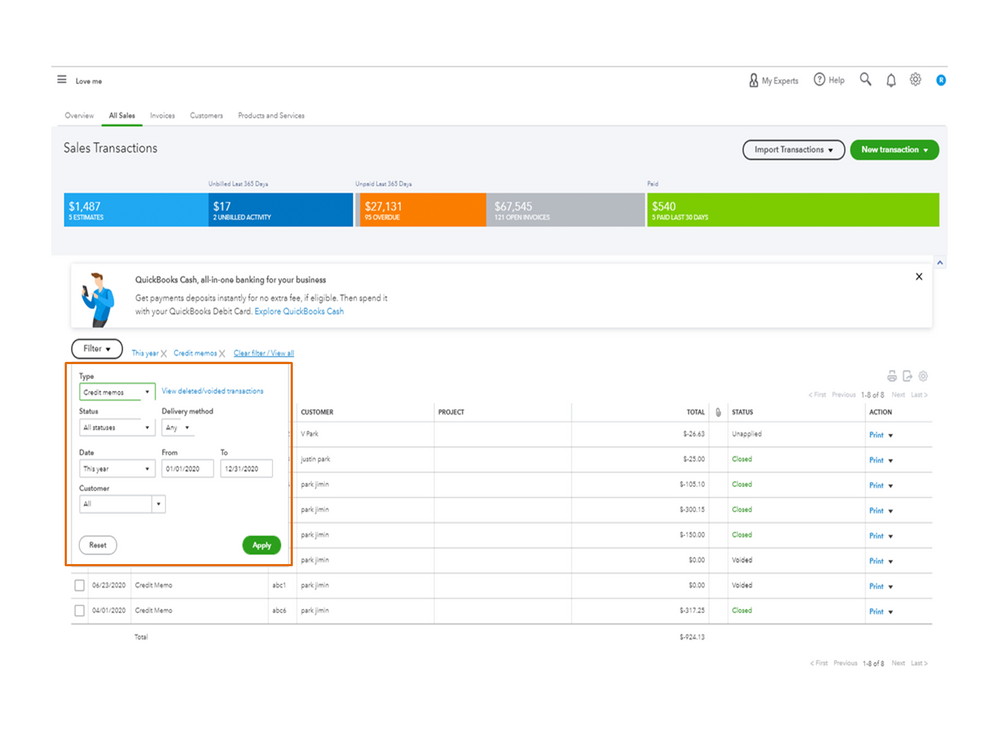

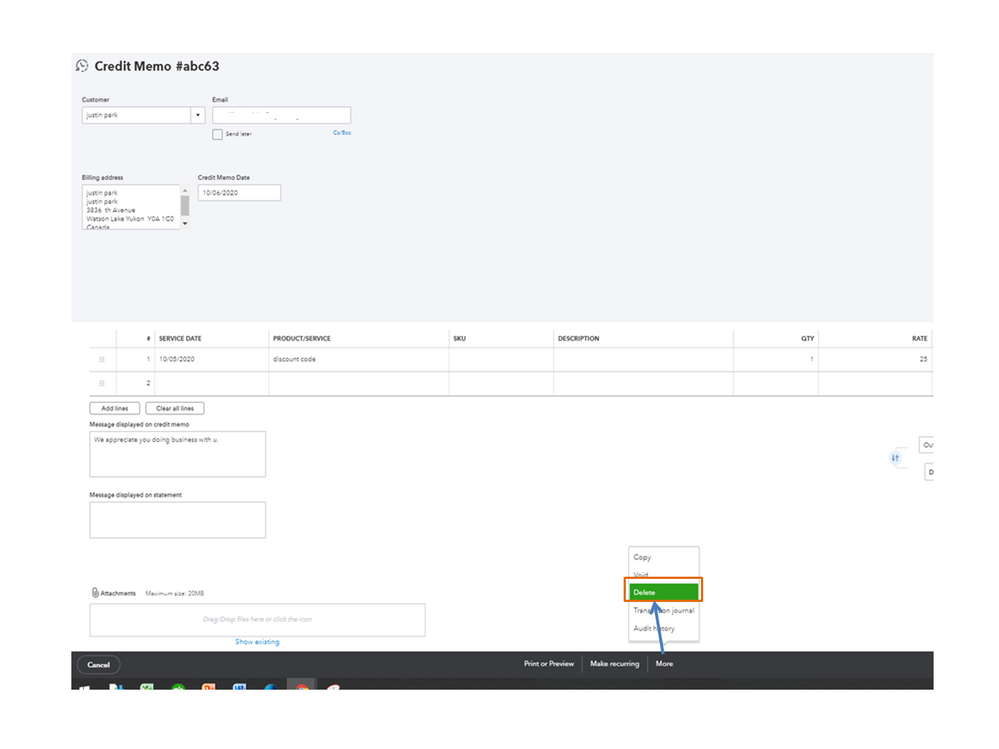

Since you entered the invoices as credits, delete them and re-enter as bills. I’m here to help in performing the process.

Here’s how:

Once done, you can now create the bills. This guide contains the complete instructions on how to add the entries and pay them: Enter and pay bills.

I'm also adding a link that contains articles to get you acclimated to the processes in QBO: Get Started.

Keep in touch if you have any other concerns or questions about QuickBooks. I’m always ready to lend a helping hand. Have a great rest of the day.

Thanks... weird that the desktop version (which we just upgraded from) allowed you to switch a transaction from an invoice to a credit and vice versa. This is a pain... appreciate the answer though!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here