Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi @nicolemcgary,

Thank you for posting here in the Community. I can help you show your office expenses in the financial report.

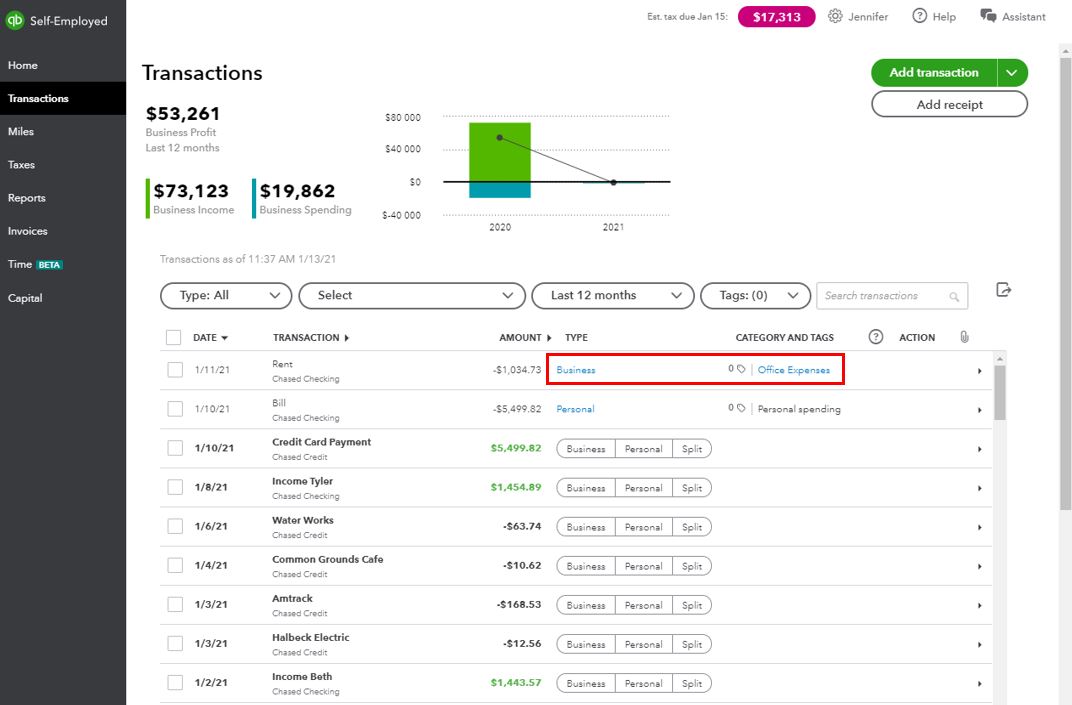

First, you'll need to categorize your transactions in QuickBooks. Go through your expenses and make sure to select Office Expenses as the category.

Here's how:

I've also attached an article you can use to upload bank transactions manually in QuickBooks: Manually import transactions into QuickBooks Self-Employed.

Feel free to hit that Reply button if you have additional questions regarding the Profit and Loss report. Have a great day ahead.

Thank you so much,

Oddly enough mine all have a category, but mine is listed under Rent and lease (home office) so perhaps that is the issue. I leave it at 100% of what I paid for the whole house and have listed my office square footage (which won't change from standard no matter what I do to get it to itemize).

But anyway, all of my expenses are already categorized - for home office. But on the p&L no home office expenses are listed. See attached. I can select dates etc. but I've tried for 2 days and chatted with a 'human' in QBSE for 2 hours. They just kept telling me to ensure the listed categories etc. they even logged in and shared my screen. They never got it to work and just told me it will show up for my tax filing. But i actually need the full P&L for some other things I am doing.... according to what you're saying my category could be wrong? If so, do I need to split the deduction or will QBSE use my sqft?

Hello, nicolemcgary.

Thank you for getting back to us. You can update your category instead of Home office update it to Office expenses to show up in your Profit and Loss. You can follow my colleague's steps above on how to modify it.

You can refer to this article for more detailed information on categorizing home office expenses in QBSE: Categorize home office expenses and enter square footage in QuickBooks Self-Employed.

Additionally, here are some articles where you can get further information about handling transactions in QuickBooks Self-Employed:

Let me know if you have other questions. I'm always around to help. Keep safe always.

I am having the same problem. Why would you switch the category to 'office expenses' when you still need it categorized under 'home office' for tax purposes? Surely because home office is an expense QB should have the capability for it to show up on a P+L Report. . . Is there something I am missing here?

I'll answer this question for you about your home office expenses and why they're excluded in the Profit and Loss report.

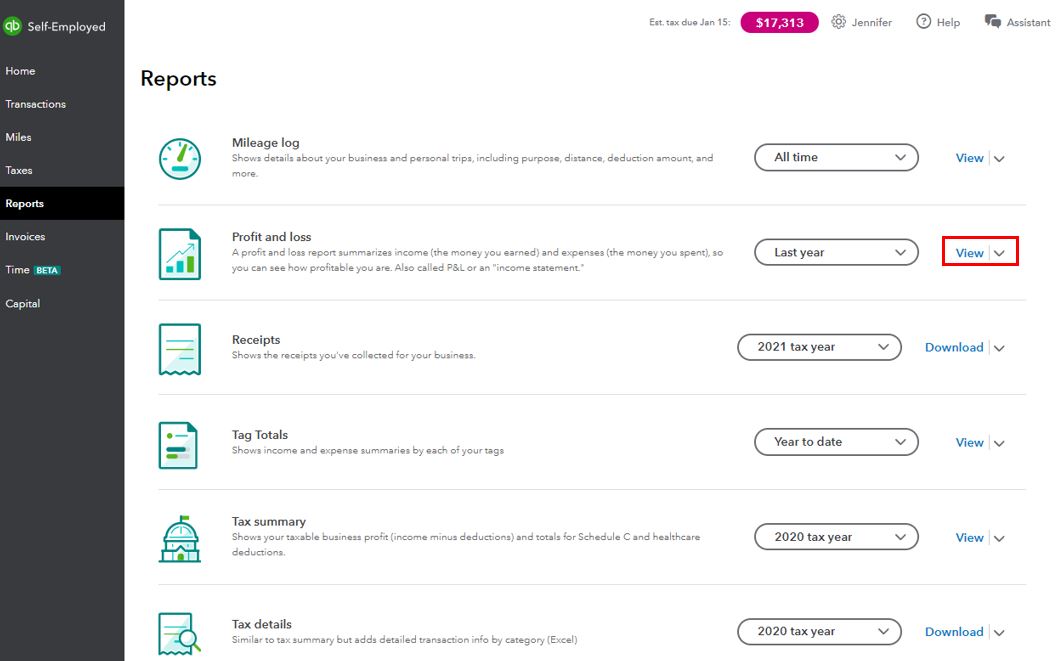

The home office expense accounts are used to track home office deductions in QuickBooks Self-Employed (QBSE). With that said, expenses you tag with any home office expense account appears in the Tax Summary and Tax Details reports.

You can refer to this article for more details: Schedule C and expense categories in QuickBooks Self-Employed. You'll see a table with a list of expense categories, along with an indicator if they appear in the Profit and Loss report, or not.

I suggest you open this article as well: Categorize home office expenses and enter square footage in QuickBooks Self-Employed. It has a table that lists which expense categories go to which line on the IRS Form 8829.

Post a reply if you have other questions about your expense accounts in QBSE. I'll be around to help you out.

I am having the same issue and my accountant is questioning this...

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here