Get 50% OFF QuickBooks for 3 months*

Buy now- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Reports and accounting

- :

- Re: I need to bill a contractor for part of an invoice. QB won't allow me to enter the contractor...

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need to bill a contractor for part of an invoice. QB won't allow me to enter the contractor as an invoice vendor member. How should I proceed?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need to bill a contractor for part of an invoice. QB won't allow me to enter the contractor as an invoice vendor member. How should I proceed?

Hello there, wre steven.

Glad to see you here in the Community space. Helping out with billing your contractor for part of an invoice is my priority.

When creating an invoice, QBO won’t allow you to use the vendor’s name. This is because sales transactions are linked to customers, while payables are for vendors.

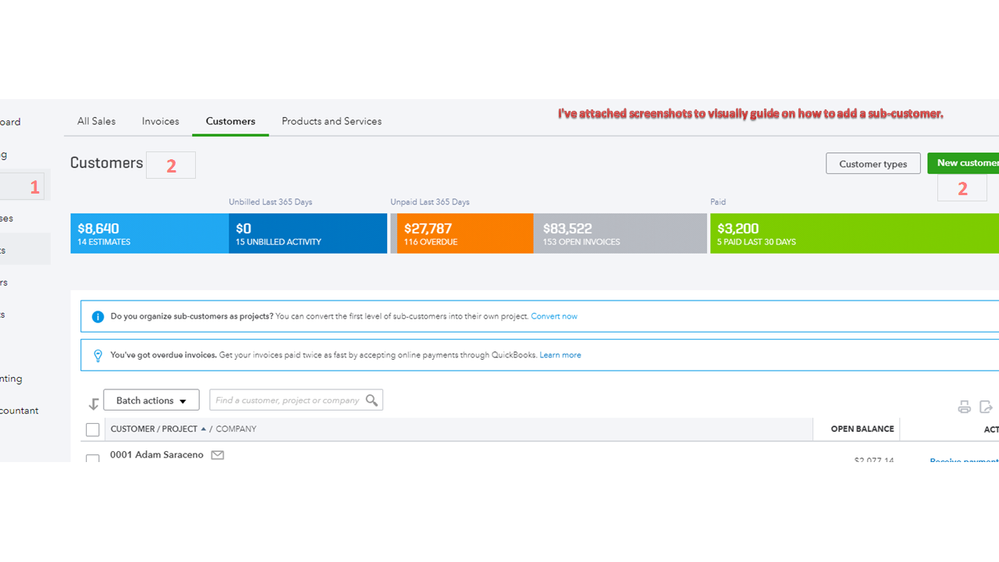

In situations like this, you’ll need to create a sub-customer using the contractor’s information. I'll walk you through the step by step process.

Here's how:

- Go to Sales on the left panel.

- Select Customer, and click on the New customer button.

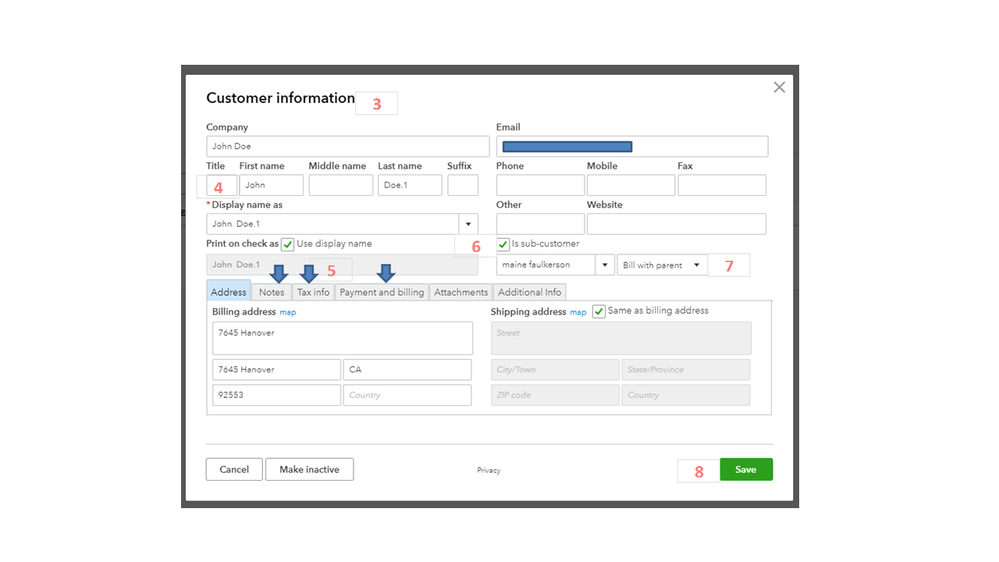

- Fill in the Customer Information window.

- When entering the contractor’s name, make sure to add another character to differentiate it. If the contractor's name is John Doe, you can enter it as John Doe.1.

- Enter additional information on the Notes, Tax info, and Payment and billing tabs.

- Mark the box for Is sub customer.

- Choose the parent name and whether you want to have it Bill with parent or Bill this customer.

- Once done, click on Save.

After entering the sub-customer's data, you can start with creating an invoice. This time, select the customer's name to properly track the transaction.

I also added a link to give more insights on how to add a customer or sub-customer. The resolution steps will help you get moving today.

If you have any follow up questions, leave me a comment. I'm always ready to assist you further. Take care and have a great day.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need to bill a contractor for part of an invoice. QB won't allow me to enter the contractor as an invoice vendor member. How should I proceed?

Thank you. I now have a follow up question:

I billed the contractor as you had suggested by adding him with a period at the end of the name so as to circumvent the duplication error.

The contractor has not paid the bill and it is now time for me to pay him. How can I deduct the amount owed to us from the check that I am writing him and apply it to my open invoice?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need to bill a contractor for part of an invoice. QB won't allow me to enter the contractor as an invoice vendor member. How should I proceed?

Thanks for coming back to the Community, wre steven.

Let me help you deduct the amount owed by your contractor from their check and apply it to your open invoice.

You'll have to record a barter transaction for this. First, set up a barter bank account, then receive payment for the invoice. Then, pay the bill for the barter transaction.

Here's how:

To set up the barter bank account:

- Select the Gear icon, then choose Chart of Accounts.

- Create a new account:

- Select New, and select Bank for the Category Type.

- Select Cash on Hand for the Detail Type of bank account.

- Enter the account name. (Example: Barter Bank Account)

- Select Save.

To receive payment for the invoice:

- Select the Plus icon (+), choose Receive Payment.

- Choose the barter customer in the Customer drop-down, then fill the date and amount.

- Select Add New in the Payment Method.

- Enter Barter in the name field, then select Save.

- Select Deposit To: and then select the barter bank account created above.

- Save the transaction.

To pay the bill for the barter transaction:

- Select the Plus icon (+), then choose Pay Bills.

- In the Payment Account drop-down, select the barter bank account created above.

- Put a check for that bill under the Pay column.

- Enter the amount then Save.

Once the invoice is created and the bill is paid, you will have a record of the exchange but the barter bank account will be zeroed out.

The How to record a barter transaction article will show you the detailed steps.

If you require additional information, please let me know by adding a comment below. Have a good one.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need to bill a contractor for part of an invoice. QB won't allow me to enter the contractor as an invoice vendor member. How should I proceed?

Can this be done in the QB Desktop version? I

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need to bill a contractor for part of an invoice. QB won't allow me to enter the contractor as an invoice vendor member. How should I proceed?

Yes, this can be done in QuickBooks Desktop, @EBGEOI.

In QuickBooks Desktop, you'll need to add a job to create a sub-customer and set up a clearing account to deduct the amount owed by your contractor. Let me walk you through the steps.

- Go to the Customers menu.

- Select Customer Center.

- In the New Customer & Job drop-down, select Add Job.

- Enter the contractor's name. Make sure to add another character to differentiate it.

- Enter additional information.

- Click OK once done.

Here's an article for more details: Create and Manage Jobs or Customers.

Then, you'll have to set up a clearing account so you can move from one account to another. For your reference, you can check out this article for the detailed steps and information: Set up a Clearing Account.

In case you need tips and related articles in the future, visit our QuickBooks Community help website for reference: QBDT Self-help.

Just hit the Reply button below if you have additional questions. We're always here to help.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need to bill a contractor for part of an invoice. QB won't allow me to enter the contractor as an invoice vendor member. How should I proceed?

This makes sense when you're discussing a Vendor and a Customer, but what about in terms of a Contractor (under the payroll). How do I deduct an expense from contracted labor? For example, I contract an instructor to teach a course. Our agreement is that the contractor is responsible for facility rental fees, however, in this case I paid that bill. How can I deduct that facility rental from the Contractor's fee/payment and maintain an accurate 1099?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

I need to bill a contractor for part of an invoice. QB won't allow me to enter the contractor as an invoice vendor member. How should I proceed?

I have a real estate business and this occurs often. The best way I've found to keep my books stright is to issue a credit to the vendor. You do this on the billing screen. There is a radio button to change the bill to a credit. Doing it this way reduces what you owe the vendor and reduces your tax deduction for the item you paid for the vendor.