Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

It’s great to see you in the Community, pruss-beds4vets-.

Let me point you in the right direction on how to handle donor receipts.

In QuickBooks Online (QBO), it’s easy to keep track of the money you receive from your donors. The process will depend on how you obtain the donation. You can record it as a sales receipt, bank deposit, or pledge.

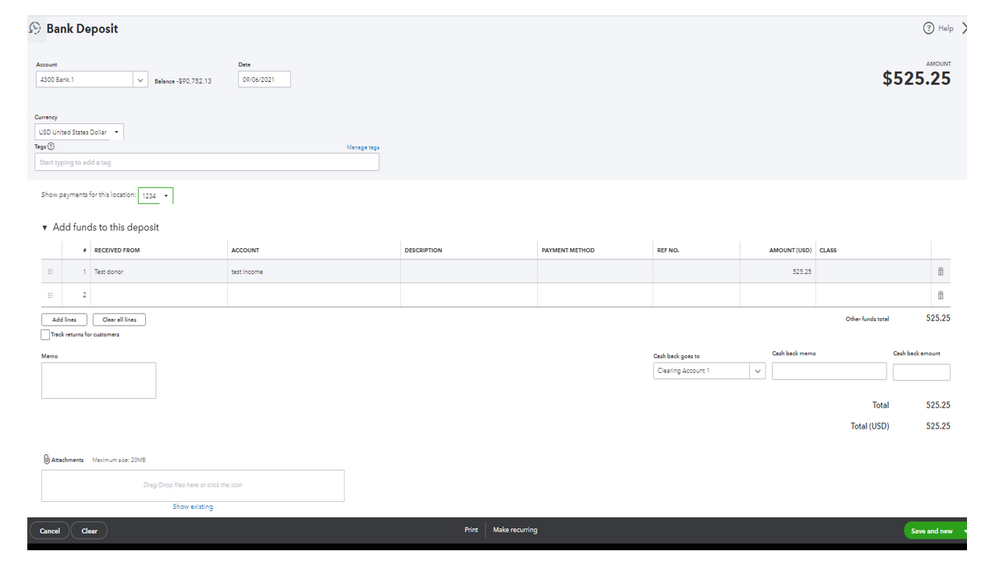

If you wish to use the deposit to affect your sales, you’ll have to select the income account. Let’s go to the Add funds to this deposit section to input the entry.

Here’s how:

However, if you’ll have to apply the deposit to an invoice, choose Accounts Receivable for the posting account and then receive the payment. This will keep your books in order and avoids any errors when reconciling the account. Here’s an article that outlines the instructions to accomplish this task: How to link a bank deposit to an invoice.

In regard to syncing the added transaction, may I know if you’re using a third-party application? Any details you can share ensures a timely solution.

For future reference, I’m adding some links below that tackle how to manage in-kind donations and monitor funds receive from donors. These resources outline the complete steps on how to perform these tasks.

Also, this link provides an overview of when to use an invoice or sales receipts, click here to access the article. From there, you’ll also see the link about managing statements.

Reach out to me again if you have any clarifications about managing donor receipts and deposits. I’m more than happy to answer them for you. Wishing your business continued success.

Hi Rasa,

So, these donations already come into QBO as bank deposits. We sync the QBO account with our Bank's checking account.

However, the first receipt I created, about a month ago was a sales receipt equal to the bank deposit. I added the name of the donor and our tax information, so a letter could be sent by email to the donor. I then noticed its effect on the balance and manually matched the sales receipt to the bank dep[ositr and the bank deposit no longer shows in the Baning --> Categorized transactions.

Does this make sense? I have a few more receipts to do and I would like the most efficient way to do them.

Sincerely,

Peter Russ

I'm here to ensure you're able to match your receipts to the deposits, pruss-beds4vets-.

Before proceeding, did you disconnect your checking account after matching the transactions? If so, this could be the cause why they're missing.

Otherwise, I'd suggest logging in to your QuickBooks Online account via a private window. This doesn't use the existing cache files, which makes it a good place to determine if this is a browser-related issue.

Here are the keyboard shortcuts:

Once logged in, check if the transactions showed. If it does, let's clear the browser's cache. This removes its stored cache to ensure the program performs efficiently.

In case private browsing doesn't work, you can use other supported browsers. They'll provide the best and most secure experience with QuickBooks.

Additionally, I've added these articles that'll help you stay informed about managing and tracking donations in QuickBooks Online.

You can always get back on this thread if you have other questions or concerns about recording donations, pruss-beds4vets-. I'm always here to assist you in any way I can. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here