Hello there, kalvinb76.

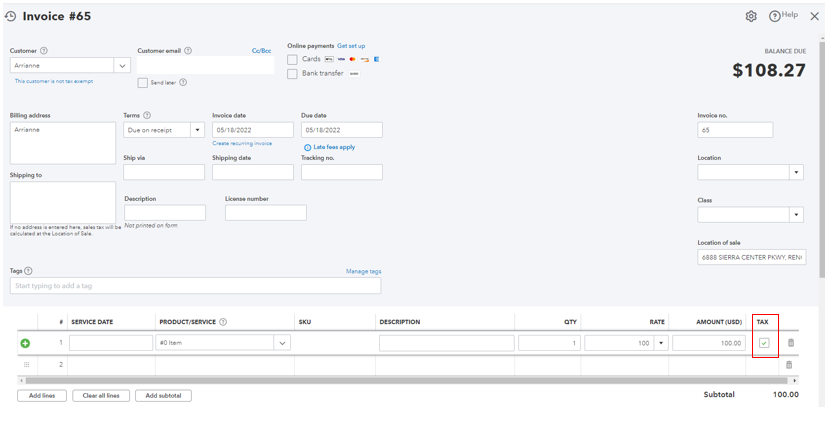

Aside from ensuring that your customer profile is tax-exempt, you'll also have to set your products and services as non-taxable in their category and manually uncheck the Tax column box when creating an invoice.

To set up non-taxable category items:

- Go to the Gear icon at the top.

- Select Products and services.

- Edit the item in question and ensure that the Sales tax category drop-down is Non-taxable.

- Click Save.

Right after changing the sales tax category, untick the Tax column on the invoice. Please see attached screenshot:

That's it! You can also, check out this article to learn on how QuickBooks calculates sales tax for reference.

Stay in touch on how this goes by commenting below. I'm always around whenever you need anything else.