Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowHey there, irv-tradesmart-u.

In the Profit and Loss report, if you select Cash, the source of the Cost of Goods Sold will be from purchases. Accrual on the other hand will report when the inventory is sold from invoices.

However, if you sell inventory that you do not have, the quantity on hand went negative. You can force the next bills, checks, or credit card charges to adjust the Inventory Asset account and the COGS account.

To ensure your COGS and inventories are accurate, you might want to ensure you're using an correct account to track your items. Here's how:

I'd suggest visiting this link if you need help in managing your items: Set up and track your inventory in QuickBooks Online. On the same link, you'll find what report to pull up to see your best sellers.

It's my priority that all of your concerns be addressed, so please let me know if there's anything else you need. Have a fantastic day!

Sorry, my title got cut-off somehow. So this is what happens:

When we record a bill for items valued at say, $1000, QBO records the whole amount in COGS despite us not having sold the item yet. So what we have is $1000 COGS and zero inventory.

When A2X creates a journal entry for when an item is sold, it adds COGS and deducts inventory. Say, we sold $200 dollars worth, we got DR $200 COGS and CR $200 Inventory.

We end up with $1200 COGS and -$200 Inventory. Is this how it's supposed to go when it's select Cash?

I'm here to help you classify your items properly, @irv-tradesmart-u.

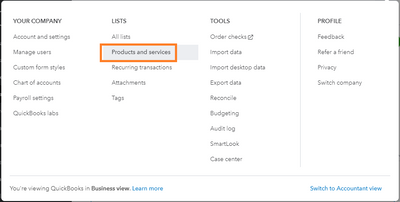

The asset account tied to that specific item may be the Cost of Goods Sold account. Let's verify the information using the following steps:

You can find these instructions from our guide: Add product and service items. You can also easily edit, delete, or restore recently deleted list elements.

I'm only a few clicks away should you need further assistance with tracking your items. Have a great day.

You're on the right path, irv-tradesmart-u. The item is correctly set up in QuickBooks Online.

I'll be delighted to impart some insights on why your bills are going straight on your COGS.

In a cash basis reporting, COGS is only posted when the sale is paid, which assumes you've paid for the purchase. For inventory-type items, the purchase cost does not show in COGS (cash or accrual) until the item is sold.

I'd suggest making sure the purchases are recorded correctly. This could be the cause of the issue. For the detailed guide, I'd suggest checking out this article: Reorder Inventory or Supplies from Vendors.

Additionally, I've included this article that'll help you see your best sellers, what’s on hand, the cost of goods, and more: Use Reports to See your Sales and Inventory Status.

Know that I'm always here to help you out whenever you need further assistance managing your inventory items, irv-tradesmart-u. I'm always ready to back you up!

Thanks for the info. This is exactly what I mean:

For inventory-type items, the purchase cost does not show in COGS (cash or accrual) until the item is sold.

It's weird that the bills are recorded in COGS just as we pay them, and not when the item is sold.

Could you please look into the sample bill that I've attached? Could the "Class" column be causing our inventory purchases to go straight to COGS?

Thanks for getting back to us, @irv-tradesmart-u.

I'd like to make sure we're on the same page so I can give the right amount of information. Can you send the sample bill that you've attached? I can only see the Product and Service screenshot. The screenshot would be greatly appreciated.

I'll be keeping an eye on your response on this, and we'll take it from there. Take good care, @irv-tradesmart-u.

Thanks for getting back to us and for the additional info you've provided, @irv-tradesmart-u. Let me share insights about class tracking and how it affects your inventories in QuickBooks Online (QBO).

Classes will only represent meaningful segments in your company, like store departments or product lines. But it won't be affecting your inventory purchases to go straight to COGS.

When you pull up the Cash basis report, COGS is affected when you make purchases. Then, the cost won't show in COGS until the item (inventory) is sold. To check this, I'd recommend changing the Accounting method on your Profit and Loss report. This is to see the difference in your reporting and compare the results.

With that being said, you'll have to make sure your purchases (bills) are recorded accordingly. This way, you can effectively track your items and post them to the appropriate accounts. You can refer to this article to know more about this process: Reorder inventory or supplies from vendors.

Also, I'm adding this article to further guide you about using reports to get helpful insights on the things you buy and sell and the status of your inventory: Use reports to see your sales and inventory status.

Please don't hesitate to keep me posted on how it goes. Let me know in the comments if you have other inventory and reporting concerns and questions about COGS in QBO. I'll gladly help. Take care, and I wish you continued success, @irv-tradesmart-u.

if i want to cash purchase in quickbook online were i can post

Thanks for joining the thread, @Shabelle Auto Spare Parts. Let me provide helpful information recording your cash purchase as an expense.

You can record your cash purchase as an expense in QuickBooks Online (QBO). If you have already set up a cash-on-hand account, we can create an expense directly.

Here's how:

However, if you want to record an expense for your purchases and don't know what expense account to use, I'd recommend contacting your Accountant. By doing this, they can provide advice that best fits your needs.

In addition, you'll want to check this article to learn how to handle bills to be paid later and bills to be paid immediately using bills, checks, or expenses: Learn the difference between bills, checks, and expenses in QuickBooks Online.

Feel free to reply to this thread should you need additional assistance managing expenses on QBO. I'm always here to assist. Keep safe.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here