Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI sent and invoice out in February on Net 30. The customer returned the product in March, after I had closed my books for February and before remitting payment to me. I need to "cancel" (intentionally not using "void" or "delete" as I don't know which option it is) the payment that is due from the customer for the original invoice, maintain my February Revenue, book a negative revenue for the return in March, and also make sure my inventory increases in March. I'm 99% sure I don't want to "delete" the transaction, especially since I've already closed my Feb books.

I can't process a return since I don't have cash that I received from the customer.

My concerns with voiding the invoice are:

1. Will this change my Feb books?

2. Will this return my inventory?

3. I need to somehow reduce my revenue in March to account for the fact that I don't have that income without being able to process a return.

When I asked the QBO help (in person), they had me create a vendor credit for the same amount as the invoice. This kept my Feb books in line but I don't believe it changed my inventory, nor did it show up as decreasing my March Revenue. They then asked me to create an inventory adjustment, so now I have a negative shrinkage on my Income Statement, which I guess I'm okay with but I don't know that it's the best way to do it.

If anyone has any insights I would greatly appreciate it!

Thanks,

Thank you for reaching out to us, Sandor57.

I'll share some options for dealing with returned items while keeping your February revenue.

If you use accrual accounting, the answer to your first question about whether voiding the invoice will affect your February income is yes. The accrual method records your income and expenses as they occur and before any money is received or paid out. When you void the invoice, the inventory will also return automatically.

To resolve this, consider writing it off the invoice to reduce your March income and then creating an inventory adjustment, as suggested by our QuickBooks Online Support. I'll show you how.

Create a bad debts expense account:

Create a bad debt item:

Please continue to Steps 4 and 5 in this article for a complete guide: Write off bad debt in QuickBooks Online.

Once done, you may now create an inventory adjustment to match your actual stock. Check out this resource for more insight: Adjust inventory quantity on hand in QuickBooks Online.

I also recommend consulting with your accountant to determine whether voiding or writing off is best for you. They can assist you in ensuring the accuracy of your books.

Furthermore, if you require assistance with reconciling your bank account after processing and matching those transactions? For detailed instructions, see this link: Reconcile an account in QuickBooks Online.

If you have further questions about refunding and returning the item, let me know. I'll be around to help you.

When I asked the QBO help (in person), they had me create a vendor credit for the same amount as the invoice.

That's all you need to do. The credit memo will put the items back into inventory and reduce your March revenue. If you have QBO set up to automatically apply credits, the invoice will show paid, the credit memo will show closed, and QBO will create a payment transaction to link the two transactions. There's no need to make an inventory adjustment or create a bad debt expense.

I cannot find a setting in which to choose "automatically apply credits" so I have years of credit memos that have never been applied to anything. Some of the customers no longer do business with us. How best to void the credit memos?

I appreciate you being a part of this thread, trish7856. I'd gladly walk you through voiding credit memos in QuickBooks Online so your financial records stay up-to-date and accurate.

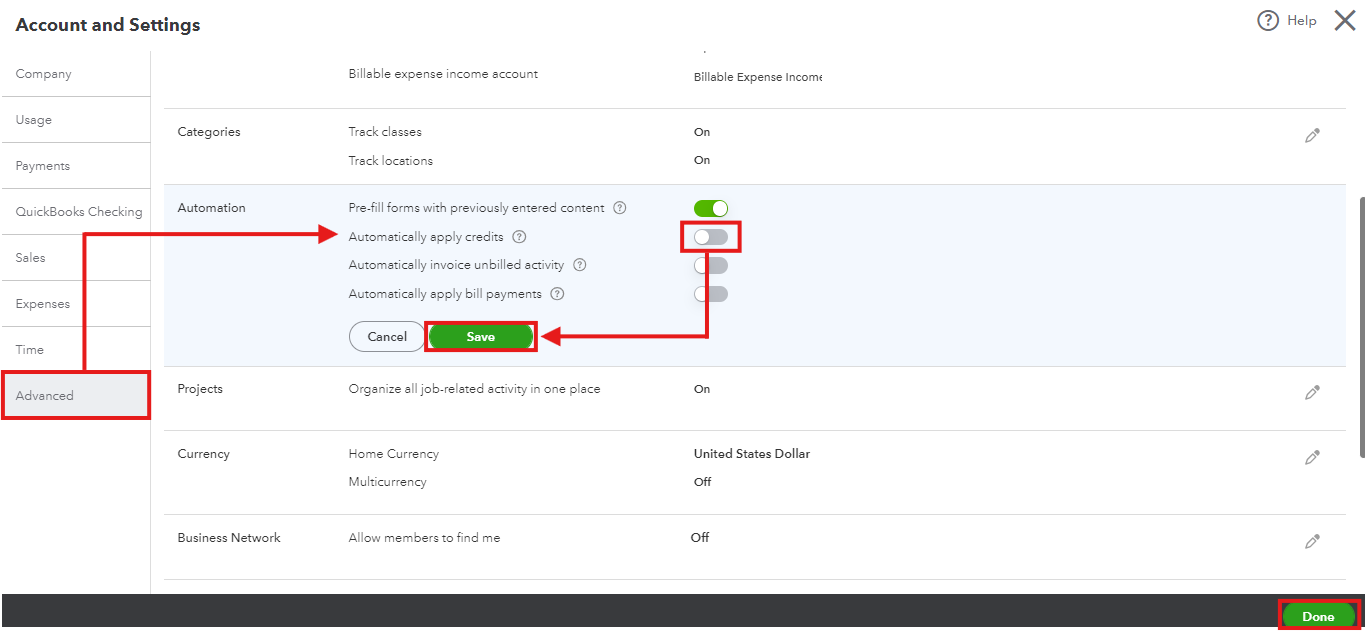

Before anything else, let me show you where to find the setting to automatically apply credits. Here's how to set that option:

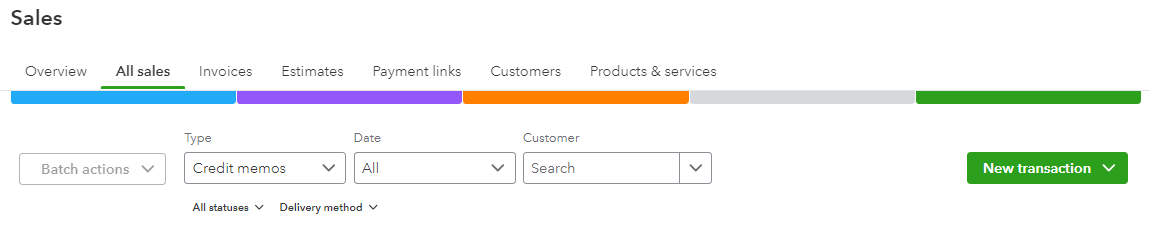

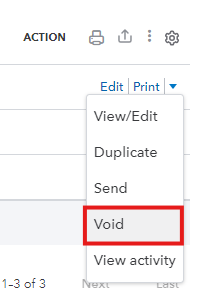

Additionally, please note that you can only void credit memos one at a time, as there is no batch option available. Here's the process to follow:

Voiding credit memos zeroes them out, so they no longer affect accounts, but they will still exist in your records for reference.

To find out more about credit memos in QuickBooks, feel free to check out this comprehensive resource: Create and apply credit memos or delayed credits.

If you've issued a refund to your customer and need assistance with recording it, check out this helpful article for guidance: Record a customer refund.

Feel free to leave a reply below if you have other concerns about credit memos in QuickBooks, I'm here to ensure you have all the support you need, trish7856. I'm here to ensure you have all the support you need. Keep safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here