Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowClass assignment is to the detail items in the check, not the bank acvount. Once you turn on Class Tracking the class column will be visible for all line items in checks, sales, invoices, journal entries. Only receipts and invoices allow, at least in desktop, setting the class once for the entire transaction. If the class column is not visible when creating checks then you have not turned the feature, which is only available in Plus, on yet

the class field has been removed from 2019 Quickbooks unless you buy plus?

Hello csp art,

The Class Tracking feature is only available in the Plus and Advanced versions of QuickBooks Online. You can upgrade your subscription so you can use it.

Here's how you can upgrade:

You can also visit our website for more information:

You might also want to check our page for tips and recommendations of your future tasks: Income and expenses.

Feel free to swing by anytime if you need help with anything else.

I have the Plus version of QB online. I have turned on the class function. I'm able to assign a class to the line of the transaction. The problem is the balance sheet side is not being assigned a class. I'm trying to maintain a balance sheet by class. Is there a way to assign a class to the cash or balance sheet side of the transaction? (I've had the same issue with A/P and bill payments).

Hi there, @ELIVI.

Currently, we can only assign classes to Accounts Payable (A/P) by creating a check or an expense transaction, while the bill payments dont.

Also, please know that there isn't a specific Balance Sheet report that's showing by class.

Here's how you can assign classes to your Accounts Payable (A/P) transactions:

Once done, you can now run the Balance Sheet Detail report to see the assigned classes to your A/P transactions.

You might want to check out these articles to learn more about class tracking and what specific reports you can run:

Please keep in touch if there's anything else I can do to help you succeed with QuickBooks. I've got your back. Have a great day.

Hi, i can assign a class at the line item level but not the header level. Subsequently my expenses are all tracked by class but not my Checking Balance. How do i enable that class is also tracked for the checking account?

Allow me to chime in and provide some information about the Class feature, ChrisMeyer.

As mentioned by @john-pero, the class assignment is to the detail items in the check. Aside from that, you can also add it to the expense or bill per line item.

Check out the Track your transactions by class guide for future reference. It outlines the complete steps on how to organize your customer and vendor transactions using the feature. Additionally, the Get started with class tracking in QuickBooks Online article provides detailed instructions from the setup process up to creating a budget for each segment.

Feel free to visit the Community if you have questions about QuickBooks. I’m here ready to answer them for you. Enjoy the rest of the day.

I am having the same issue as above - I need a way to track restricted funds, at a glance, without diving into the detail.

I went through all the work of creating classes, I can run the Statement of Financial Position, but unless I make manual journal entries, none of the bills I pay reduce the correct column - they all end up in uncategorized.

If I make a payment against a restricted account, I need it to reduce the restricted amount, and I need to be able to report the current balances to the board.

Is there a way to accomplish this with Quickbooks Online?

Hello there, ChelleMtoo.

I'd like to verify further details about the restricted account you are using so I can sort things out with you. If there are changes made to a transaction, it doesn't affect related transactions. You'll need to open each transaction and assign the class from there. Then, you can run and refers to the report to see updates.

Aside from that, the posting account affected on the bill is Accounts Payable and it affects the bank account used once its paid and the Accounts Payable account. I'd suggest reaching out to an accountant to help you identify the accounts to be affected when creating a journal entry just not to mess up your books.

You can look into these articles that will help manage your classes and customize reports:

Any additional information about the accounts you used is much appreciated. I'm just around to help you with it. You take care and have a great day!

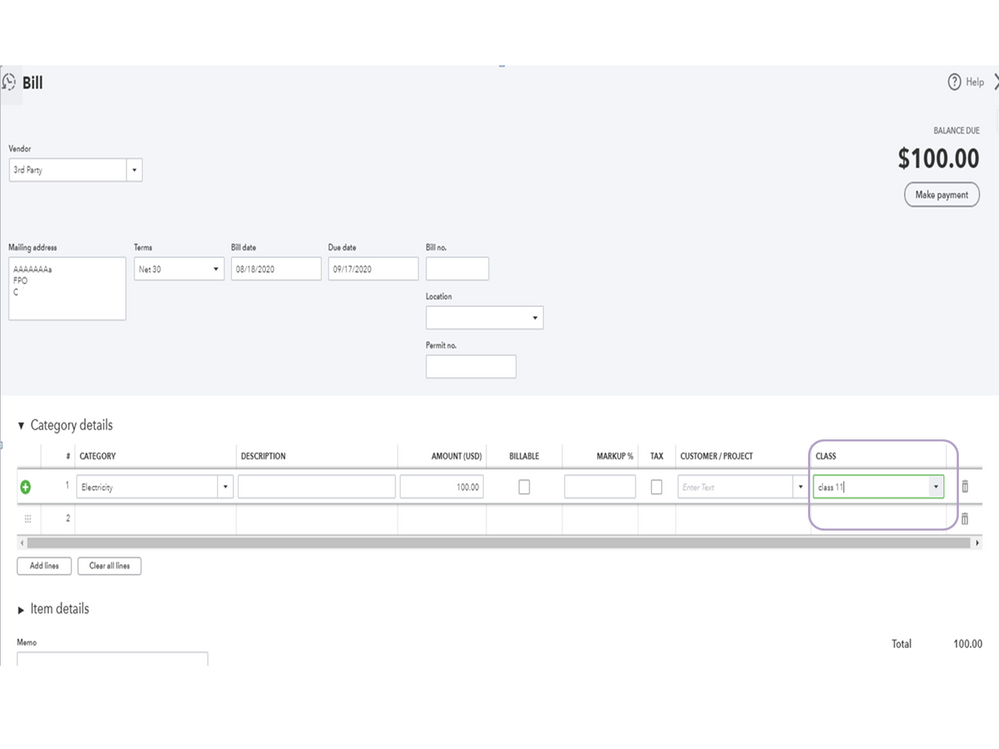

I attached a screenshot to explain what I'm trying to do.

Each transaction has a class. I enter a bill (and assign a class) but when I PAY the bill out of the checking account, I can't find a way to assign the change of money to a class, so it shows as "uncategorized" on the Statement of Financial Position (what would be the Balance Sheet in for-profit organizations).

How do I ensure that the bill payment correctly gets assigned to a class to avoid it ending up in uncategorized on the cash account? It's sales, bill payment, basically EVERY transaction ends up in uncategorized no matter what class the individual transactions are assigned to.

Thanks for coming back for more support, @ChelleMtoo. Let me chime in and add more insights about what you're trying to achieve today.

As mentioned by my peer @Mark_R, QuickBooks only supports assigning classes to Accounts Payable (A/P) by creating a check or an expense transaction. This is why you're unable to assign the bill payment to a class.

Moreover, QuickBooks doesn't have a specific Balance Sheet report that's showing by class.

Should you need to assign classes to your Accounts Payable (A/P) transactions instead, you may follow the steps he outlined above.

For future reference, read through these articles:

Feel free to message again if you have additional questions. We're always delighted to help.

Thanks for your response.

The balance sheet DOES have the option for classes, it just doesn't report it correctly.

What I need to be able to report to my board is how much of our cash or other assets is restricted to a specific use, and how much is available for general use. The only thing that comes close is using classes, as far as I can tell, but I'd certainly be open to any other suggestions?

If Quickbooks doesn't offer classes on the balance sheet, how can I track and report restricted balances?

Thanks.

Thanks for getting back here, ChelleMtoo.

I have an idea what's going on with the Balance Sheet report. Every transaction is separated into two sections: the header and the detail.

The Balance Sheet report only uses the data from the headers, but classes are linked to the details section of a transaction. This is why your transactions are under Not Specified.

Instead of using the classes on your checks, you'll want to use the Location tracking option to filter the balance sheet report. Please make sure to enable the option by following these steps:

Here's a sample screenshot for reference:

Once done, open the check you want to add a location by following these steps:

Finally, run the Balance Sheet report by following these steps:

Here's a sample screenshot of what the report looks like:

I'm also adding this article for more information: Run a balance sheet by class or location.

Please let me know in the comments if you need anything else, or if you have other concerns for QuickBooks. I'll be around to help you some more.

This is great - I feel like I'm 90% there - but while I can assign a location to checks, I can't find where I can assign a location for paying bills?

The bill itself has a location, but again, header/detail being what it is, it's not flowing through to the balance sheet.

How can I assign a location when I'm paying a bill, not just writing a check? Is there something I can turn on in that screen? Looks like the same situation for receiving payments against open rec'bles.

Any more advice?

Thanks so much,

Michelle

This is great - I feel like I'm 90% there - but while I can assign a location to checks, I can't find where I can assign a location for paying bills?

The bill itself has a location, but again, header/detail being what it is, it's not flowing through to the balance sheet.

How can I assign a location when I'm paying a bill, not just writing a check? Is there something I can turn on in that screen? Looks like the same situation for receiving payments against open rec'bles.

Any more advice?

Thanks so much,

Michelle

Let me provide some information about adding a location with your transactions, @ChelleMtoo.

The location feature in QuicBooks Online (QBO) can only be added to estimates, invoices, expenses, checks and bills. You can't set a location when paying bills or receiving payment.

The location that you set for that bill will be carried over when you process bill payment.

Let me help you in customizing the Balance Sheet Report to display the location:

Also, make sure to add a location on all of your transactions to show the Location column.

To learn more about how QuickBooks handles location tracking and generating related-financial reports. Check these articles:

I'm always here if you have any other concerns about your transactions. Keep safe and have a wonderful day!

Hi again -

We're set up as a non-profit, so it's the Statement of Financial Position, but I assume the rest would be the same.

I've done as you say, however, even though I put the location in the original bill, the payment is coming up uncategorized on this report.

I'm attaching screen grabs so you can see. The only things left in my "uncategorized" are paid bills, which are all entered to the location (division in this case).

Please advise? I'm not sure where I'm going wrong.

Thanks,

Michelle

Well, it will only let me do one file at a time. So I mushed them together best I could. The bill itself has a location (division) but it's still not specified on my balance sheet.

You're on the right track, Michelle.

As mentioned above, the location that you set for the bill will be automatically added to the bill payment.

Since you've already assigned locations (divisions) to your bills, we'll just have to retrigger the payment to apply the changes that you've made. I'll show you how:

Once done, all the payments in the Total for Not Specified section will be categorized into the appropriate locations (see below).

You'll want to consider memorizing this report to save its current customization settings.

Additionally, I encourage running these popular custom reports in QuickBooks Online to get awesome insights about your business.

If I can be of any additional assistance, please don't hesitate to insert a comment below. Stay safe and have a pleasant day ahead.

Are there any plans to add classes to bill payments and payments received (and any other transaction that omits it right now)? This is a huge problem when we need to run balancing financials by class and its kind of weird that a double entry accounting system would not allow this for all transactions.

@Seabiscuit wrote:

Are there any plans to add classes to bill payments and payments received (and any other transaction that omits it right now)? This is a huge problem when we need to run balancing financials by class and its kind of weird that a double entry accounting system would not allow this for all transactions.

You already would have entered the Class in the Bill or Invoice. Bill Payment and Receive Payment are simply movement of money. The thing is a bill payment can cover such a wide array of transactions and bills that a single class assignment would rarely be correct. Each line in a bill and for invoices, an entire invoice (in desktop for certain) can have one class assigned to the entire invoice or you can add a class to each line item.

BTW Class is an extra tag, an add-on, and not something recognized as a required or normal part of double=entry bookkeeping

Yes, I understand that its not technically an accounting function but it would make sense to allow the ability to assign this tag to both sides of a transactions so that every transaction within a class has an offset. How else would one run a balancing set of financials? (assuming that the accountant was careful to input the same class to each side). Now if I run a balance sheet, it doesn't pick up all transactions in the class because 1/2 of some are not being picked up...

A great example is a deposit. You cannot choose the class on the cash side so, when a balance sheet is run by class, deposits are not included in the cash balance, thus causing the statement to not balance. This is a problem that I am surprised has not been addressed.

Hello - sorry for the delay in response.

This trick works for bill payment now, although I'm not sure why I have to reflash them constantly.

But it's not working for deposits.

When I book a sale to "undeposited funds" so that I can add them to one deposit, the location is still not flowing through. I've tried unchecking and rechecking, but it's not helping.

Can you help? I'm so close to being able to do this without a bunch of GJ entries to reclass things.

Thanks!

We may utilize an importer tool to define the Class

https:// transactionpro.grsm.io/qbo

Prepare the Deposits data with the following template

| RefNumber | TxnDate | PrivateNote | Currency | ExchangeRate | DepositToAccount | Location | Entity | LineDesc | LineAmount | Account | PaymentMethod | PaymentRefNumber | Class | CashBackAccount | CashBackAmount | CashBackMemo |

| 1 | 12/12/2020 | USD | Checking | Robert | Deposit | 10 | Account1 | Cash | ||||||||

| 1 | 12/12/2020 | USD | Checking | Robert | Deposit | 20 | Account1 | Check | 12345 | |||||||

| 1 | 12/12/2020 | USD | Checking | Robert | Deposit | 30 | Account1 | Cash |

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here