Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi there, @mcgowanj-trine-e.

When running a charitable or nonprofit organization, it's best to look for the lowest fees possible. You may check out our QuickBooks Online Pricing page to see the available plans and their offers.

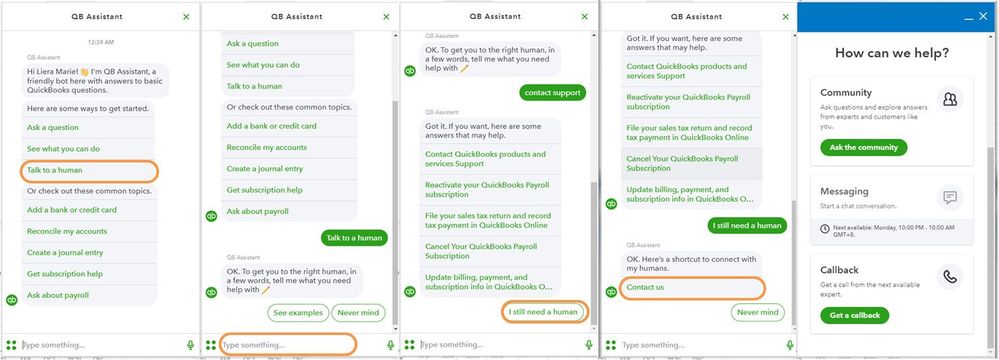

I'd also recommend contacting our Customer Care Support team. They can further assist you with your billing concern and provide options that suit your business needs.

Here's how:

You can also check out these articles should you decide to get your desired plan:

I'd be delighted to see you again here in the Community. We're always here to help if you need more help with managing your account. Have a lovely day.

If you are eligible, purchase a new blank QBO account from TechSoup. You will get the special price for Non Profit. Otherwise, purchase a one time license of QB Desktop 2021.

I just spent several days trying to accomplish this. We are in the situation of having 10+ years of transactions in one of the bank accounts.

Problems that Intuit and Tech Soup do not describe:

- Reconciliations do not copy over from one Company to another. So when you set up the new company with the access that Intuit donated to Tech Soup, you need to do ALL the reconciliations over again.

- Custom reports and Memorized/Recurring transactions do not copy over, so those need to be re-created.

- If you have any closed accounts, that info and those transactions do not copy over (or did not for us). So I was faced with the scenario of adding the account, importing the transactions, editing each one so that it was correct, etc.

If Intuit really wants to benefit Nonprofits, they need to adjust the billing in the back-end. There must be a way and apparently they refuse to do it...

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here