I've got the details you need to switch over employee's transactions to contractor payments in the program, @leaksfitness.

First, you'll have to delete or void the employee's paychecks. Then, change the employee's status from Active to Not on Payroll or Terminated. Once done, set up a new contractor and re-enter your payments via expenses or checks. I'll guide you how.

To delete the manual paychecks:

- Go to Workers from the left menu.

- Select Employees.

- Choose Paycheck List under Run Payroll.

- Set the date range and select the paychecks you want to delete.

- Choose Delete.

- Click Yes to confirm the deletion.

For detailed instructions, see the Delete paychecks section through this article: Delete or Void Paychecks. Just go to the Intuit QuickBooks Online Payroll Enhanced menu.

If the paychecks are direct deposit, you'll need the assistance of our Customer Care Team. They can assist you with voiding the paychecks for the previous quarters. This ensures your books are accurate.

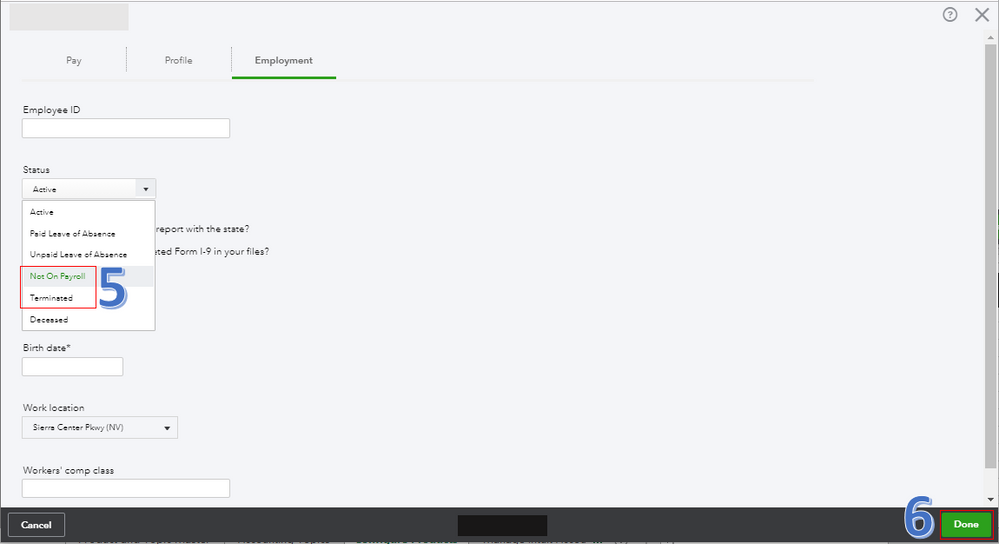

To change the employee's status:

- Go to Workers from the left menu.

- Select Employees.

- Locate and click the employee’s name.

- Click the Pencil (Edit) icon beside Employment.

- From the Status drop-down, choose Not On Payroll or Terminated.

- Hit Done.

The screenshot below shows you the last two steps.

After that, add the contractor from the Workers or Expenses menu. Then, you'll have to enter checks or expenses for the contractor payments.

At year-end, you can prepare and file your 1099-MISC forms through the software. To learn more about this process, visit this article: Filing 1099s.

Also, I'd suggest checking out this website: Common Questions About 1099s. This link provides you with answers to the frequently asked questions about this form.

Feel free to leave a comment below if you need further assistance. Have a great rest of your day, @leaksfitness.