Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowOriginally, I set up a bank deposit to bring in a donation for restrictive account. That put the deposit in the correct account.

Going to the invoice I select the service. However, there was not a way to match the deposit to the invoice.

I did find Quickbooks "Applying a Deposit to an Invoice' but the problem that the deposit can only be made to bank or asset account.

So how an I to set up the restrictive account so I can apply the deposit to that account?

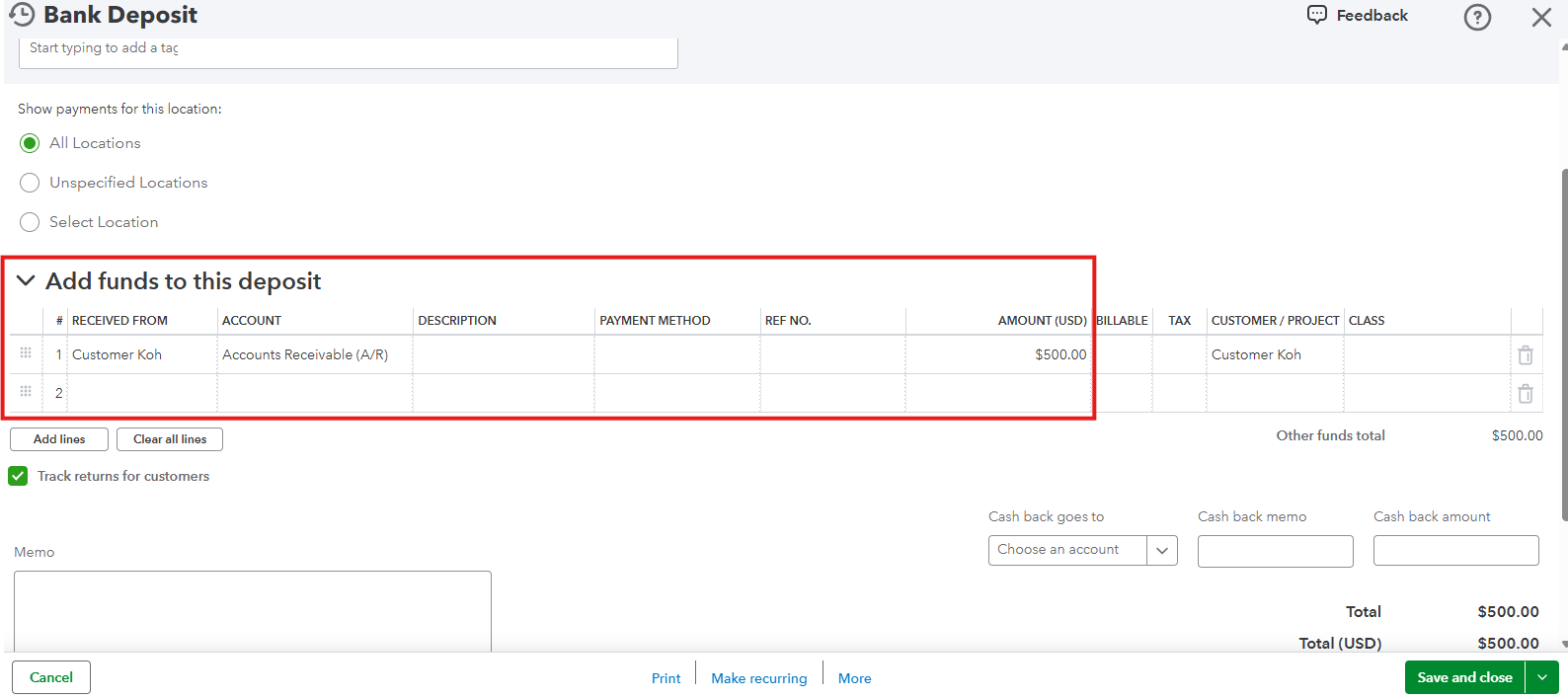

To apply a bank deposit as payment toward an invoice, you'll need to allocate it to the Accounts Receivable account, Playawest45.

Here's how to do it:

To apply a deposit to the Accounts Receivable account:

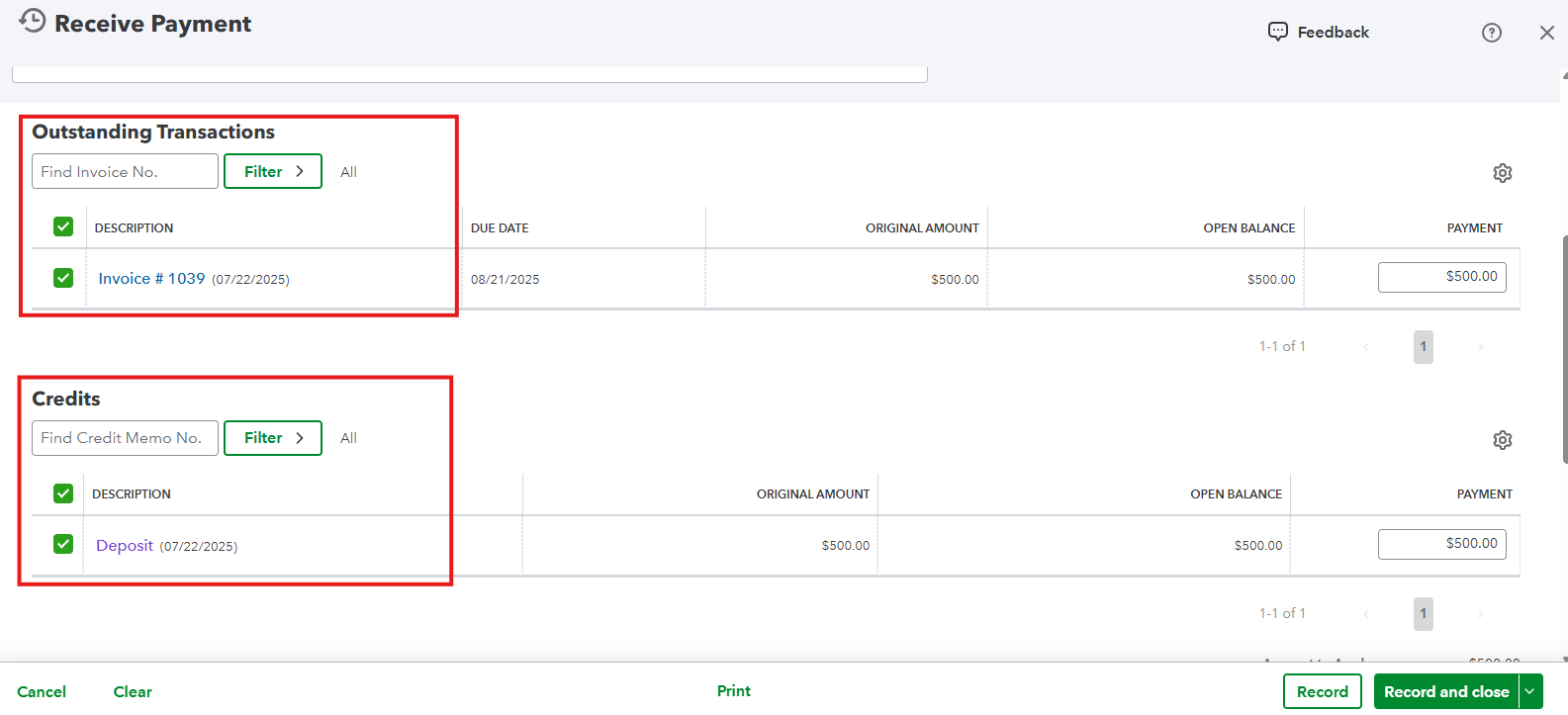

To apply the deposit to an invoice:

Feel free to use this link for reference: Add a deposit to an invoice.

You can designate the restrictive account as a bank account type in the Chart of Accounts. For detailed instructions, you can refer to this article: Add an account to your chart of accounts in QuickBooks Online.

If you initially deposited funds into a "restrictive account", you can create a Transfer to move the amount into the correct bank account.

We'll be right here if you have any additional questions.

I can not access the Ask Community account I first posted this question on. I did put Question using a different account.

Thanks for the response.

There is added complication of that in this case the deposit is Paypal. Quickbooks has Paypal connector by Quickbooks to bring the funds into bank Paypal 2

Quickbooks was able to match the invoice and the deposit into the general fund.

But now the problem is that this is a restricted donation and the funds are in the general fund.

The invoice says this is restricted donation but the correct Product and Service does not get the funds in the correct account.

Do I have to track the restricted donation through the general fund and make the donation reappear on the other side? Then move the donation to what kind of account?

I'm glad to see you here, @Playawest45. Since the restricted donation also shows up in the General Fund account together with the unrestricted one, you have the option to track it separately or not.

You can create another account in the Chart of Accounts or make a sub-account to the parent for that restricted fund to track it accurately.

Here's how:

Then, go to the invoice payment link of the restricted funds and change the Deposit to option to the created account before saving.

Speaking of the product and service does not get the funds in the correct account, you can simply apply the process above and place the payment to the accurate category.

You can also review the income account of your products and services to ensure they are assigned to the right one.

On top of that, I highly recommend reaching out to your accountant to know the kind of account and category and help you decide what's the best approach for these entries.

With regard to you unable too access your Ask Community account, let's troubleshoot it by adding Intuit as a trusted site. Then, remove your browser's cached date and any cookies related to Intuit.

Let me know if you have additional questions about tracking restricted funds by leaving a comment below.

As far as the cache problem, I had tried deleting the cache but what I missed was the default is a day. I had to select all time to clear the problem. The steps to clear cache were by given by another advisor.

If I want to track the donation separately, then I do not see a way. Going back to the original Paypal deposit, the only selections for deposit account is a bank. In my case the choices are organization bank or Paypal bank. I guess the restrictive donation could be put in a restrictive donation bank but that seems odd.

There currently is an account Restrictive Donations and sub account under the Restrictive Donations.

In regard to payment links, I would have to be admin to set that up. That is another problem how to get admin access with the account set up as personal account. Not sure if Quickbooks allows something besides the SSN like EIN to avoid this type of problem.

As far as the cache problem, I had tried deleting the cache but what I missed was the default is a day. I had to select all time to clear the problem. The steps to clear cache were by given by another advisor.

If I want to track the donation separately, then I do not see a way. Going back to the original Paypal deposit, the only selections for deposit account is a bank. In my case the choices are organization bank or Paypal bank. I guess the restrictive donation could be put in a restrictive donation bank but that seems odd.

There currently is an account Restrictive Donations and sub account under the Restrictive Donations.

In regard to payment links, I would have to be admin to set that up. That is another problem how to get admin access with the account set up as personal account. Not sure if Quickbooks allows something besides the SSN like EIN to avoid this type of problem.

Even with completing the steps given by another advisor, I find authentication problems with Microsoft edge. Switched to Chrome to continue.

If I want to track the donation separately, then I do not see a way. Going back to the original Paypal deposit, the only selections for deposit account is a bank. In my case the choices are organization bank or Paypal bank. I guess the restrictive donation could be put in a restrictive donation bank but that seems odd.

There currently is an account Restrictive Donations and sub account under the Restrictive Donations.

In regard to payment links, I would have to be admin to set that up. That is another problem how to get admin access with the account set up as personal account. Not sure if Quickbooks allows something besides the SSN and like EIN to avoid this type of problem

Upon configuring PayPal, the default selection for the deposit account is set to a bank account, Playawest45.

With this, all invoice payments are linked directly to the general funds account.

You can change the Deposit To field to point to a restricted account. However, if the restricted account is not categorized as a bank account in QuickBooks Online, it will not appear in the dropdown list of available deposit accounts.

Also, the payment link shared by the previous agent corresponds to the one associated with invoice payments. However, it is not referring to the link that allows direct invoice payment, which requires setting up an SSN. If you can't access the payment link, I suggest reaching out to your primary admin to modify your user role.

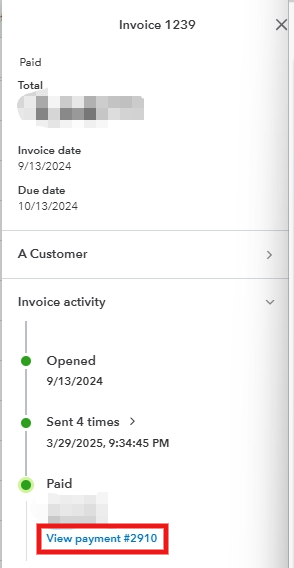

To locate the payment link, navigate to the Invoice page and select the specific invoice you want to review. This will direct you to the invoice details page, where you'll see the View Payment option. Clicking on it will display the payment link associated with that invoice.

The Community team is here to support you whenever you need help. Feel free to share your questions below or start a new post to get assistance tailored to your needs.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here