Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

How do i book the compensation deduction allowed on the missouri employer's state withholding tax return?

It’s great to see you in the Community, SusieQStL.

I can help point you in the right direction, so you can book the Missouri withholding tax compensation deduction.

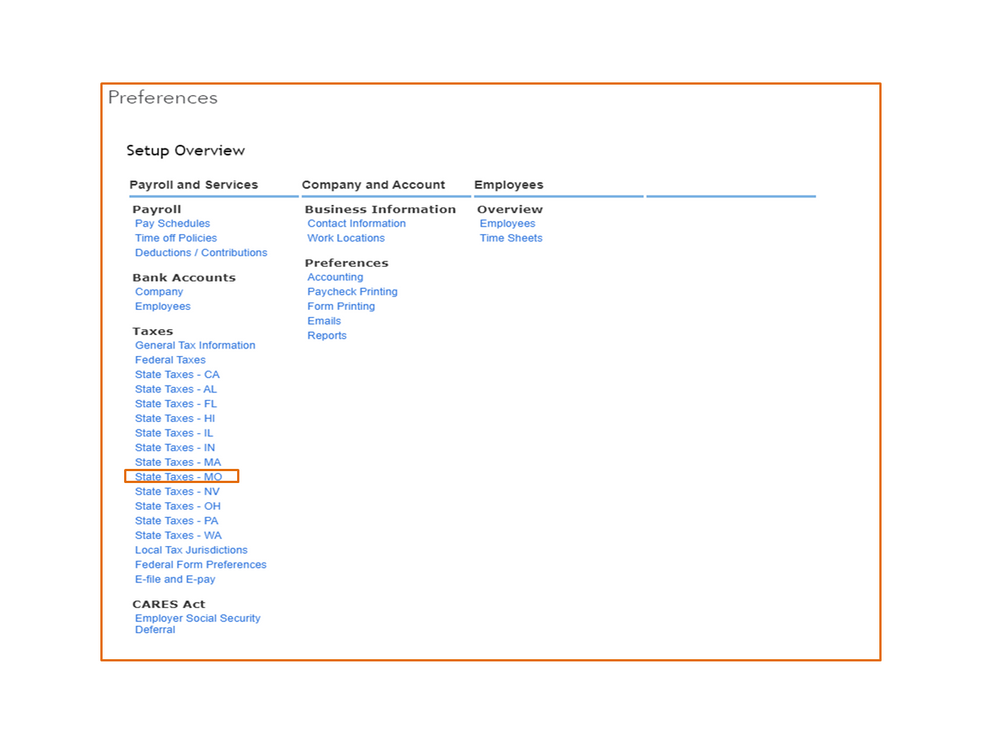

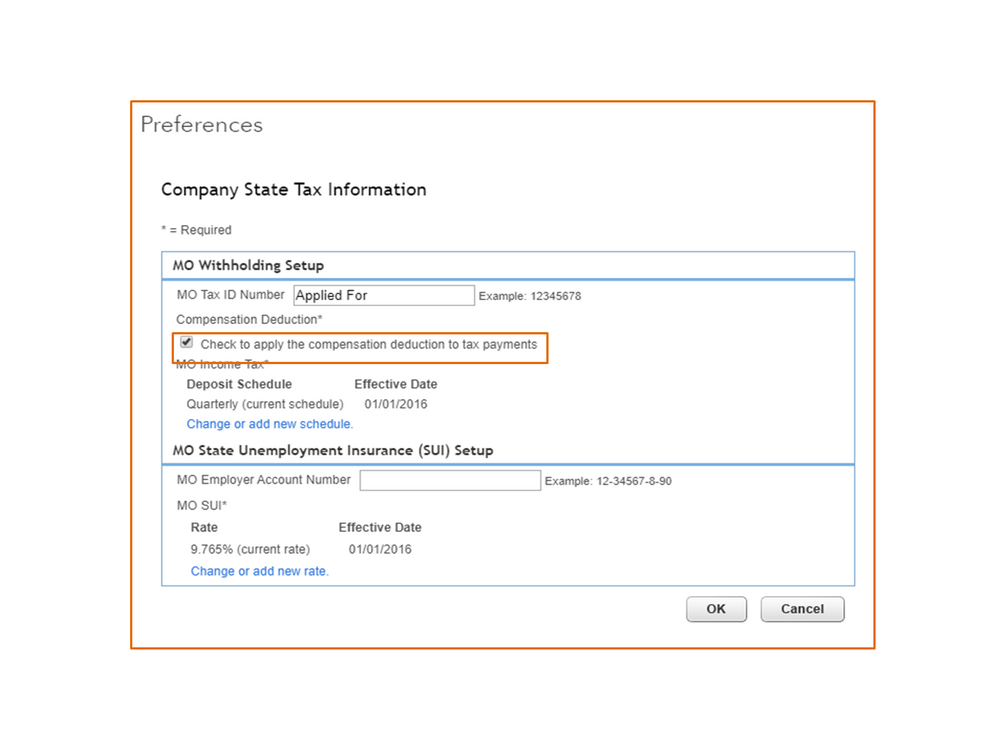

The compensation deduction is automatically tracked in QuickBooks as long as the Company State Tax Information is set to book the payroll item. We’ll have to review your Payroll settings and make sure the Check to apply the compensation deduction to tax payments box is selected.

Here’s how:

After processing the tax return, QuickBooks will automatically book the compensation deduction. If the compensation deduction is from the previous year, we’ll have to make sure it’s properly tracked in your payroll records.

It requires us to access gather personal information to access an account. Our Payroll Support Team can view payroll data in a secure space, so I recommend contacting them. One of our specialists will perform a payroll correction to ensure your tax information is correct.

To keep you up to date with the state payroll tax regulations, here’s an article that lists all the MO tax forms, filing and deposit schedules, etc: Missouri Payroll Tax Compliance.

Also, this guide outlines the complete steps on how to update the state account information: Changing a state account number.

Keep in touch if you have any clarifications or other questions. I’ll jump right back in to answer them for you. Have a great rest of the day.

Thank you for this information. Would the compensation deduction be booked as Income?

How can I do this on the desktop version (Quickbooks Pro 2021)

Hello there, LRLUND.

When filing the form, you as an employer can deduct and retain as compensation from remittances made to the Revenue Dept on or before the specific due dates for the payments. Keep in mind that if the employer is not entitled to compensation if payment is not made on or before the due date, But if compensation deductible is allowable, then it must be deducted on each file return.

To further guide you on the process, I recommend contacting your Tax Adviser. That'll help you ensure your books are in order.

For more information about Missouri state tax regulations, see the below articles:

If you have any other payroll concerns, feel free to reach back out. The Community is here to answer it for you. Have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here