Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSo I'm helping a friend get his business books together from last year. I'm pretty familiar with QuickBooks but wanted to see if anyone had experience with a situation like this before. So he's got two checking accounts that he's used back and forth to pay for both personal and business expenses. He's a handyman (LLC) and so basically just runs everything through that. Generally, he would receive income into the business account, maybe pay for some business things there before transferring it all to his personal account. Then in the personal he spend it on personal things, but also business expenses.

So I'm more or less taking it from the perspective that everything he has is essentially the net for the business. Thoughts or recommendations on how I can organize and work this in Quickbooks between the two checking accounts? Certain transactions types to indicate the transfer of funds from one to the other and then just have a general Owners Personal Expense (equity) account to put everything else under?

Thanks!

Thanks for the detailed explanation, @rekuhl19.

While we recommend avoiding the mixing of business and personal funds, we understand that it can happen sometimes.

To begin, you should record any business expense that you paid for using personal funds in QuickBooks. After that, you can decide how to reimburse yourself, either by recording it as a check or as an expense. Conversely, if you used a business account to pay for a personal expense, you should also record that and reimburse the company accordingly.

Here's how to record the business expense you paid for with personal funds:

To record the reimbursement, please refer to this article for detailed steps on your two options: Decide how you want to reimburse the money.

Similarly, for paying personal expenses charged to a business credit card or bank account in QuickBooks, follow the steps outlined in this article: Record a personal expense from a business account and reimburse the company.

It's advisable to consult with an accountant to assist you in transferring funds between personal and business accounts and in categorizing transactions to an Owner's Personal Expense (Equity) account. This helps prevent errors in financial reports and maintains the integrity of the business's books, which is critical in minimizing audit risks associated with mixing business and personal funds.

Let me know if you have any further questions.

Obviously, the right answer is to make it clear that he should not be using the personal account to deposit business income into or make any withdrawals from for business expenses. It should all go through the business account - I'm sure you know that. I would tell him that it's costing him more because it takes you longer to record transactions into and out of his personal account than it does the business account (it does). Also, tell him that mixing personal and business funds essentially nullifies the liability protection that his LLC was designed to provide. If he were sued, there is no question that his LLC is not being used properly, and the comingling of funds is a sure way for a court to allow someone to go after his personal assets. Sorry about the rant...

Having said that, there should only be the business bank account in QB. Any transactions that go into or out of his personal account should be booked to Owner's Equity if the LLC is taxed as a sole proprietorship or Shareholder Contributions/Distributions if taxed as an S-Corp and he's 100% owner.

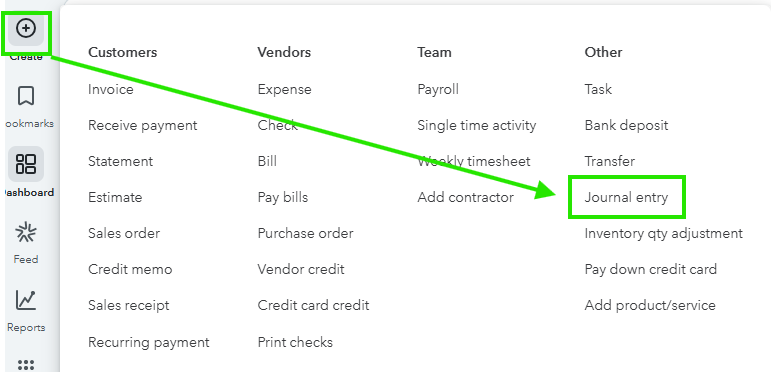

There is no reason to use a journal entry for a business expense paid for with personal funds. In fact, it's a bad idea because journal entries do not show under the vendor's account. A business expense paid for with personal funds should be recorded as a $0 bill or $0 expense transaction so it appears on reports. There should be a line item with a negative amount booked to the appropriate owner's equity account that nets the bill/expense to $0.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here