Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Really nothing to account for. Any unpaid amounts remain as unpaid amounts until paid. You will see it in A/R - Accounts Receivable. If you are accrual your income posted the moment you hit save for the invoice even if you never get paid. If Cash your income posts as payments are received.

I generally agree. But I will eventually get a check for all these invoices and this will be years from now. So then how will I get QB to apply that single amount to multiple invoices?

It would be easier if I could get the invoice paid, the 10% accounted for in a separate account and then pay off that account when I get the retainage. QB desktop does that pretty well.

Also now I have a bunch of over due invoices that seem to want to send themselves to the client. I get emails about this filling my inbox and cannot resolve.

I get that.

it would be easier if we could assign that to retainage and have QB track it separately. Because I will have many invoices with that 10% withheld and a single payment later. How does that get applied to all the invoices? Have issues with QB not doing that with 2-3. This will be 36-48 different amounts and I get a single check for the retainage.

Plus now I have a bunch of overdue invoices that email me and fill up my inbox with items I cannot resolve, and I have to be very careful if sending other true overdue invoices that these don't get sent as well.

QB desktop can do this very well. There does not seem to be a mechanism to do this in the online version.

Thanks for joining this conversation, @cphubb.

I can help you account and record the invoice transactions in QuickBooks Online.

The common features used with a construction business in QuickBooks Desktop are Job Costing or Progress Invoicing. In QBO, you can utilize the Project and Progress Invoicing feature too. It can help with tracking income and expenses and invoice customers for partial payments.

However, if you want to stick with recording a retainer or deposit, you can refer to this article to learn more and get the detailed steps: How to record a retainer or deposit.

Meanwhile, you have the option to turn off the automatic email notification for overdue invoices. Here's how:

Keep me posted on how these steps work out for you. I'll be here to keep helping. Have a great day.

HoneyLynn_G wrote:

Meanwhile, you have the option to turn off the automatic email notification for overdue invoices. Here's how:

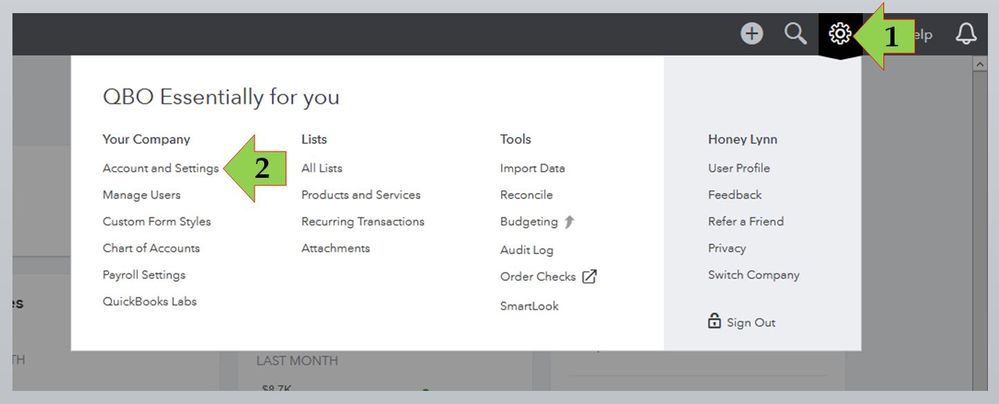

- On the top menu, click the Gear icon.

- Choose Account and Settings.

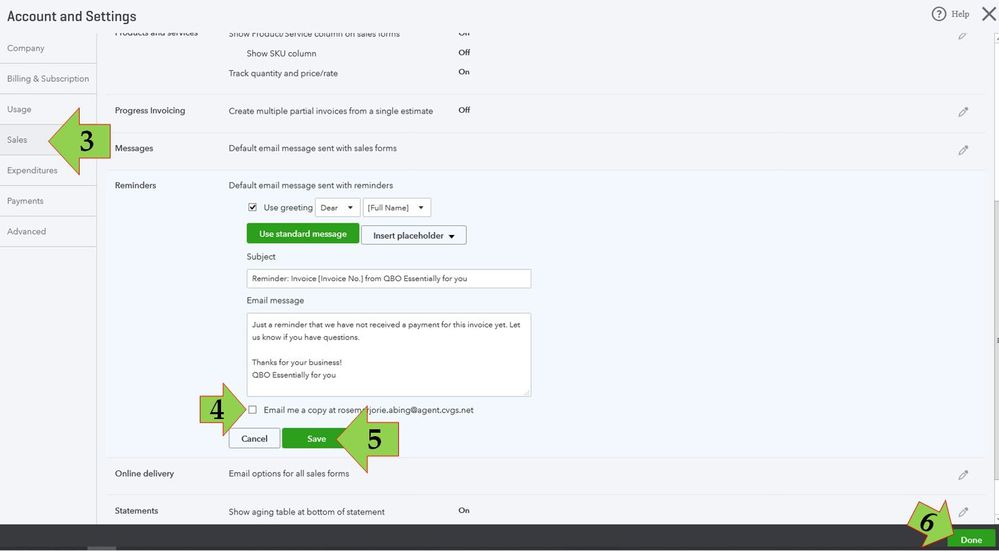

- Go to the Sales tab.

- Select the Reminders section and make sure to uncheck the Email me a copy box.

I don't see that will do it. I suspect it's Manage Routines in Labs

Hi Malcolm Ziman,

I appreciate you joining this thread and providing another suggestion.

You're correct. Aside from the steps I've given, the customer can also customize or turn off the Routines for QuickBooks button. That way, he can manage alerts and repetitive tasks in QuickBooks Online.

For chris.h's reference, I'll be providing the steps on how to turn off the Routines feature.

If you wish to only customize its rules and setup, here's how:

That's it. If I can be of any help for you, just let me know. Take care always!

I do want to be clear I am not trying to account for a Retainer or deposit, but a retainage, where the payer holds back a portion of the payment each pay period. This is common in public construction projects to ensure all the end of contract requirements are met. QB Desktop has an account for this and when you apply it, the invoice is then paid in full and the account to manage retainage for the project adds money. At the end we get a check that should equal the amount in that account.

So I want QB to be able to close the invoice so I don't have to track a bunch of overdue invoices that are not really overdue and when I get notifications about overdue, I want those to just be the actual over due not all these that have legitimate retainage. I also want to be able to compare the final check to the total without having to go through each one with a calculator.

@cphubb wrote:

So I want QB to be able to close the invoice so I don't have to track a bunch of overdue invoices that are not really overdue

Just changing the due date will make it not overdue

So in the desktop when you applied partial payment to an invoice and saved it, you had three options

1. Leave the underpayment - Invoice stays open

2. Apply a credit to customer. Closes the invoice and changes the amount of AP for the client. Can compare to original estimate to track differences

3. Apply to another account. Here we would either send it to a retainage account or a write off account if we planned on dropping the money.

4. When we get our retainage released we use a report to compare the check amount to the client or project specific retainage to date and verify it matches. We then can either apply the amount to all the invoices listed in the report or use a journal entry to offset the amount. Depends on how long it takes to get that release. It can take years depending on how may changes lawsuits billing disputes etc.

So its very important to track this amount, but at the same time manage our invoices properly, with proper due dates and notifications. Messing with that system is just working around something that should be included if this is intended to replace desktop as was advertised when we purchased it.

@cphubb wrote:

Messing with that system is just working around something that should be included if this is intended to replace desktop as was advertised when we purchased it.

They lied. Happens all the time in business. They have deeper pockets.

That aside, a workaround would be to receive an additional false payment from each customer and deposit same to a retainage asset account. But here is the rub, no matter what you do other than create a customer credit or receive a payment and call the invoice paid in full your invoice will remain unpaid - I actually like Malcolm's idea of just changing the due date to sometime far in the future, say 01/01/2101 and although the retainage amount will be equivalent to unpaid invoice amount the invoices will not pester you that they are late and overdue.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here