Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowEnter the bill for the actual amount due

then use pay bills and pay the actual amount paid, QB will ask if you want to keep a vendor credit, say yes

So where does that credit go? I tried doing that and I couldn't find the actual vendor credit?

Hey there, @Angel11-72.

I’m here to assist you with entering a credit for a vendor.

Here’s how:

I’m here to lend a helping hand if you have further questions.

We don't have an item field. We're a restaurant and only have categories. Any other suggestions? Like I said the vendor shows a credit of 14.87, the amount that was overpaid by.

We don't have an item field. We're a restaurant and only have categories. Any other suggestions? Like I said the vendor shows a credit of 14.87, the amount that was overpaid by.

Sorry for the double post.

Hey there, @Angel11-72.

Thanks for reaching out to the Community. It's my pleasure to assist you with the vendor overpayment.

Since the overpayment was recorded as a vendor invoice, you'd need to leave it as is. This transaction is recorded on your bank statement, which would then cause issues when trying to reconcile the accounts. I recommend reaching out to your accountant for further advice on the best solution to handle this.

If you have further questions, feel free to reach back out anytime. Wishing you and your business continued success. Take care!

Hello,

I'm having a similar problem. However the statement I'm paying against has several individual invoices that accumulated over the statement period. If I select all of the invoices in Pay Bills the total amount to pay does not equal the check that was manually written. I don't see a way to apply an overpayment in Pay Bills.

I've received the next month's statement and have entered all the invoices from that statement but still cannot figure out how to apply the payment for $27,717.74 (please see attached files). The vendor uses Quickbooks too.

Hello @TH505,

Let me help share how you pay your vendor invoices or bills in QuickBooks Online.

To start with and base on your screenshot, the overpayment you'll need to enter is the CREDMEM transaction on your statement. Since you already entered the bills, you'll have to create a vendor credit for the transaction with the amounts $86.28 and $1694.43.

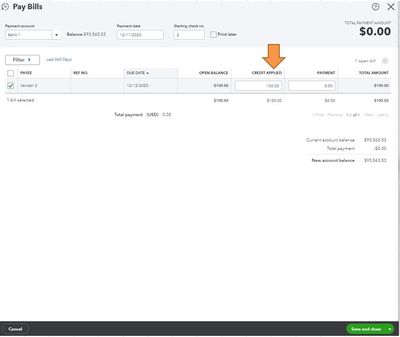

Once done, you can go back and pay your bills at once. From here, the amount of the overpayment will show up in the CREDIT APPLIED column and the rest of the payment amount will auto-populate.

On top of that, here's an article you can read to learn more about how you can pay your bills: Enter bills and record bill payments in QuickBooks Online.

Additionally, I've got you this helpful article for guidance in preparation for the 2020 tax season: QuickBooks Online Year-end Checklist.

If there's anything else that I can help you with, please let me know by leaving any comments below. I'll be here to lend a hand.

Thank you for your prompt reply. The person I'm working for has Desktop version of Quickbooks Pro 2016.

Thank you but I'm not using the online version. The person I'm working for has Desktop Pro 2016.

Hi there, @TH505!

Thank you for letting me know you're using the desktop version of QuickBooks. Let me walk you through how you can enter the overpayment.

Once done, you can open a bill payment transaction and the amount of overpayment will show up on the Set Credits window. Here's a screenshot for your visual reference:

Additionally, I've got you this helpful article for guidance in preparation for the 2020 tax season: QuickBooks Desktop Year-end Checklist.

Keep me updated by leaving any comments below if you have any other questions. Stay safe!

We overpaid a vendor by $40,943.39. There is a credit on the vendor account. They submitted a check back to us for the overpayment, how do I record the check to clear the credit. When I enter it in the deposit, I selected Accounts Payable as the account and it ends up putting another credit on the vendor account for the same amount - doubling it. What are the proper steps to clear the credit from their account with the check they sent to us and bring the account back to zero?

Thanks for joining here today, @BMW1973.

To verify, is the vendor balance a negative or a positive amount? For overpayment, the vendor balance should show negative amounts. Thus, depositing to your bank account from the A/P account should zero out the balance.

In your case, you'll want to check the amount if it's an overpayment or a pending balance.

Here's a guide on how record refunds in QBDT:

If you need help with other QBDT tasks, browse this link to go to our general topic with articles.

Keep me posted if you still have questions or concerns with vendor payments. I 'm always here to help. Take care and have good one.

Hello,

I'm having the same issue. We overpaid a vendor 13K, the vendor sent the money back and now I have to match it in banking. When I match it as it is a journal entry as a debit and credit in accounts payable, my accounts payable report is affected and it has negative values. What should I do?

Hi there, capitology.

We have a way of recording overpayment to vendors. It will also depend on how they refunded you. In recording vendor refunds, you may not create a journal entry. Instead, you'll just have to record a deposit of the vendor check with the refunded amount and then create a bill credit. To link both deposit and credit, you'll use the Pay Bills option. Afterward, match it to the bank downloaded transaction.

Here's a link that will guide you through the steps on recording vendor refunds. Choose the best scenario of how you received a refund from a vendor: Record a vendor refund in QuickBooks Desktop.

I'd still suggest reaching out to an accountant so they help you manage overpayments from your vendors depending on your business preference and before deleting the journal entry.

Keep me posted if there's anything else that you need help with. Take care and have a great day!

Hello,

I have a similar scenario where we’ve overpaid a vendor by $418.60. I went back and corrected the bill amount to reflect the overpayment. The vendor refunded the overpayment in which I did the deposit under the vendors name and selected AP as my gl account. However when I review the bill tracker, it’s still showing an Unapplied payment of the $416.60? How can I correct this portion of the transaction?

You're almost there, @Ncfundi.

Since you've already entered the vendor credit by creating a deposit using the Accounts Payable account, all you need to do is to apply that credit to the bill with a "zero dollar" payment. Doing this links that unapplied payment to the overpaid bill. I'd be glad to show you how.

For additional details in entering a credit from a vendor, feel free to read this article: Manage Vendor Credits.

Get back to me if you have other concerns about applying vendor credits. I'll be around to answer them all for you. Keep safe and have a good one!

Thank you so much! This was very helpful!

We had this same thing happen to us. The trick is to unattach the check you wrote from any bill. In Quickbooks desktop, any monies paid to a vendor and not attached to a specific bill will show up as available credits in the Pay Bills routine.

NOTE: Do Not add a credit from the Vendor as this should only be used if the vendor has granted you an "unearned credit", meaning a credit you did not exchange cash for.

Follow Intuit's instructions below to Pay the invoice you overpaid.

When you pay the next invoice, use the remaining credits and your check will only print for the invoice minus credits used.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here