Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

So P&L is showing a balance for unapplied cash payment. All transactions go to undeposited funds . There is zero balance in undeposited funds. The invoice and the bank accounts all line up. Run a report for unapplied cash, and the report comes back with zero. From the P&L, when clicking on that line item, it gives a breakdown it seems as though they are all pertaining to invoices with multiple payments.

Hello there, @richard H II.

In QuickBooks Online (QBO), unapplied cash payments may appear in your report when a customer prepays and the payment is recorded before creating the corresponding sales form (invoice or sales receipt. Also, if the payments were entered without being applied to any sales forms.

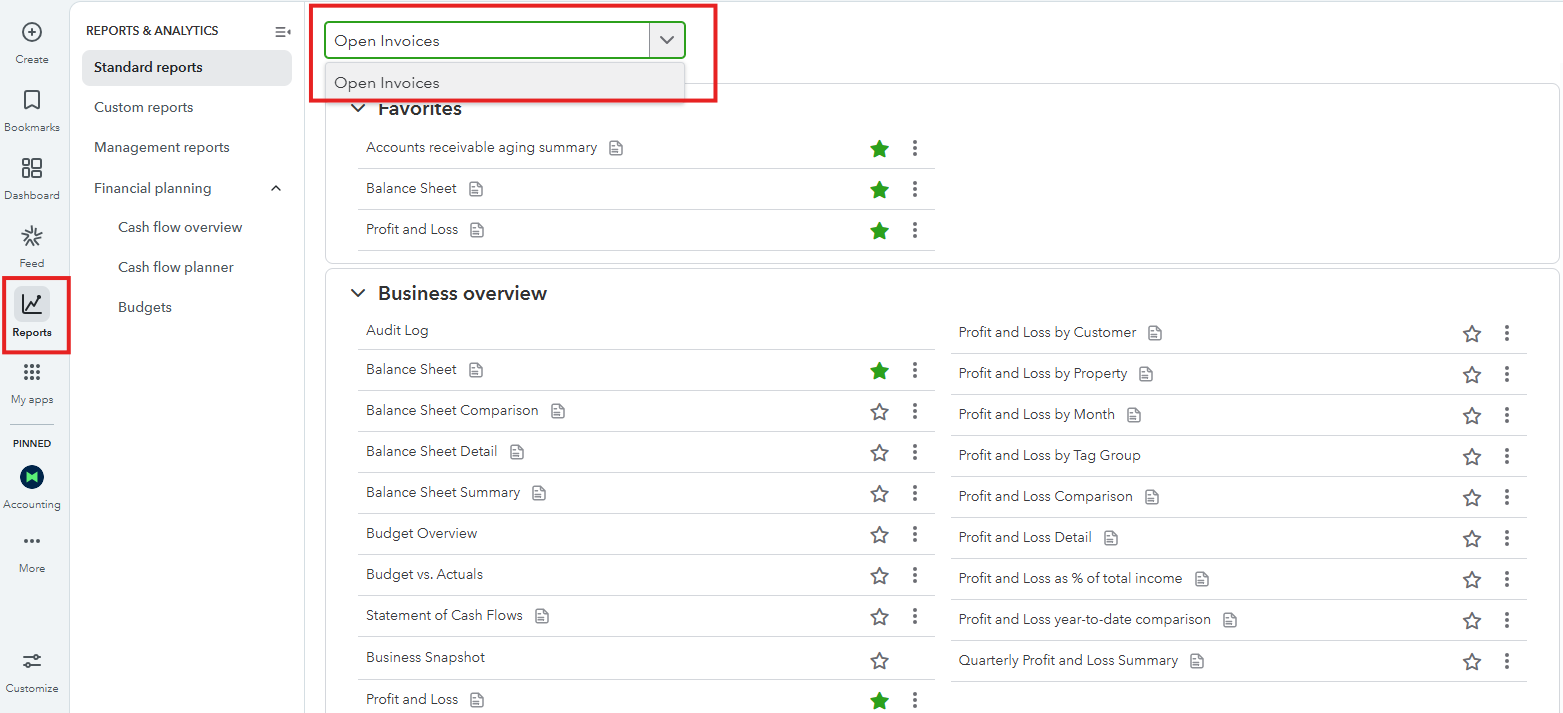

I understand that your invoice and bank account are all aligned. However, I recommend checking your Open Invoices report to further identify any unapplied payments. Here’s how:

If you find a payment transaction that matches an open invoice in the report, follow these steps:

If the payment doesn’t match any open invoices, you’ll need to create a transaction to match the unapplied payment with an invoice. Here’s how:

Also, you may want to explore our QuickBooks Live Expert Assisted team. They can assist you with your transactions, accounts, and reports.

We’re always here to help you if you have any other concerns.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here