Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am NOT an accountant. I was looking over the detailed P&L for the first quarter. I had a bill come in for $140. I charged it to WMU (expense account). I paid the bill and charged it to WMU as well. However, the report shows a balance of $280 for WMU instead of zeroing it out. What am I doing wrong?

*side note: I have a horrible headache so I may be thinking too hard or not enough!

Thank you!

Robin

Hi there, Robin.

Let me clarify things and help you with your concern about the Profit and Loss report.

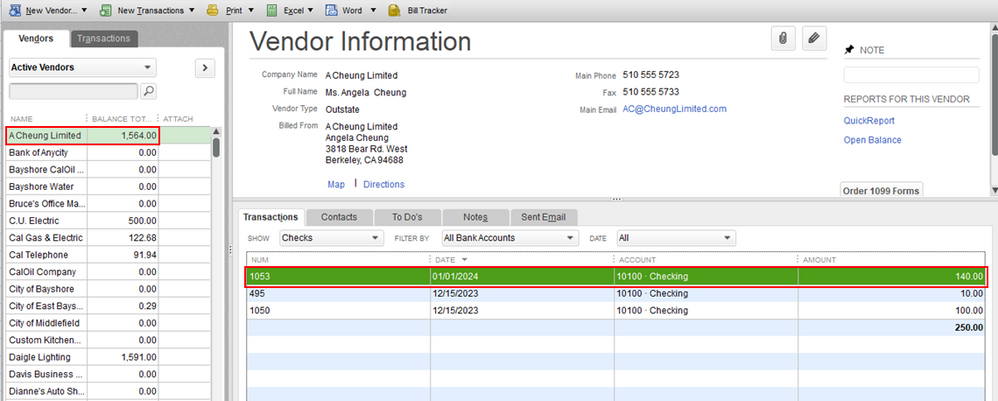

Did you write a check when paying the bills and using the WMU (expense account)? If so, it's the possible reason why your Profit and Loss report showing the doubled amount of the bill under the WMU account.

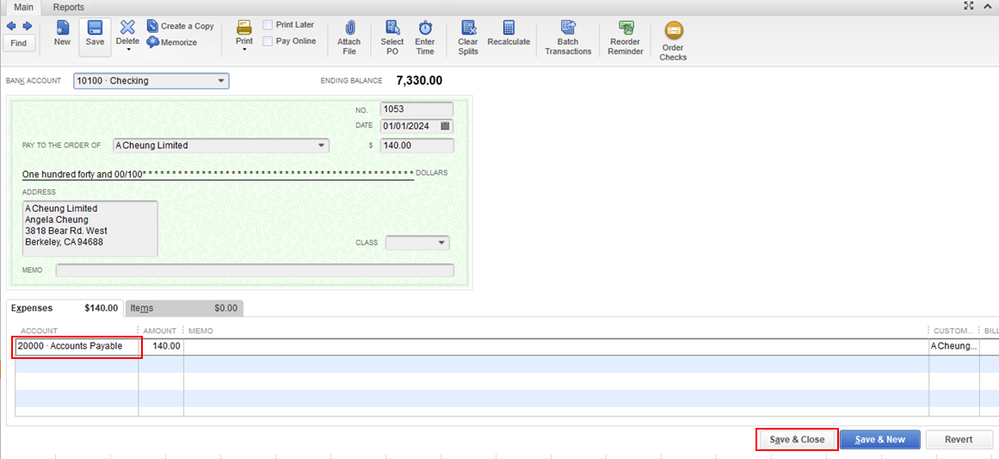

To get this fixed, you'll have to apply the check to the bill to zero it out. Firstly, you'll need to change the expense account in the check to Accounts Payable. This way, you can apply the payment check to a bill.

Here's how:

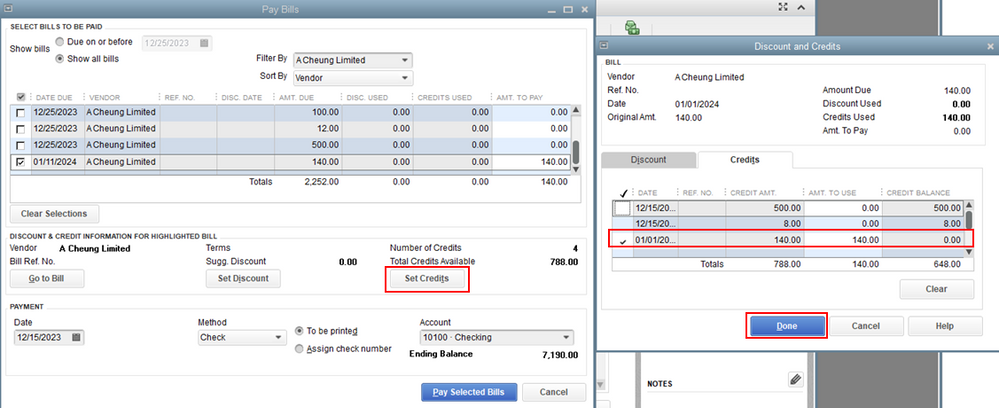

Once done, let's now apply the check to the bill.

After applying the check to the bill, go back to your Profit and Loss report, and check the WMU account.

Most importantly, I recommend seeking help with your accountant. This way, they can guide you on which option is suitable for your business.

As always, feel free to visit our QuickBooks Community help website if you need tips and related articles in the future.

Keep in touch if you need any more assistance with this, or there's something else I can do for you. I've got your back. Have a good day and stay safe.

You cannot charge the invoice and the payment to same expense account, that double-counts it.

When you input bill from vendor, these entries were likely made:

Debit Expense

Credit A/P (Accounts payable)

So when you post payment, the entries need to be:

DR A/P

Credit Cash (Bank)

When I check my account posting of the bill payment, it appears to have been charged to Accounts Payable but it still is showing as a double posting. I've probably just done something wrong in posting or paying. I will post screenshots but will have to do it in 2 posts.

Thank you all for your input.

Robin

Hello, @tcba2016.

The reason why it doesn’t zero out the balance of your expense account in the Profit & Loss report is that, the credit is still unapplied. To apply this, you can follow the steps above given by my colleague to apply for the credit.

I also recommend reaching out to your accountant so you’ll be guided correctly.

Please leave a comment if you have any other questions. Keep safe.

I suggest you don't want this to zero out on P&L, you want it to show there but only once not twice.

Where you want to see it zero out, is on AP Aging report and Balance sheet once it has been paid.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here