Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhy are my undeposited funds not showing on my Profit & Loss statement as income? I receive the payment and deposit it into the correct bank account, but instead of the money that was actually taken in showing on the P&L it shows what has been invoiced- whether it has been paid or not. What am I missing here?

Solved! Go to Solution.

Payments received from customers don't use income accounts, so they'll never show up on your P&L.

A Payment uses your A/R account and either the Undeposited Funds account or can use a bank account directly, if you have that option enabled.

None of these accounts are income accounts.

Payments should be received against invoices, which do use income accounts - which is where your income is gathered for your P&L.

Hey there, @topdogsewer.

Thanks for reaching out to the Community for support and sharing your concerns.

It sounds like you may have some data integrity issues causing some of your undeposited funds to not show in your Profit and Loss statement as income. Let's run a quick Verify to ensure that's not the case.

Should the verify discover some data integrity issues, you'll need to run the Rebuild utility to clear the errors.

Here's how:

Please, let me know how it goes. I want to ensure we get you back to business. I'll be sure to keep an eye out for your reply.

Take care and have a great day ahead!

@Tori B Thank you so much for the advise! Unfortunately, I have verified data, rebuilt the data and restarted several times and the monies received from Undeposited Funds are still not showing on the P&L.

Allow me to step in and help you further with showing the monies on your Profit & Loss report, topdogsewer.

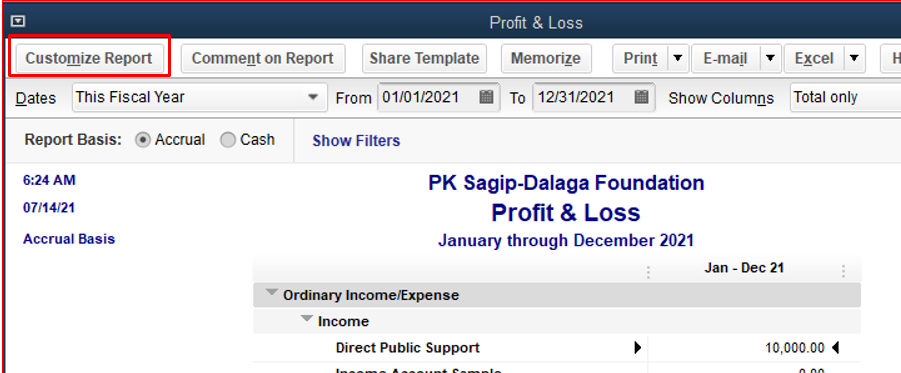

To get this sorted out, you need to ensure you select the correct date ranges and reporting basis.

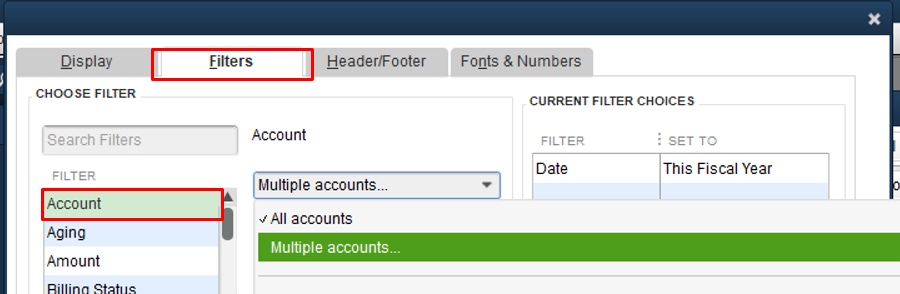

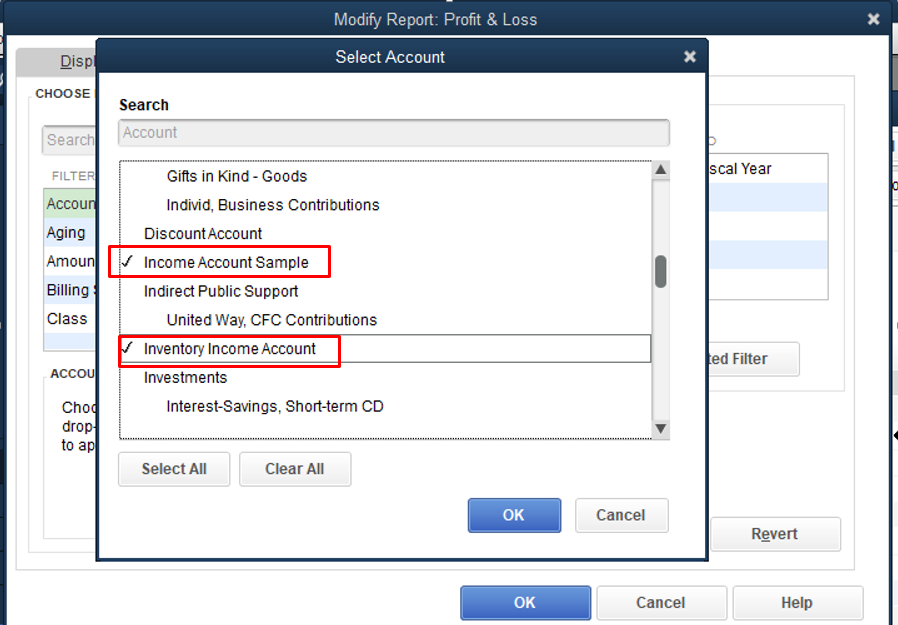

If you're still not seeing the funds, let's filter the report to show the information you need. Here's how:

I recommend customizing the report to get the specific details you need. You can also memorize it to save its current customization settings. It serves as your record and helps you quickly access it for future use.

Feel free to get back to me if you have any other QuickBooks-related or other reports concerns. I'll keep an eye on your response. Have a great rest of your day!

Payments received from customers don't use income accounts, so they'll never show up on your P&L.

A Payment uses your A/R account and either the Undeposited Funds account or can use a bank account directly, if you have that option enabled.

None of these accounts are income accounts.

Payments should be received against invoices, which do use income accounts - which is where your income is gathered for your P&L.

hi - did you ever figure this out?

Welcome to the Community, Kels.

While you can follow the previous recommendations from other users on this thread, I'd like to help you with your specific concern. May I know what are you trying to achieve while working with the Profit and Loss report? I would appreciate any details you can share to help me better understand your concern and provide an accurate solution.

For tips and related articles in the future about the "How Do I" steps in QuickBooks Desktop, visit our QuickBooks Community help website for reference.

I'm looking forward to hearing your response. It will be my pleasure to assist you. Have a good one.

hey there, thanks for the reply. after 2 days i finally figured it out! i was trying to show on my p/l cash that received for services (not deposited via a bank) and for the life in me i was not able to figure it out but i did! thanks anyway.

One income account is not showing in the P&L. I am using QBs Desktop Pro Plus 2023. I researched it and all of the invoicing and payments against are correctly done. That one account is just missing???

I'm just budgeting looking at where we stand as a company. It is a glitch in the system because there is no reason why my income account with activity in it should not show up on the P&L.

Hi there, Weeza.

Most of the time, transactions and accounts might not show up when running reports due to an incorrect date, accounting method, and data damage. Allow me to give you the steps that can help you sort this out.

First, make sure that you have the right accounting method in the Report Basis section. There are times that an account or transactions would not show up when an incorrect reporting method is selected. Here's an article about this for more details: Differentiate Cash and Accrual Basis.

Second, use the QuickBooks Tool Hub to check if a possible data damage or causing the issue. Here's how:

Please check out these articles for additional details about the steps that I've shared:

After that, go back to your Profit and Loss report to check if the income account is already showing up.

Just in case you need more guidance when running reports, fell free to check out these articles:

The Community is always here if you need anything else.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here