Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi, everyone! Thank you in advance for any help you can provide with this.

We bill our clients once a month by creating an invoice for the service they have purchased and charging their credit card.

We have one client who requested paying in advance for several months with one lump sum. To do this, we process the lump sum payment, and then apply her credits to the invoices in the coming months as we create them.

However, I have discovered that this causes the payments to show up as "unapplied cash payments" on our profit and loss reports. We use the cash method of accounting. If I click on "accrual" for the report, it does not do this.

It appears that this problem is caused by us creating the invoices and applying the credits after we have taken the lump sum payment. I'm not sure how to fix this, so that we do not have "unapplied cash payments" showing up on the report. I saw other entries on the forum related to this, but my situation seems to be slightly different.

Any suggestions on how to solve this? Thanks so much!

Thanks for reaching out to the Community about this, peter205.

When you run a profit and loss report using your cash method, you may see unapplied cash payment income. This account's created for proper tax reporting. The first step in resolving these records is running your Open Invoices report.

Here's how:

Once you're finished, you can generate a new profit and loss report and you'll no longer see your unapplied income.

I've included a couple resources about using QuickBooks that may come in handy moving forward:

I'll be here to help if there's any additional questions. Have a wonderful day!

Thanks! I will give this a try.

Thanks again, ZackE. The issue we are having seems to be slightly different than the one addressed in these steps. As are result, I have decided to contact our accountant regarding the issue. I believe that he will be able to solve it for us.

When i receive a payment it apply to the oldies invoice and is messing up my invoicing how can i change it to just apply to the invoice that is paid?

It's great to have you join this thread, @Charlie53. I can see how essential it is to correctly link the payments to their corresponding invoices. Let me share some information and steps to avoid messing up your invoicing in QuickBooks Online (QBO).

If you're using QuickBooks Payments to process your invoice payments, please have your customer select the correct invoice for their payment so it will apply accordingly.

To sort this out, we can unlink the payment applied to the incorrect invoice and connect it to the correct one. Simply open the incorrect invoice and click the 1 payment made link. Then, untick the checkmark beside the incorrect invoice and select the right one.

Moreover, if you have recorded a credit memo or delayed credits and you have enabled the Automatically apply credits feature, here's what will happen to your invoicing process:

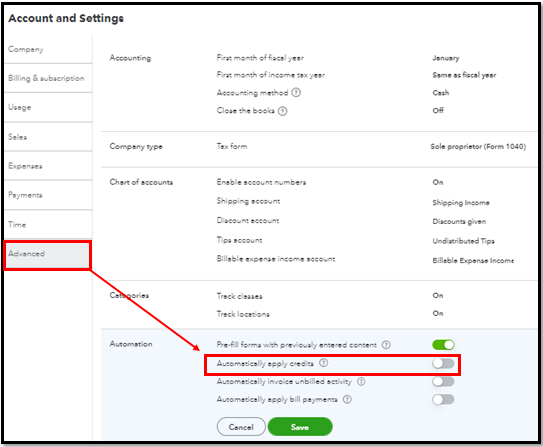

Follow these steps if you want to disable this option so you can select the correct invoices that need to be paid:

Additionally, you can personalize the appearance of your sales transactions by adding specific information to your invoices and other forms to make them more professional-looking.

I'd love to know updates on how this goes after performing the steps above. I'm always around to help if you have more questions about linking your payments to appropriate invoices in QBO. Have a great day ahead!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here