Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

After running last month's Profit and Loss Report after Reconciliation, I noticed that one of the deposits for the month, the very first on the 2nd day of the month, is not included in the Income Collected for the month. The Items are the same as other items, so it is definitely income and not taxes or something else. Any reason this deposit would not be reflected and income not counted? Account basis is correct, no filters changed when running the report.

Good day, CANELIBAR,

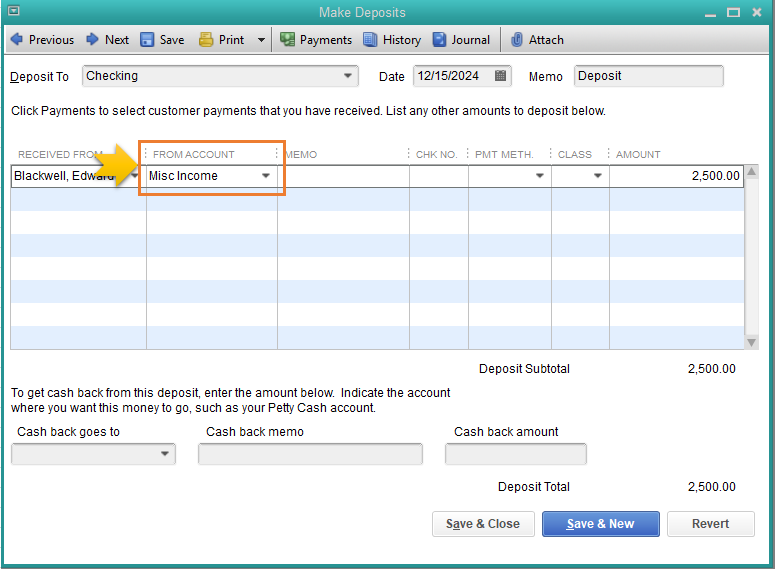

The deposit may have not been categorized correctly, and that's why it isn't reflected to the income account.

You'll want to check the transaction journal, then change the category from there. This is to ensure the deposit is counted as your income.

Let me show you how:

I've added this article to learn more about categorizing transaction in QuickBooks Desktop: Add and match Bank Feed transactions.

Let me know if you need additional information. Just tag my name and I'll be glad to help you out.

Thank you and stay safe!

All of the income was in the correct places. I undid the most recent reconciliation, unmade the deposit. Deleted all payments for the deposit and then recreated the payments and the deposit and then reconciled and it corrected. It had to be a glitch in the software. The invoices were all correctly labeled to the right income accounts, no different than any other invoices we make.

Hello, @CANELIBAR.

There are two possible reasons why your Profit and Loss report shows a difference of $20,000 in your income versus your payment transactions.

You're right, the way to fix this is to manually compare the detailed income report in the P&L and check each customer's reported payment.

From there, carefully locate the payment transactions that cause the mismatch of amounts in your P&L report.

Also, it's possible that those deposits aren't showing up in the Profit and Loss Statement is the date range is incorrect. You'll have to make sure to choose the correct date before printing the report.

You can also check this article to learn how to customize reports: Customize reports in QuickBooks Desktop.

Leave a comment below if you need further assistance. I'm always here to help.

Our business is not operated the way you are describing. We have invoices and certain payment items setup for our work product. Every single one is the same as it has always been. There should have been no disparity. I double checked dates, items on the invoices for payment. It was exactly as we do on a normal basis. It's just really strange and the only way to fix it was to back out and recreate each item. I basically duplicated the exact same invoices, then recreated the payments, then the deposit and reconciled and the P&L was correct. I made no other changes to any payment item or invoice other than duplicating.

Hi @CANELIBAR,

Let's check if it has something to do with your data. Let's run the verify and rebuild data integrity tool.

Here's how:

If you see "Your data has lost integrity", continue your troubleshooting steps by rebuilding your data.

Please check this article for details about: Verify and Rebuild Data in QuickBooks Desktop.

Once done, go back to checking your reports again. I'm also sharing our page about reports and accounting for future reference.

Should you need help with anything else, don't hesitate to reach out. The Community is here to help. Thanks for posting and have a wonderful day.

I DID THAT ALREADY AND EVERYTHING IS FINE. I HAVE ALREADY FIXED THIS ISSUE BY DUPLICATING INVOICES, DELETING ORIGINALS, RECREATING PAYMENT, REDOING DEPOSIT, RECONCILING AND RUNNING NEW REPORT.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here