Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi,

I recently purchased and installed the Desktop Premier Plus version of Quickbooks for nonprofits. After setting up a chart of accounts, I attempted to enter a pledge. When entering the pledge, the dollar amount defaults to a negative position and will not let me record the pledge, prompting me to record a credit memo. How do I correct?

Thank you,

AH

It sounds like you've set up the pledge item as a Payment or Discount type item. That won't work. Instead, set it up as an other charge item and then it will have a positive amount.

Good evening, @AH20221.

It's great to see a new face here in the Community. I appreciate you coming here with your question about pledges.

You'll want to move the negative A/R to another current liability account other than A/P. Then, you'll need to reverse your actions. For more assistance and to ensure that the transactions will account accurately, I recommend consulting with your accountant. They'll be able to give you the best advice for your business.

Review this guide for further details: A/R or A/P balances.

Keep us updated on how the conversation goes with your accountant. Have a great day!

To confirm by "pledge" you are talking about a future payment by a donor, not an actual contribution already made.

In QBs I believe a Pledge is basically handled as an Invoice. And I also believe if you have the Non-Profit version, When you go to the Customer drop-down menu you may actually see Pledge as an option. If not, just pick Create Invoice.

So if these are all new donors, you can go to the Customer Center and Add their Names and Info and once you have that info in, you can then click on New Transaction at the top and then Pledge/Invoice.

If the contributors are already in QBs, then from the main screen you can just click on the Customer drop-down menu and pick Pledge/Invoice and pick the existing donor.

You'll want to also create an Item for the Invoice. And that will need to be attached to a Non-Profit Income Acct. It does not really matter what you call the Item Name/Number, but the description will show up on the Invoice. You may never send the donors the Invoice, but just use a good Description just in case. You my end up sending them a Statement, but I'm guessing it would be a letter or email, so they'll never see QBs.

When you create the Pledge/Invoice you can also set the Due Dates, etc. if you have any kind of target date. this will make it easier to pull up reports or set Reminders on who still owes as you get closer to that date.

Also, if people are contributing for different goals/items, you can set up multiple Sub Accounts under your Non-Profit Income Acct. If you go with Sub Accts, I'd recommend you never use the Primary Acct, always use a Sub Acct otherwise you'll find multiple "Other" items in your report that are not attached to a specific Goal. That also means if you need to create a Sub Acct for small or miscellaneous contributions, don't use the name "Other" for that Acct or you may start searching in circles for items.

@Candice C RE: You'll want to move the negative A/R to another current liability account other than A/P.

The customer never indicated that they have a "negative A/R", and moving a negative customer balance to a liability account is rarely if ever appropriate. Not sure where you got that idea.

Hi All, thank you for trying to help me out. I am actually a CPA, so i understand the accounting. My issue is that when I use the pledge template to record a contribution, after I type in the amount, QB automatically changes the sign on what i've entered to make it negative, which would give me negative a/r if i processed it. I have tried entering as a negative, hoping it would convert to a double negative/positive, but that doesn't work either. I need to defeat the defaulting negative entry but have no idea how to do that............ it's very strange.

I've never worked in QB before, so i'm not sure how to attach an item type, but i've associated pledges with A/R-Donors, so that should be appropriate. I cannot really move forward helping my organization out, if i can't enter donations. Any other thoughts would be appreciated. Thank you, AH

I understand how important this is for you to enter pledges in your QuickBooks Desktop account, @AH20221. I'd be glad to help you in resolving this concern.

I'd like to know more about your concern. Would you mind adding a screenshot of the exact page where you are having this issue? This way, we can provide a resolution or workaround for it.

Also, as BRC mentioned, you'll need to check the pledged item and ensure it's not a payment or discount type item. The item type may be payment or discount, so it will automatically change into a negative amount once you enter the amount.

I'll be around if you have any other concerns or clarification. Have a good one!

I did not start this thread but you mentioned setting due dates. We have an annual pledge drive and encourage multi-year commitments. How do I create different annual due dates on a single pledge. Perhaps a progressive billing pledge?

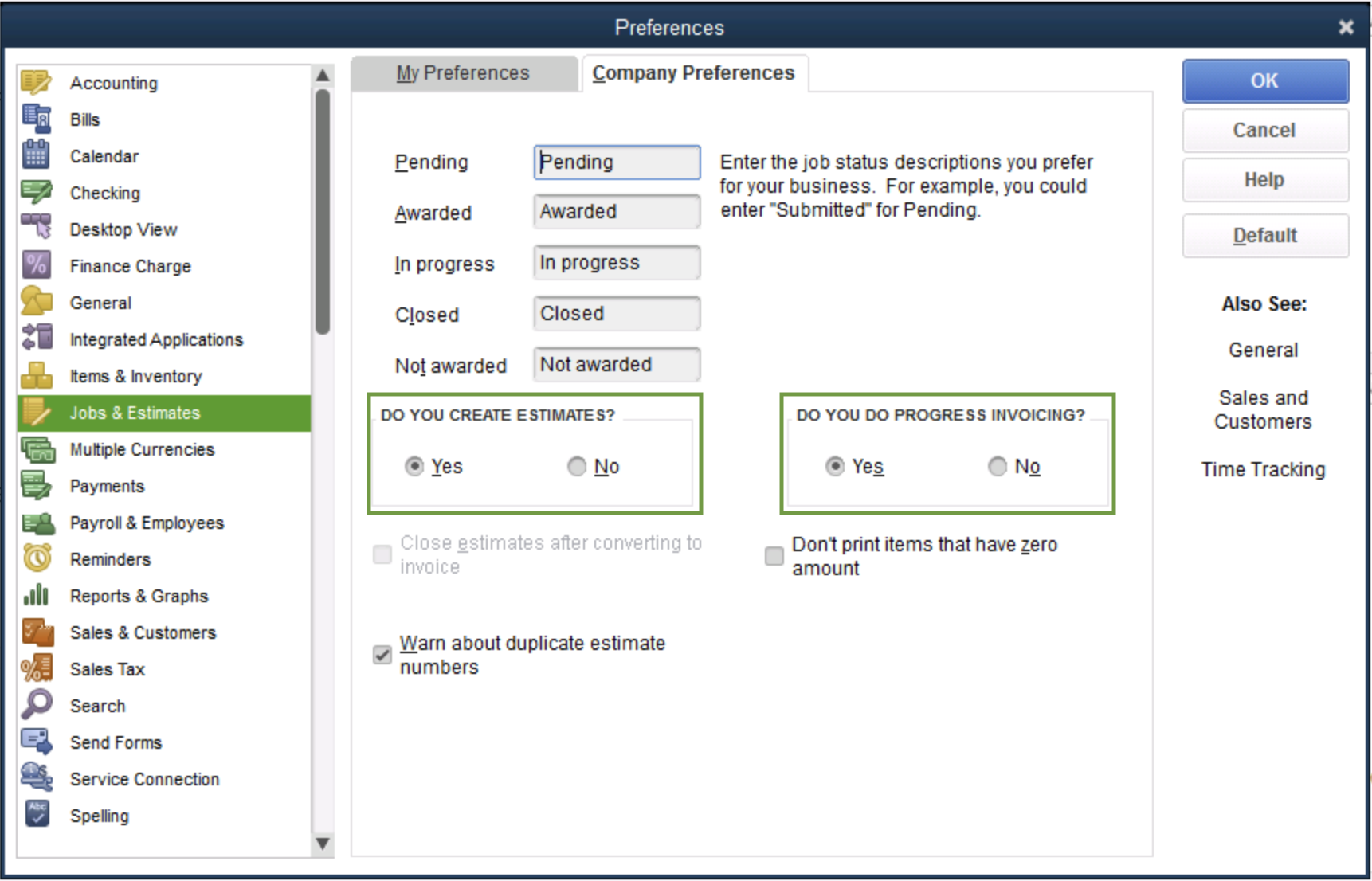

Thank you for reaching out to the QuickBooks Community, duckster116. As Pete mentioned, it seems like pledges can be categorized under invoice. Since that may be the case, you can use progress invoicing to assist. The first step would be to turn this setting on in QuickBooks Desktop. Here's how:

From here, you would need to create the estimate and the progress invoices from the estimate and keep track of it. This article goes into further detail on how to set it up.

Please let me know if you have further questions! I will be around to assist further. Take care.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here