In addition to reviewing the changes in the Audit log, you may find it helpful to check the Chart of accounts (COA) as well, mgrahamkf. I'll provide more details below.

A possible reason the starting balance for the next reconciliation is incorrect is that a transaction’s status was changed from reconciled (R) to unreconciled, rather than just updating its category.

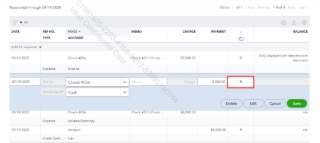

When a previous reconciliation is unreconciled, it creates a discrepancy in that period's ending balance, which then causes the starting balance of the next period to be off. To resolve this, review the Credit Card register in the Chart of Accounts to verify transaction statuses and reconcile them again as needed.

Here’s how:

- On the left pane, click Accounting, then Chart of accounts.

- Find the credit card account and click View register.

- Select the transaction and make sure it shows R.

- Once done, click the Save button.

Also, you may want to work with your accountant when addressing reconciliation discrepancies to ensure your financial records remain accurate.

For more information on why your beginning balance is off and how you can fix this, you can refer to this article: Fix issues with your beginning balance for accounts you've reconciled before.

If you have other questions, feel free to add a reply.