Thank you for sharing this concern here in the Community, @Loto. Let me share insights on running loan payments in the Profit and Loss report (P&L) in QuickBooks Online (QBO).

When dealing with financial aspects such as loan payables in your account, these payments will not shown in your Profit and Loss statements. The P&L statement only display the interest paid on loans, not the principal.

Interest is the only part of the loan payment that is expensive and impacts net profit. Reviewing the accounts set up for payment transactions is essential for accurate business finance and accounting data. Instead, loan payments will be displayed on the Balance Sheet report as they represent payments for a liability account.

Below are the steps for generating a balance sheet report:

- Go to Reports

- Select Business Overview.

- Choose Balance Sheet.

- Select the date range for the report.

- Select Run report.

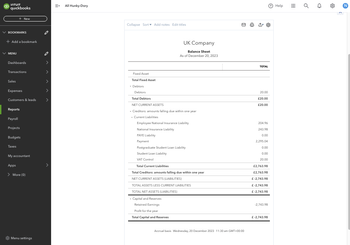

Here’s an example of what a Balance Sheet report looks like:

The Balance Sheet report will appear on your screen. You can view it in the browser or export it as a PDF or Excel file. For a concise overview, consider running the Balance Sheet Summary report.

Furthermore, I'll provide this article to assist you in recording a bad debt and writing it off, ensuring that your accounts receivable and net income remain current.: Write off bad debt in QuickBooks Online.

Let me know if you have any other concerns about running reports in QuickBooks Online. I'm here to assist. Have a great day.