Welcome to the Community, @bskerrett.

In QuickBooks Self-Employed (QBSE), invoice transactions aren't connected to the Transactions tab. You'll have to manually add a transaction for the paid invoice to record it as an income. Let me walk you through the steps.

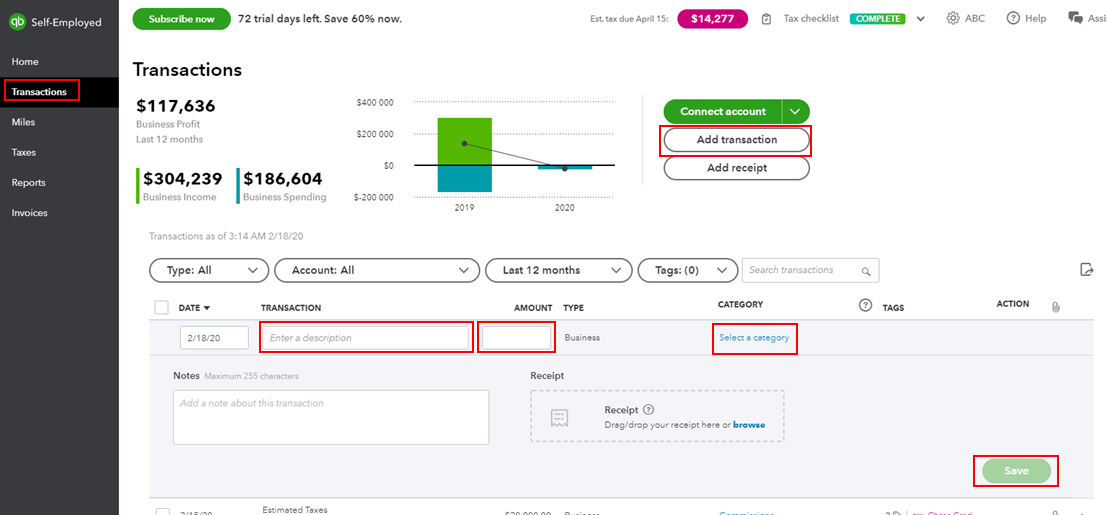

- Click Transactions from the left menu.

- Select the Add transaction button.

- Enter the invoice information and the amount.

- Choose the income category from the Category section.

- Click Save.

Here's an article you can read for more details: Manually add transactions in QuickBooks Self-Employed.

However, if the payment is coming from your bank and it's connected to your QBSE account, you don't have to enter a transaction for the revenue. The income transaction will flow to your QBSE account once downloaded.

To learn more about the invoicing feature in QBSE, feel free to check out this article: What's new with QuickBooks Self-Employed Invoicing?

Keep in touch if you need further assistance with this, or if there's anything else I can do for you. I've got your back. Have a good day.