Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Can you tell me how to do that in QBO? Following the above it gave me a negative figure on the customer account.

Welcome to the Community, @sbright11.

I can definitely walk you through on how to write off bad debts in QBO. Let me show you how:

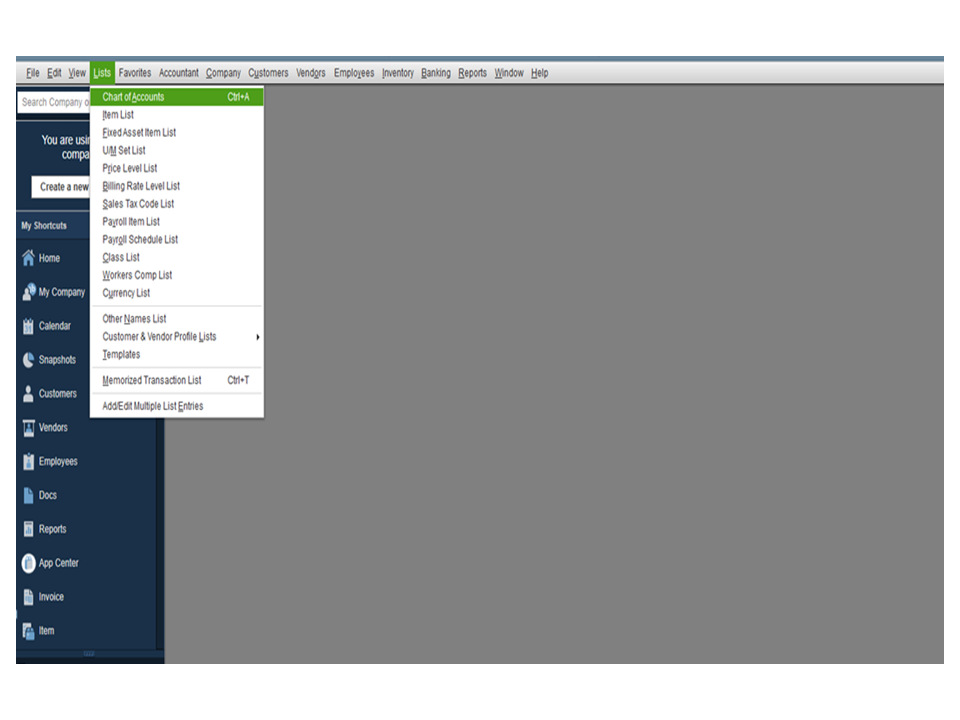

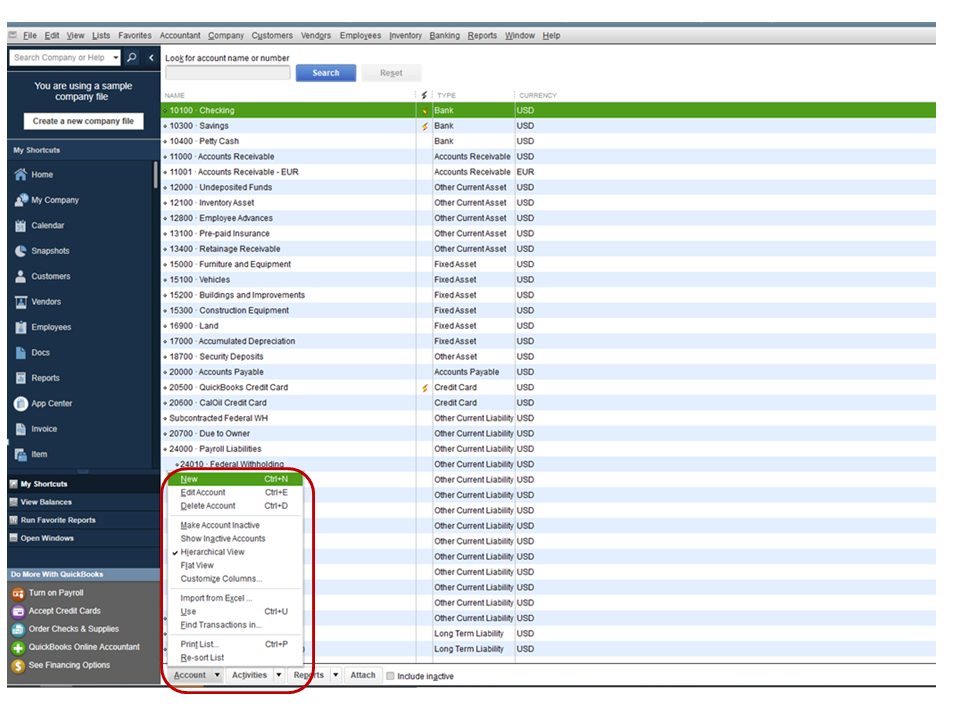

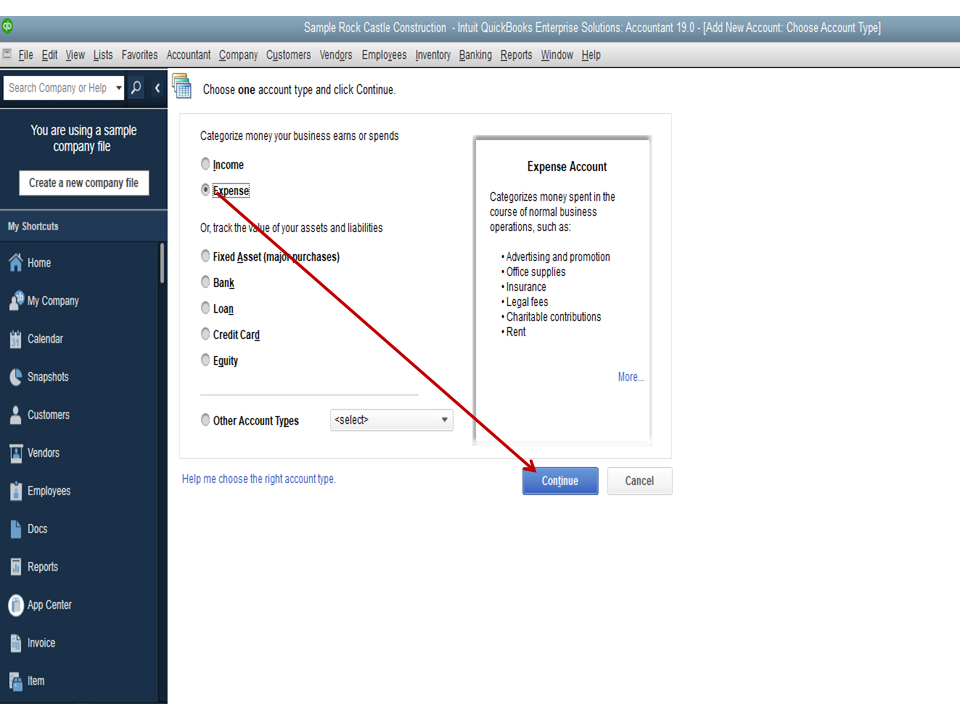

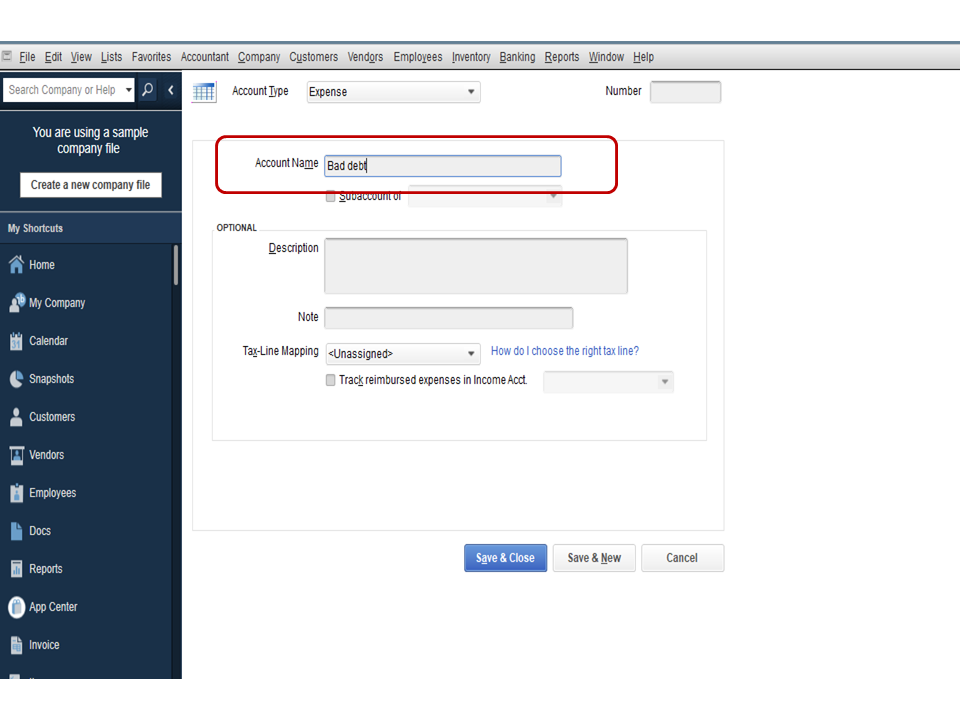

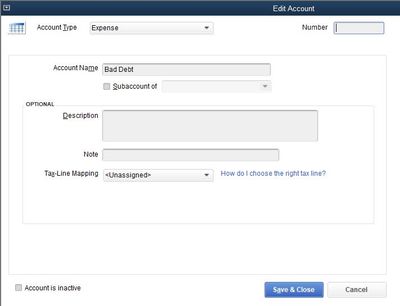

Create an expense account and name it Bad Debt:

Create a bad debt item:

Create a credit memo for the bad debt:

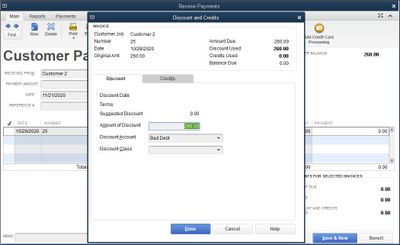

You can now apply the credit memo to the invoice:

After these steps, you can run the bad debts report:

You can refer to this article on how to write off uncollected money: Write off bad debt in QuickBooks Online.

Refer to this article in reconciling your account: Learn the reconcile workflow in QuickBooks. It includes there how to edit completed reconciliation and fix a reconciliation.

Please get back to this thread if you need more assistance. I'll be around to help you. Have a fantastic day!

I have followed the steps through creating the credit memo. Everything worked as described here and in the Quickbooks Online help instructions until I get to the Receive Payment step. When I do Receive Payment, it allows me to select the customer and I see the outstanding transactions. What is missing is the Credit section where I can apply the credit memo. It is requiring me to select a payment method and enter an amount.

When I look at my open receivables report, I see the reduction in the open receivables for the write-off. Am I no longer required to apply the credit memo to one of the invoices?

Thanks for joining the thread, @Mark381.

I appreciate you for following the steps provided by my colleague above. There's a possibility that the Automation feature is turned on, that's why you're able to see a reduction to the receivables reports in QuickBooks Online.

It would be my pleasure to help walk you through the steps on how to check the settings. Here's how:

Once verified, nothing to worry about your reports because you're on the right track. If you don't want to automatically apply the credits to your existing transaction, simply turn off the feature.

However, if the Automation is already turned off and still unable to apply to credit, I suggest performing a few basic troubleshooting steps to resolve the issue. To start, access your QBO account using a private browser. At times, the stored data can cause some problems in your browser's web pages.

Use these shortcut keys:

Once logged in, go to the Received Payments and check if you're able to apply the credit memo. If the private browser works, you can clear the cache depending on which browser you're using through this helpful article: Delete Temporary Internet Files. Using another compatible browser is a good option too.

Let me know if there's anything else you need about QuickBooks by clicking the Reply button below. I'm always here to help.

Thanks. That is what it turned out to be. I found it in another training video. When this feature is turned on, it applies the credit to the next invoice. Once I turned it off, I was able to apply it to a current invoice.

Thanks for the quick response.

Uh oh...that's how I have been doing it while in accruel is that ok? Nothing has ever ended up in bad debt...not because I didn't want it to but because I didn't know how. My only concern was that it might look as if the customer returned items to inventory and that obviously never happened so all these years when I didn't want to have inventory in qbks it's affected my cost of good sold probably making it appear I had more in inventory than is real...I hate accounting and bookkeeping as they make it impossible to understand the accruel and I bet I've lost so much money not understanding anything. Sorry but whoever thought up accruel

makes me upset.

Thanks for following on this thread, @LW2.

Based on the details provided, record the uncollectible customer transactions using the bad debt process. This ensures your accounts receivable and net income are up to date.

You can also use this method for accrual accounting. Since there were transactions recorded as credits, I recommend consulting with an accountant for further assistance.

They can provide recommendations on how to properly input them in QBO. This way, it will not throw off your records.

If you’re using the online version, follow the steps provided by @Jovychris_A above. For QuickBooks Desktop, let me show the process.

You’re now ready to close the bad debt. To accomplish this task, follow the recommended steps in this article and proceed directly to Step 2: Write off bad debt in QuickBooks Desktop.

Let me know in the comment section below if you need further assistance. I’m always ready to help you. Have a good one.

I have tried this, the issue I find is these write offs will eventually end up in the sales tax liability report. So my question is, are the items supposed to be taxable or nontaxable items. We have been audited by the State of Texas before and anything listed under non tax has to have a valid reason. If non taxable or taxable, either way shows up on reports we submit to the state. What do you advise.

Thank you.

sw

How do you create a Credit Memo if you don't use Quickbooks for invoicing?

Thanks for joining this thread, @andrewcoplon.

Credit Memo is used for the overpayment of the customer which is greater than the outstanding invoice. If you want to keep it, you'll have to create a deposit posting to the Accounts Receivable account.

If you want to refund it to your customer, you'll need to create a check.

Before doing changes in your company file, we recommend always create a backup copy so you can always restore your data.

Here's a great source where you can find articles that can help you in managing your books in QuickBooks, please visit our QBDT help articles page. This includes topics such as reconciliation, track income, and expenses, run reports, etc.

Keep in touch with me if you have further concerns about creating a credit memo in QuickBooks. I'll be around whenever you need further assistance. Take care always.

Do you have to create a bad debt account for each customer? I have several that just didn’t pay their last bill. If I have to create a bad debt account for each it seems there should be an easier way...

This is just the place to get the answers you're looking for, @greencross.

There are times when an invoice becomes non-collectible and you need to write it off and declare it as a bad debt so you can clear the invoice out of your accounts receivable and reduce your net profit by its amount. All you need to do is to create one expense account for bad debt. There's no need to create one for each customer. You can track them by running an Account QuickReport. The steps below will ensure your success in writing off bad debts:

Step 1: Add an expense account to track the bad debt.

Step 2: Close out the unpaid invoices.

This article outlines the steps for writing off bad debt: Write off bad debt in QuickBooks Desktop.

To run the Account QuickReport, follow the steps below:

In addition, you can check your customers' open balances by running the Accounts Receivable Aging Detail report. Just follow these steps:

Please let me know if you have any follow-up questions about writing off bad debts. I'm always here to help. Have a wonderful day.

The invoice then shows "PAID," and I don't like that. Is there any way to change that terminology?

"WRITE OFF" OR "BAD DEBT" WOULD BE PREFERRABLE.

I appreciate your thoughts and opinion, @SMOSSCSPUMP.

I recognized having the option to change the PAID status stamp to WRITE OFF or BAD DEBT would be beneficial to you and to your business. However, the option to do so isn’t available in QuickBooks Desktop (QBDT).

Rest assured our product team is always looking for ways to improve our product to meets the needs of our users. To stay current on our latest news and enhancement, check out our Product Updates page for reference.

In addition to this, let me attach this link that you can use for future guidance in personalizing your invoices: Use and customize form templates. This resource can guide you through the steps on how to add logo and change and fonts of your sales form.

You’re always welcome to post a comment below if you have any other concerns or questions about invoices in QBDT.

I'm lost. I have a customer that has not paid me and I have to take her to court. I followed the instructions for bad debt in the customer payment page. My question I can't seem to find an answer for, WHAT account do you select for DEPOSIT TO field?

Hello @rcoiteux1,

You don't have to worry about the account used to deposit the payment for a bad debt invoice. Bad debt is designed to close out invoices from customers with whom you didn't receive any payment with.

For an in-depth discussion about these invoices, here's an article you can read to learn more: Write off bad debt in QuickBooks Desktop.

On top of that, I've also included this reference for a compilation of articles you can read while working with us: The different transactions you can use to track your sales.

If there's anything else that I can help you with, please let me know in the comments below. I'll be here to lend a hand.

@CGW08 wrote:Someone PLEASE hold my hand! I see all this advice to attach memos, etc. When I run a report or open the unpaid invoice my only option (as far as I can tell) is to receive payment and input a monetary amount in the amount paid block before I have the choice to write the unpaid balance off. I'm not going to get the unpaid balance so my only option I can see is to show a payment of at least 1 cent and then write off the remaining. I run a heavy equipment business and I'm good at that but not QB. Thanks for any clarification.

I'll help you in writing off the balances of your invoices in QuickBooks, Youdeline laurint.

I know how it is important to record correctly all of your transactions in QuickBooks. When invoices you send in QuickBooks Desktop become uncollectible, you need to record them as a bad debt and write them off.

Here's how to add an expense account to track the bad debt:

Once done, we can start over to close out the unpaid invoice.

In addition, you can check the customer's open balances by going to the Reports menu and selecting Customers & Receivables. Then, click A/R Aging Detail.

I'm also adding these resources that can guide you manage your reports in QuickBooks:

I’m happy to offer assistance again if you have any other concerns or questions about invoices in QuickBooks Desktop. Post a new thread or reply here and I’ll be there.

Fantastic response that went above and beyond. Thank you very much.

Oz

I have the same problem. I want the invoice, which already had work done on it...charged as a loss not just a transaction to clear the balance but actually charged to a loss. why isn't there just an option to charge off the balance on an invoice instead of either having to just delete the thing and not take the loss in the instance that it's a small re-negotiated amount. We are professionals, no inventory and are running the enterprise professional just so we can get a correct accrual report and that is screwed up all the time by "paid" but not actually recorded...what does that mean????? UGH

I do have one question. If you write off the bad debt as a whole, do you still then end up paying HST on the sale to the CRA? Is there a way to write off the base amount and apply the HST offsetting credits to your HST account?

Hi vsilinin,

Thanks for joining us here. When you write off an invoice as 'Bad Debt', the transaction is closed out. However, if you're still not certain, I recommend reaching out to your accountant for their expertise. If you don't have an accountant, we can help you locate a ProAdvisor in your local area.

Feel free to reach out again if you have other questions or concerns. We'd be glad to help!

What are the steps to do this if you do not use the Products/Services portion for invoicing? Meaning that when I'm on the credit memo screen, I cannot choose a product/service as the option to do so isn't there.

I have the bad debt expense in my chart of accounts already.

But I cannot find a place on the credit memo to tie that to this customer's account so that I can clear the $187 portion of the invoice they did not pay, and move it to bad debt expense.

FWIW, we are cash basis and I'm using QBO.

Thank you.

Hello there, @mbell19.

Allow me to jump in and help you write off bad debt in QuickBooks Online (QBO).

There are different options on how to close an open invoice, however, the process depends on the scenarios.

First, once an invoice becomes non-collectible, you'll need to write it off and declare it as a bad debt to clear the invoice out of your accounts receivable and reduce your net profit by its amount.

Here's how:

Create a bad debts expense account.

Then, create a bad debt item.

After that, create a credit memo for the bad debt.

Lastly, apply the credit memo to the invoice.

You can check this article for detailed steps on how to write off bad debt.

Once done, you can now run the Accounts Receivable Aging report again. See this article, for more information: How to get your Aging Reports to match.

Additionally, you can visit the following write-up: Sales and customers. This will provide you with links on how to manage your company income as well as resources about other customer-related concerns.

I also recommend consulting an accountant if you’re not familiar with the process to ensure your books are accurate.

Please know that I'm just a post away if you have any other concerns about the Invoice in QBO. Wishing you and your business continued success.

I’m sorry, but you did not fully read my question. We do not use the products & services option on our billing, therefore, I cannot use that method.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here