Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

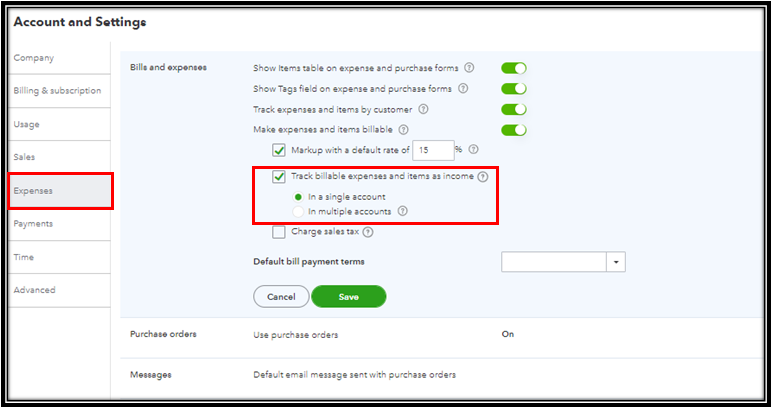

Buy nowI turned on the setting to track billable expenses and items as income but the reports for the income account I selected to track this expenses is blank.

My expense accounts reports are populating correctly but the income account tracking these expenses is not. It is my understanding that the income account is supposed to start automatically tracking expenses marked as billable. is this not the case?

Thanks for posting here in the Community, claudia2191. I'll share information about how the billable feature tracks income accounts in QuickBooks Online (QBO).

In QBO, you'll have to enable this billable expense feature before generating an invoice. This way, you can select the Billable checkbox when creating a bill.

Here's an example of billable expense tracking:

You enter $100 worth of Wood payments on the Check page using an expense account called Wood and make them billable to one of your customers. Then you include that billable expense on the invoice to that customer.

In the check transaction, QuickBooks decreases your checking account by $100 and increases the Wood account by $100. While in the invoice transaction, QuickBooks increases your accounts receivable account by $100. It's also affected by the income account setting you choose:

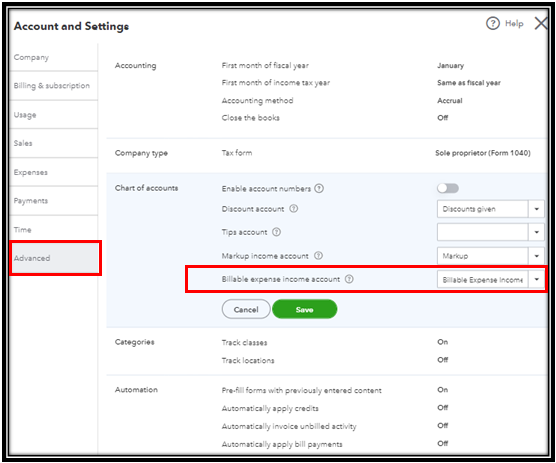

Doing this will ensure that the billable expense is being tracked to the correct income account you specified in the Advanced > Chart of accounts > Billable expenses income account.

You can refer to this article for more details about this feature: Enter billable expenses.

Additionally, you can check out this article to learn more about how to personalize your reports in QBO: Customize Reports in QuickBooks Online.

I'm all ears if you have other concerns or additional questions about your QBO account. I'll get back to you to help ensure this is resolved for you. Have a good one!

@Kevin_C , thank you for your comment, however, as mentioned in my post, I had already enable this feature in my account settings. The single income account I picked to track the expenses is the "Sales of Products Income" account. The problem is that when I run a report on this account it is empty, regardless of the date range I select.

I already have a good amount of expenses tagged as billable and categorized to the Cost Of Goods Sold expense account. Why isn't the income account I selected tracking the billable expenses?

Thanks for the quick response, claudia2191.

We want to ensure we're giving you the correct solution to answer your query. Thus, I have to ask for some details about this.

Can you please provide us with some additional information or screenshots of your setup? Please include the Billable expense income account, the invoice transaction, and the specific report page in your screenshots.

Also, may I know what specific report you have run to view these data?

Furthermore, have you seen any amount on the Billable expense income account since this was the default account selected? And have you tried deleting and recreating the transactions to check if they re-synced?

I'd appreciate it if you could provide more details about your concern. We look forward to it. Keep safe!

@Kevin_C , attached are the snapshots you requested.

Based on the billable expense in the snapshot, my income account balance should go up to $31.50 but it is not showing any balance.

Thanks for providing a screenshot, Claudia.

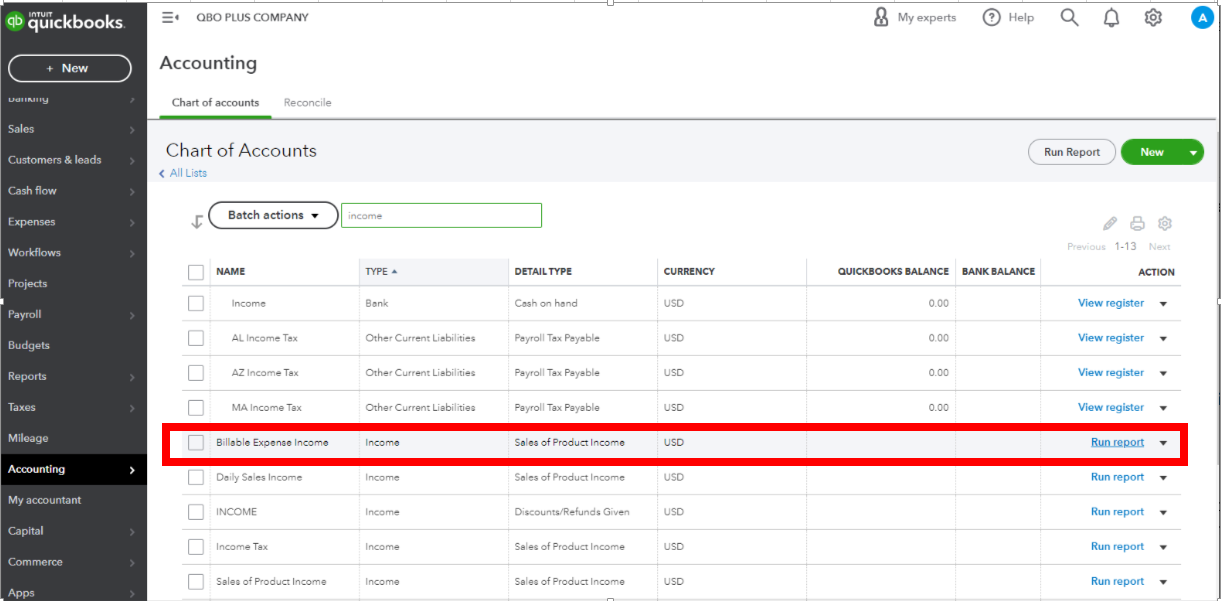

I'm here to clarify why you don't see any balance in your Chart of Accounts.

Only balance sheets accounts such as assets, liabilities, and equity have a current balance. Moreover, income statement accounts (income and expense) only have a balance between two defined dates, so there is no current balance to show in your chart of accounts.

You can click to run a report if you want to see the balance. See the screenshot below for your reference.

Furthermore, check out these articles below on how to personalize your Chart of Accounts and customize reports in QuickBooks:

If you have questions about QuickBooks, please feel free to notify me. I'd be happy to help you with anything related to the program, especially if you need help with your account balances.

@AbegailS_ , thank you for your message! Running the report with custom dates worked now. However, it seems like it is only picking up recently added billable expenses, is there a way to make it back track to previously entered billable expenses?

My cost of goods sold has the cost in there BUT not visible and NOT included in totals.

Welcome to the Community, @Twodown.

Thanks for raising your concern here. To clarify some things, can you provide me with precise details of your concern for me to be able to comprehend your issue and to efficiently assist you?

Your cooperation is greatly appreciated as it will provide a solution. If you provide a screenshot that would be amazing, however, please be mindful and careful to not include sensitive information. This precaution is taken to prevent any potentially fraudulent activities.

Please know that we're here to assist you throughout this process. I'll patiently wait for your response. Keep safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here