Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHaving trouble understanding our accounts receivables. We invoice a customer for $200, due at some point in the future. Everything appears correct - customer has a $200 outstanding balance in the "customer center", and accounts receivable increases by $200. However, our primary/operating account also goes down by $200 and a new line item (an INV) has appeared in our general ledger as a debit. As a result, our corporate checking account is now $200 less than its actual balance. I do not understand why this debit transaction is being created. Please help. Thanks,

Solved! Go to Solution.

Let me help you sort this out, nkastner.

Typically, a business sends an invoice to a client after they deliver the product or service. This will add a journal entry as a debit in the accounts receivable account and a credit in the sales account.

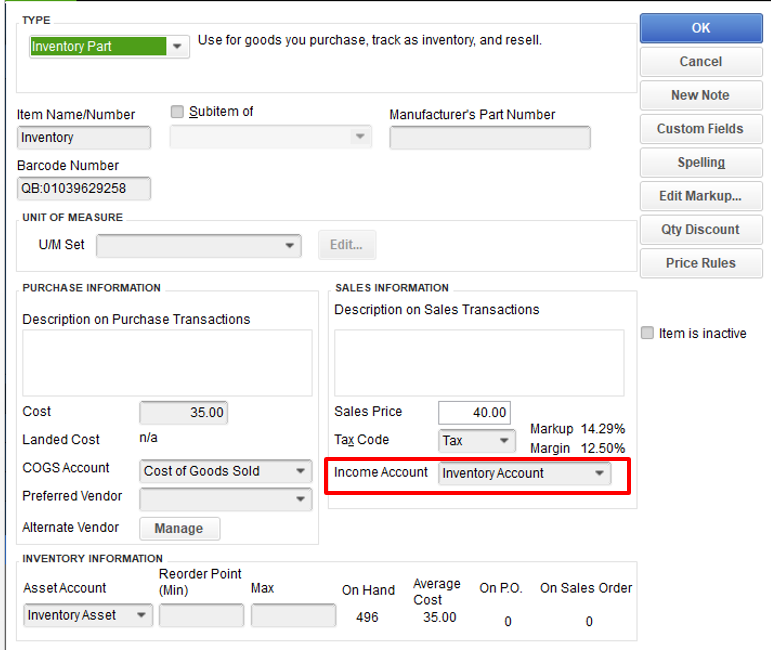

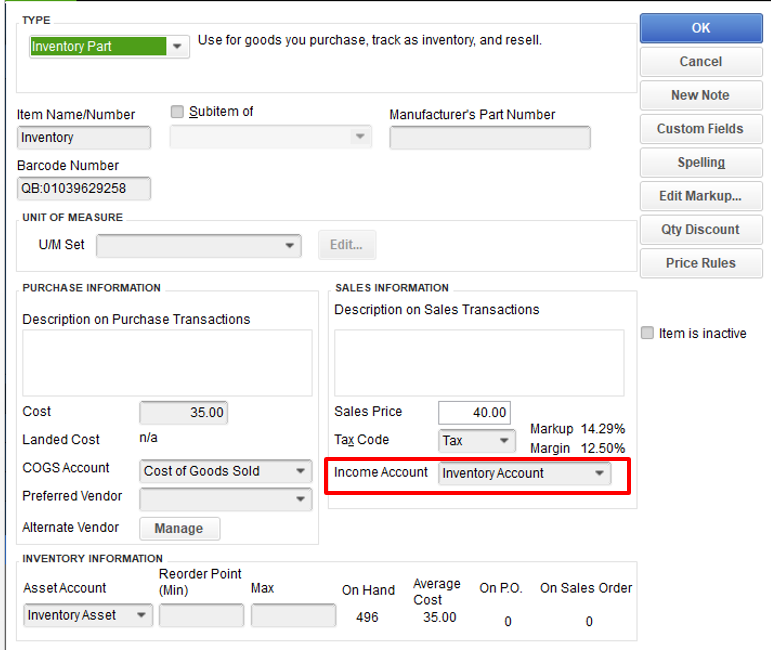

To ensure your accounts are accurate, you might want to check the items used or if the new line item (an INV) is mapped correctly.

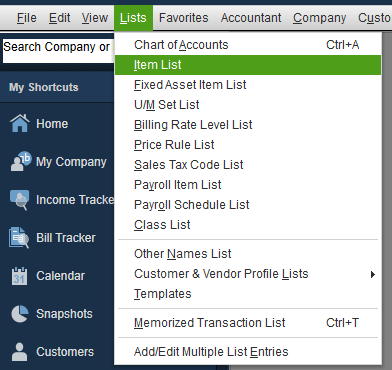

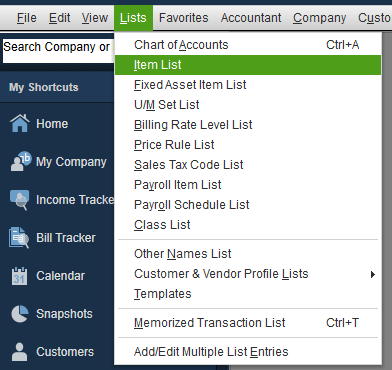

Here's how:

To know about more how inventory item works as well as steps on how to apply discounts to customer payments in QuickBooks Desktop, check out the following resources below:

If there's anything else you need, please let me know. I'd be more than willing to lend you a hand.

What item(s) is on the invoice? Look at that item to make sure it isn't mapped to your bank account. When you create an invoice, A/R increases and, if the item on the invoice is mapped to a bank account, it will decrease your bank account.

Let me help you sort this out, nkastner.

Typically, a business sends an invoice to a client after they deliver the product or service. This will add a journal entry as a debit in the accounts receivable account and a credit in the sales account.

To ensure your accounts are accurate, you might want to check the items used or if the new line item (an INV) is mapped correctly.

Here's how:

To know about more how inventory item works as well as steps on how to apply discounts to customer payments in QuickBooks Desktop, check out the following resources below:

If there's anything else you need, please let me know. I'd be more than willing to lend you a hand.

What item(s) is on the invoice? Look at that item to make sure it isn't mapped to your bank account. When you create an invoice, A/R increases and, if the item on the invoice is mapped to a bank account, it will decrease your bank account.

That fixed the problem. Many thanks.

Thanks. That was the problem.

Thanks for getting back with the Community, nkastner.

I'm happy to hear CharleneMae_F and Rainflurry were able to help with better understanding your accounts receivable account and how it works.

You'll also be able to find many detailed resources about using QuickBooks on our help article archives.

Please feel welcome to send a reply here or create a new thread if there's ever any questions. Have an awesome Friday!

Oh man. That is the answer. I was going crazy on this. I had set up a new part to get rid of some inventory and did not set it up correctly. Thank you so much.

Hello there, @ChrisS67.

I'm grateful that you took the time to inform us that my colleagues' solutions were beneficial to you. I also commend you for implementing the suggestions and utilizing all available resources to arrive at your current solution.

As always, the Community is filled with experts who possess extensive knowledge about QuickBooks. So, if you require any assistance, feel free to reach out to us here. We're always delighted to support you on your journey to success. Best wishes for continued prosperity in your business!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here