Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowHi there. I own a jigsaw puzzle company and host an annual puzzle drive. I have a sneaky suspicion that I'm not entering these things correctly and could use another set of opinions. Here's how the puzzle drive works: (first, it's a Toys for Tots donation, just to get that out of the way)

1. our customer/donor goes to the website (bluedotrobot.com) and visits a donation page, which is separate from the regular product page.

2. rather than buying a single product they sponsor, or buy, a case of 6.

3. rather than the retail price, the case is sold at cost.

4. the customer never handles the case(s) - I transport the items to T4T when their donation distribution centers open. This year our donation amount was so great I arranged for T4T to pick up the order at the warehouse.

Now this is why I'm confused.. the puzzle costs, when manufactured, are in a COGS account. When the customer makes their donation, it's being entered as a regular sale which, I guess, is technically correct? I'm recovering the cost but making no profit. It appears as income which, again, is technically true. I don't want to shoot myself in the foot here. I'd love to know if I'm totally off-base with how I'm entering these or if I'm missing any sort of advantageous way of entering it.

A small 2nd question: I've also matched this year's donations. I think it's pretty straightforward in that this is simply inventory given as an in-kind donation. This is the advice I plan to follow, but if you, oh helpful one, have other advice or I'm off base, I'm all ears. https://quickbooks.intuit.com/community/Inventory-and-projects/How-to-track-donated-inventory/m-p/18...

Thank you in advance!!!

Solved! Go to Solution.

Hello there, mische7.

I appreciate you for getting back to us and providing more insights. It would be my pleasure to answer any questions you may have about tracking donations.

Yes, you're right. In addition to that, recording the donation as a Sales Receipt will also allow you to print a receipt if you need one.

However, there are some extra steps you can do to record the donations correctly. You need to create a separate income and clearing account and the product items you need to enter as a donation.

After creating the accounts, items and creating a Sales Receipt, we'll need to create a bill to zero out the balance and for the donation to reflect.

I'm linking an article that includes the step by step instructions on how to perform the process: How to record in-kind donations.

Please don't hesitate to reach out should you have any questions or concerns. The Community is always here for you.

Good day, @mische7.

It's nice to have you in the Community. I'm glad you're doing great with your donation amount this year. :)

I can see you're on the right track in entering your donation items. In QuickBooks, the steps provided in the article is the best way to track items for an in-kind fundraiser. However, I'd still suggest consulting your accountant to verify if this is the best practice for your business.

I'll be here to help if you have further questions. Have a good one.

Hi Lily. Thanks so much for the reply. And it's nice to be in the community. :)

I had to part ways with my accountant after an expensive mistake a few years ago. I lost faith.. But most everything has been very straightforward so I've carried on as usual. This one is just slightly outside my comfort zone.

1. If I understand correctly (and, of course, I know this is just general guidance and not hard answers) entering the donations from customers as a sale is correct, since it's still a sale but at cost value.

2. Then with my own donations I'll just follow the instructions on the other page.

Sound about right?

Hello there, mische7.

I appreciate you for getting back to us and providing more insights. It would be my pleasure to answer any questions you may have about tracking donations.

Yes, you're right. In addition to that, recording the donation as a Sales Receipt will also allow you to print a receipt if you need one.

However, there are some extra steps you can do to record the donations correctly. You need to create a separate income and clearing account and the product items you need to enter as a donation.

After creating the accounts, items and creating a Sales Receipt, we'll need to create a bill to zero out the balance and for the donation to reflect.

I'm linking an article that includes the step by step instructions on how to perform the process: How to record in-kind donations.

Please don't hesitate to reach out should you have any questions or concerns. The Community is always here for you.

Thank you, thank you, thank you. Im on it!

I really appreciate this guidance.

Hello again, mische7.

You're very welcome. Please remember I'm here anytime you have additional questions or concerns with QuickBooks Online. You can reach out by posting a response below.

The Community seeks to serve you.

Hi again AlcaeusF,

I'm really pushing the envelope on getting taxes done this year! Alas, it's time no matter how busy I I am... so here goes.. I am in the process of setting up the income account according to the walk-through in the link. My problem is this: I don't have access to a 'Detail' account type. (so, #4 on the list is hanging me up) My QB version is 2014 Accountant. . . a wee bit dated.

Do you happen to have any advice on making sure this lands in the right spot? My options are:

Account Type (income, of course)

Account Name: "In-Kind Donation Income"

Sub-Account of: I don't have this checked so it's not a sub of anything at this moment.

Then, in a box that's labeled 'optional' overall:

Description:

Note:

Tax-Line Mapping:

That's all there is in the setup dialogue.

Thanks again - I know this goes above and beyond but I am so grateful.

Good day, @mische7.

Thank you for reaching out to us about setting up an income account.

The article my colleague provided is for QuickBooks Online, and I appreciate you converting the steps to the Desktop version. I'm here to help you more in setting up an income account.

For additional reference, you can check this link: Understand QuickBooks Chart of Accounts.

That should do it, @mische7. Let me know you have more account questions by leaving a comment or mentioning my name. Have a good one!

Thanks HoneyLynn_G! You rock.

Hopefully you can provide a hot tip for me here as I'm still terribly confused.

For this fundraiser, I sold a bunch of my stock of puzzles at cost to friends and family, but rather than them getting the puzzles, they went straight to Toys for Tots. Now, those 'purchases' (though really donations)came through to me through the regular sales sources. (my website, where some folks bought via PayPal and others bought via Stripe) Those sales, I just recorded as regular sales, created receipts for everyone so they can have the donation amounts for their taxes. I deposited the funds (in QB, anyway) into my PayPal or Stripe QB banking accounts.

- THEN -

I matched puzzles for puzzle plus another 57 cases. That was just a simple, donation from my company (which is just me) to T4T. That was totally separate from the donations of friends and family.

I get the impression both of the above scenarios are supposed to land in the In-Kind Fundraiser account somehow, but I could be misunderstanding the direction from the 2 pages I was learning from. If that is true, I'm not sure how to deal with the 'purchases' made by friends and family. Let's take a purchase paid for w/ Stripe for example.

Sale -> recorded by me into Stripe account -> Then Stripe takes their % and deposits into my bank. -> I reconcile my Stripe QB account and transfer that dollar figure into bank account. (where it really was anyway since Stripe put it there)

Where does the In-Kind Contributions account fit into that flow?

Thanks for the help (to everyone that's helped, actually) and thanks for being patient with me. This part is REALLY not my thing. I'm going to search for a new accountant after these taxes are done!

Thanks for explaining further what you're trying to accomplish, @mische7.

I'm here to help share some details on how you can get the in-kind contributions to flow into your account.

To give you the right amount of information, I just wanted to ask some questions about this concern. How did you record the transactions from your vendor? May I know what is the nature of the transaction? Did you gain an income for it or you get a commission?

Please get back to me with more information so we can straighten this issue out. I'll keep an eye for your reply. Have a good one.

Hi there. Thanks for the guidance. I'll do my best to answer.

I'm not totally sure who the vendor is from your perspective so I'll cover a couple of things.

1. My company owns the products (puzzles) that went to T4T - I had them manufactured years ago and all of those costs are in the COGS in QB.

2. If it's the online credit card processing you mean, then the purchase was done like any online purchase, except that I was selling by the case (6 puzzles) at a special rate. The card processors still kept their part as per usual, then deposited the funds into my company's bank account.

3. If it's the customer (friends/family) you mean, to them it was just a normal online sale. They just knew they wouldn't get the product itself and that the goods were being taken to T4T.

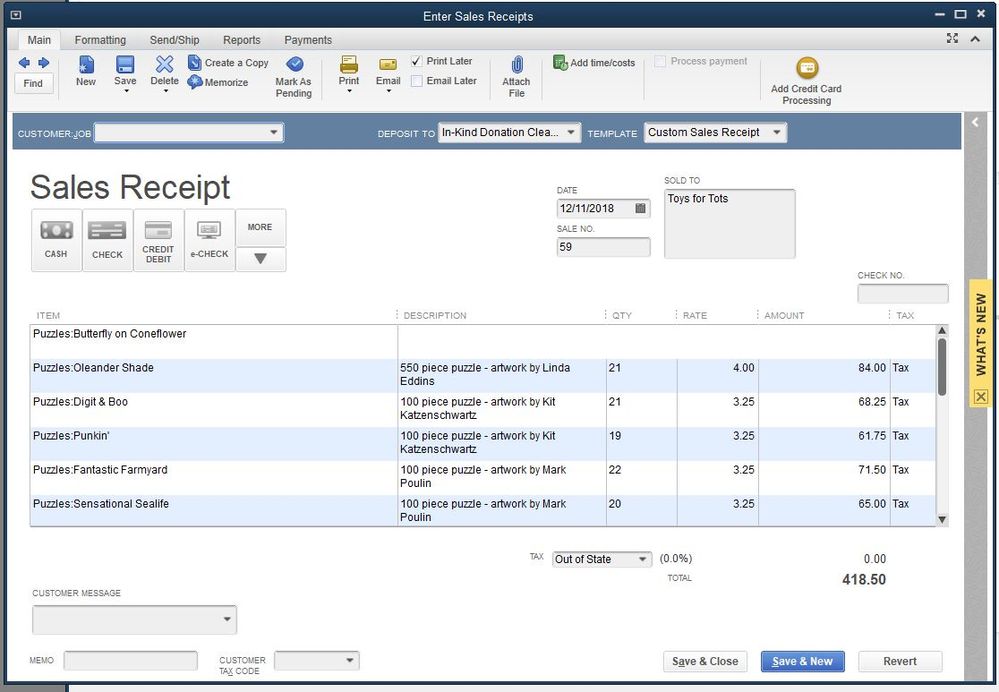

I'll add a snapshot of one of the friends/family sales. You can see that I recorded the sale into the PayPal banking account I have set up in my chart of accounts. (since they paid via PayPal on my site) I'm also adding a snapshot of the donation I made, which is just my company donating our product inventory to T4T. (not totally sure I'm doing that the right way either but I just as the 1st step I simply recorded it as a sale and deposited it into In-Kind Donations Account I create.)

As for money made, with the friends and family sales, each puzzle made $1 over cost, which will allow me to give the artists some $. (part of the business goal is to get these cool artists exposed to people via jigsaw puzzles) So a puzzle with a true cost (in COGS) of $2.25 was bought for $3.25.

Whew. I sure hope that answered your questions. It seems like such a simple concept but the bookkeeping for it is anything but!

Thanks so much - I really appreciate this.

Hello again, mische7.

I appreciate you for proactively getting back to us for any clarification you need. Allow me to chime in and provide additional assistance with any concerns you may have about the In-kind donations.

I've taken time to read the thread starting from the top and found out that you're using the Desktop version of QuickBooks. Since you're generating income from the puzzle products, technically, the In-Kind donations are coming from your customers.

The way you record the transactions in the program depends on the situation. Since your customers are only paying and not receiving the goods, you may consider your Jigsaw Puzzle company only as a connection on helping with the In-kind donation distributions.

That said, the most crucial part of the process is how you give the toys on behalf of the customers. If you're the one who'll be giving the goods into the Toys for Tots program, this will fall as an expense on your company's end.

I want to ensure that you're able to figure this out, so please feel free to let me know how it goes. If you should have any questions regarding the process, I'm just a click away.

Hi again AlcaeusF. Thank you SO much for taking the time to read through the thread. You're totally on point here.

Everyone who donated to the Toys for Tots fundraiser got their receipt and those puzzles were strictly their donation. I had them pulled from inventory, called a Toys for Tots guy and had them pick up the pallet from the warehouse in MA. This part of the donation was 74 cases. (444 puzzles) I'm not totally sure how I should have recorded these since I needed a sales receipt for the customers to have (for taxes) and I needed to reconcile the incoming credit card deposits. I think you're telling me these should not pass through the In-Kind account at all. (which makes things much easier!) I'm hoping that the cost of the puzzles in COGS balances out with the sales receipt when I do my final reports.

THEN, there was my matching donation: 74 in MA, which got piled onto that pallet with the other 74, and 57 locally. In total, 131 cases that had nothing to do with the friends/family. (It was amazing - 888 kids got a gift this year in the NEast then another 342 locally.) Anyway, this part I believe DOES go through the In-Kind Donation Clearing account. ?

Am I following?

Hey there, mische7.

Let me start by saying how much I appreciate your intent to get this straighten out. I want to provide additional insight into the In-kind donations.

You can mirror transactions in QuickBooks Desktop like how it happens in the actual as long as you're sure of the process. I also believe you're on the right track with your understanding of when to use the In-Kind account in the program.

As long as you choose the correct COGS accounts for the items, it should show correctly on final reports. Donations that went out from your company and aren't from the customers can go through the In-Kind clearing account.

You can follow the steps and screenshots attached by my colleague @HoneyLynn_G above. In case the time comes that you need to perform the reconciliation, I'm adding the article below for future reference:

Reconcile bank and credit card accounts.

Lastly, It would still be best seeking expert advice from an accountant to ensure your books will be on the right path and to avoid tons of corrections.

I look forward to serving you to the best of my ability with regards to the In-Kind donations. Please remember the Community is always around for you.

You guys and gals are wonderful. Thank you! :)

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here