Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi Folks,

I paid an insurance premium deposit with two checks written on "Accounts Payable": $320.50 and $415.50 for a total of $736.00. The eventual premium was $584.60 with a refund of $151.40.

I entered a bill for $584.60 on the account "Insurance". I deposited the refund to "Accounts Payable".

When I "Pay Bills", I think I should be able to include all three items ($320.50, $425.50, -$151.40) for a total of $584.60, but I can only include the checks. I want to match the credit left on the payments in Accounts Payable with the refund.

Am I trying to do something that can't be done, or am I just doing it incorrectly?

Thanks for the help,

Chris.

I can help match the credit left on the payments with the refund, cjm51213.

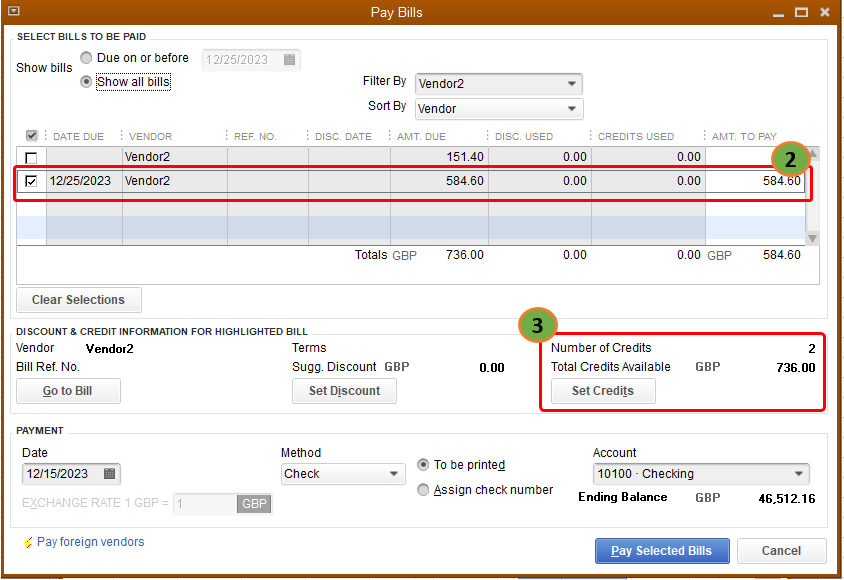

Those two checks and the deposit you've written under the Accounts Payable are considered credits of the vendor. When you pay the bill, just mark the bill. Then, click set the credits to zero out the balance.

Here are the screenshots of the transactions you can check to ensure they're entered correctly.

And, here are the steps on how to pay the bill:

When you click the Open Balance of the vendor, the remaining credit offsets the deposit.

Now, you're ready to reconcile your accounts.

Let me know if there are other things you need with QuickBooks. I'm always right here to help you.

Hi MaryLandT,

Yes. That is exactly what I have done. It does not solve the problem, if the report covers the date range of the insurance policy. I need to enter a negative amount in the "Pay Bills" component. We both know that this is a normal function of "Accounts Payable", but QuickBooks to has simply disabled this. Morons!

How do I book a refund and accrue the financial impact to the period of the original premium?

Thanks for the help,

Chris.

Hello, cjm51213.

Booking the refund has to be done separately since it's a deposit transaction. On her 4th screenshot, she created a bank deposit for the amount of $151.40. We're technically receiving a portion of the amount that we paid for the premium deposit.

Now, I'll add something to clarify the "Pay Bill" step and help you resolve this.

The Pay Bill step is the one that closes out the Bill and the check transactions. QuickBooks won't let you enter a negative value since it will mess up the calculations. Instead, we'll be using the Set Credits function.

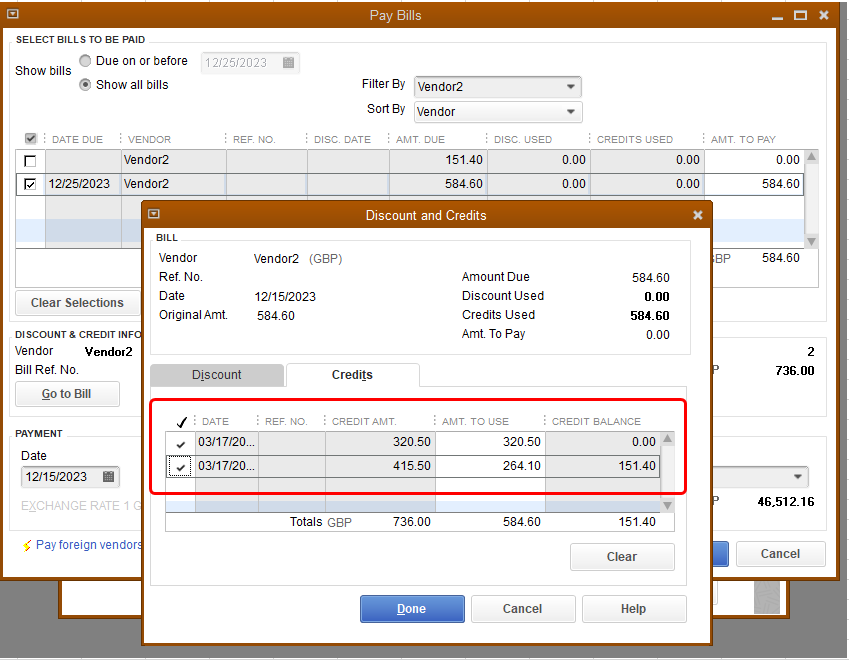

You can actually select all of the three transactions you created (the refund and those Accounts Payable check for the deposit) through Set Credits.

Going back to the Pay Bill window, you'll see that there will be two selections. Simply highlight and check the first one (the refund of $151.40) then click the Set Credits button. Choose the credit to apply, then hit Done.

This will zero-out the refund, and it will look something like this:

Now, check the second bill (for the two check payments of $584.60). We simply need to apply the same amount through the Set Credits screen. Simply apply the credits again, and it will look something like this:

This will create a zero-dollar bill payment transaction that will close out the records we've made. This is what it will show before we process the "payment" record:

Now when you reconcile, you would simply select the two checks (the Accounts Payable checks) and the refund deposit we created. Also, make sure to include the zero-dollar bill payment transaction. The total will balance out everything:

After dealing with the transactions, you can check out other articles in our general articles list page. They contain steps to help you run reports, handle your online bank feeds data and more.

Let me hear your thoughts if you have more concerns regarding the processes in QuickBooks Desktop. I'll clarify or give out the steps to help you complete your tasks.

Thanks for the help,

Chris.

Hi, @cjm51213.

I appreciate you for following up with us here on the Community forum.

I want to ensure you'll be able to record the vendor refund and your payments accordingly.

Usually, the steps provided by my colleagues above are the proper way of applying vendor credits to an existing bill. If you're having difficulties with entering your transactions, I suggest checking assistance from a professional accountant. This way, they can help you with correct accounting that fits your business needs and get the report you need.

To achieve your report, please ensure that the expense generated from your bill has the same date on the insurance premium. The insurance premium will be determined by the expense generated by a bill, not with the A/P account.

If you have any other questions, please let me know by adding a comment below. I'm always here to help. Keep safe!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here