Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThey might not "need" separate accounts, but to be honest, there is no good reason not to have completely separate accounts for two different businesses.

If you're a sole proprietor, you could mingle both businesses even along with your personal accounts as long as you keep separate books for both businesses. For a sole proprietor, there are no legal ramifications for intermingling funds. But if you don't keep completely separate books, you lose the ability to track either business. You won't be able to tell in advance from the numbers if things are going south, likewise with identifying opportunities. The numbers will speak to you if you keep them separate.

If you have formed a business entity the legal ramifications are enough to mess things up if not done properly. For one, if your numbers are ever questioned by a state or federal government agency, such as an audit of your tax returns or sales tax or employment law, you won't be able to verify your numbers if you don't have separate books. It allows an auditor to pick and choose which numbers to use to settle the case, and guess which direction they'll go (hint: it won't go in your direction).

If you have business entities such as a corporation, S corporation, LLC, or nonprofit, failing to have separate books means you're not treating the company as a separate entity, and you increase the risk of losing any liability protection you may have from the entity (whether a corp or LLC actually protects you from personal liability is a separate discussion. If there's a claim there will be lawyers involved and they can pierce the corporate veil very easily, and intermingling funds is one of the main reasons the liability shield is pierced. There's no replacement for a good business insurance policy).

I can't think of a single reason why it wouldn't be a bad idea to intermingle funds from two different businesses.

Good day, and welcome to QuickBooks Community, Vfeucht75!

LEmerson explained it well. If you need to create new QuickBooks company file for the other business entities and track its TAX ID numbers, we can use the same sign-in info, which requires a separate paid subscription.

To add a second account, we can follow these steps.

Then, we can go to the settings to enter the TAX ID number and select appropriate company type.

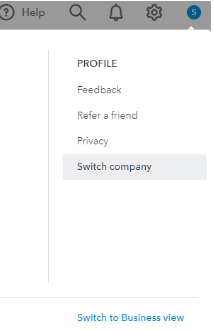

After we create a new one, QuickBooks will ask you which company file to open after you login in. We can go to the Gear icon and select Switch company to change between the companies you created.

We can check out these articles for more details about handling accounts in QuickBooks:

Please let me know if I can be of any additional assistance with any of your QuickBooks concerns, especially managing your QuickBooks account, click the Reply button. I'm ready to help you.

One QBO account is one company file. Utilize the class tracking feature available in QBO Plus or Advanced to manage branches/divisions. Otherwise, you should open a new blank QBO account for your second business.

https:// quickbooks.grsm.io/US

https:// quickbooks.grsm.io/us-promo

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here