I'm here to help your credit card payments come up as an expense in QuickBooks Self-Employed, mpmlmft.

To report your credit card payments as an expense in QuickBooks Self-Employed, you can simply enter them as an Expense transaction.

Here's how:

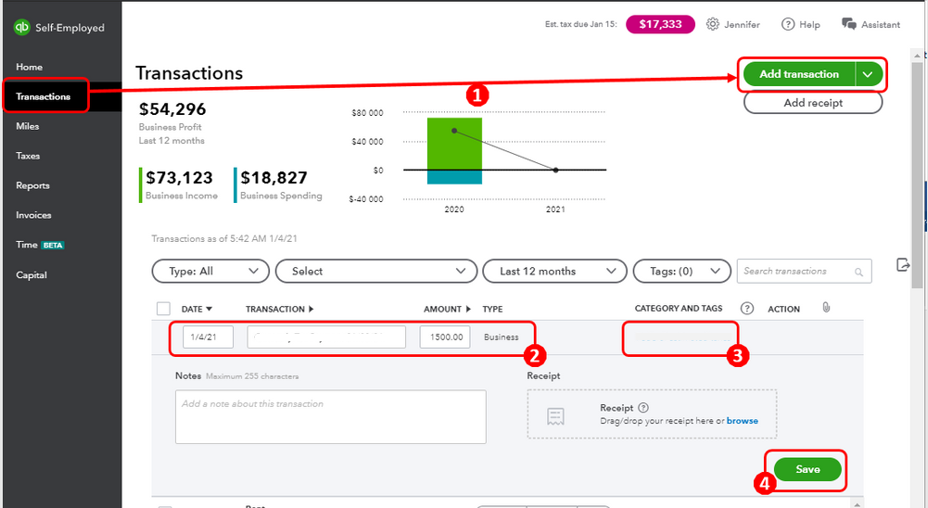

- Click the Transactions menu in the left panel and select Add Transaction.

- Enter the amount and a description.

- Select a category menu.

- Hit Save.

You can take a look at the following article. This will provide you lists of categories to help guide you in tagging or categorizing your transactions as well as organizing them accurately in QuickBooks: Updates to expense categories in QuickBooks Self-Employed.

Additionally, you can visit the following write-up regarding how Schedule C categories show up on your financial reports: Schedule C and expense categories in QuickBooks Self-Employed.

Keep in touch if you need any more assistance with this or there's something else I can do for you. I always got your back. Have a good day and keep safe.