Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I've got your back, @cclayton.

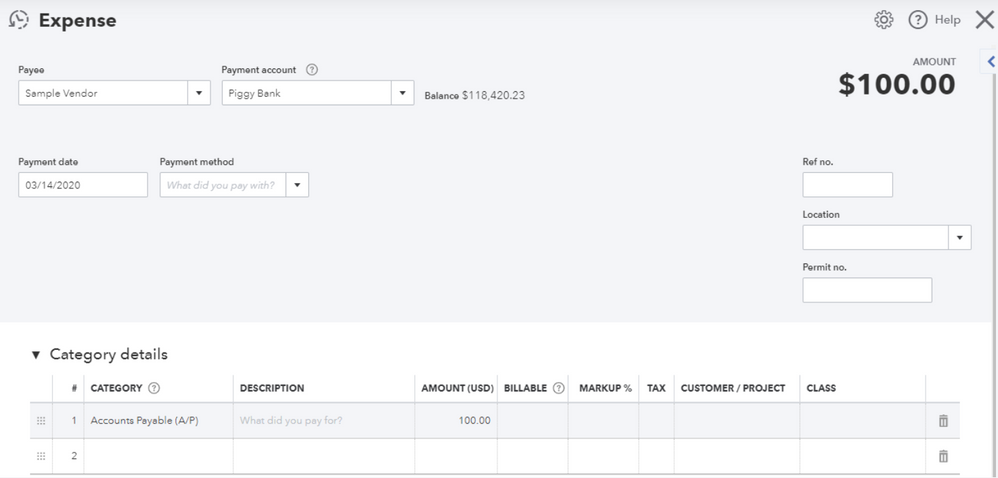

Let's record a vendor prepayments to avoid creating Unapplied Cash Bill Payment Expense when paying bills before the date. You can enter an expense transaction to record it.

Here's how:

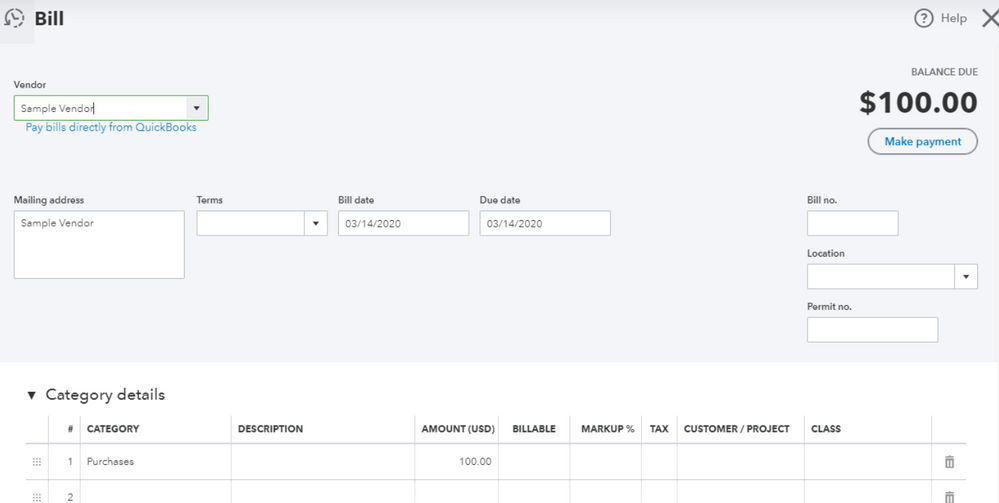

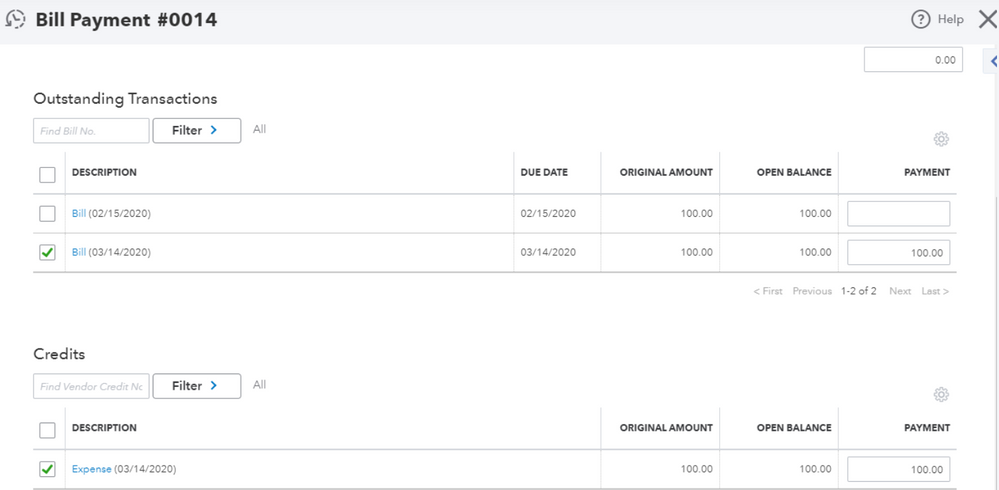

Once you receive the product(s), you can then create a bill and pay it with the prepayment amount.

As always, feel free to visit our QuickBooks Community help website if you need tips and related articles in the future.

Please know that you can always get back to this post if you have additional questions with QuickBooks. I'll be around to provide further assistance. Have a good one.

I'm here to ensure everything is flawless, @cclayton.

Were you able to follow the steps I provided to record bills that are paid before the invoice date? If you need more clarification on this process, just let me know. I'll be sure to get back to you.

Wishing you all the best.

Sorry to interrupt somone elses post, but I have a question about the steps you provided.

In the first section, step 4 "On the Category details section, under the Category column, enter Accounts Payable (A/P)." Is it the Accounts Payable category that makes it so you have that credit needed?

Hi Shalene.

You're correct, the Accounts Payable category makes it so you have that credit. For additional information on understanding the chart of accounts, you can check out this link: Understand the chart of accounts in QuickBooks.

Let me know if there's any other questions you have. Have a lovely evening.

Thank you for clarifying, @Nick_M. I appreciate it.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here