Good day, pahenr61-gmail-c.

I'm here to help ensure your customer is not being taxed in QuickBooks Online (QBO).

The investigation about customers being charged tax, even when marked as Tax Exempt, is already closed and resolved. Our engineers have determined this is working as designed.

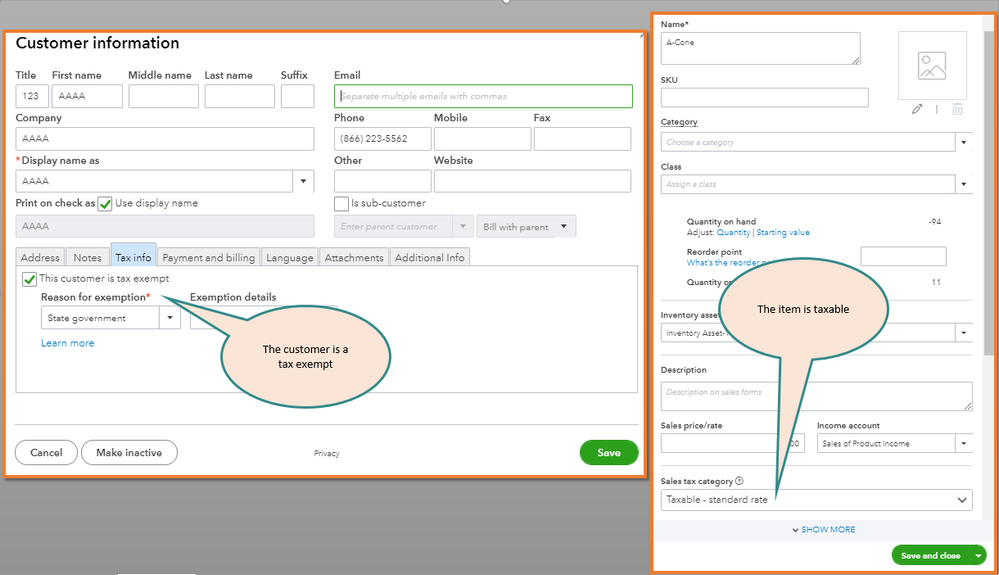

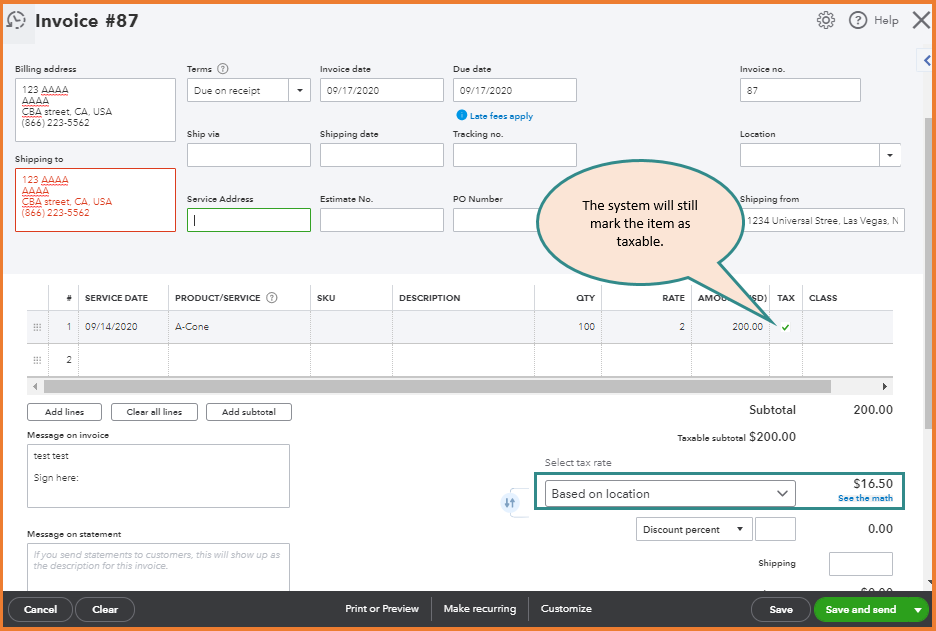

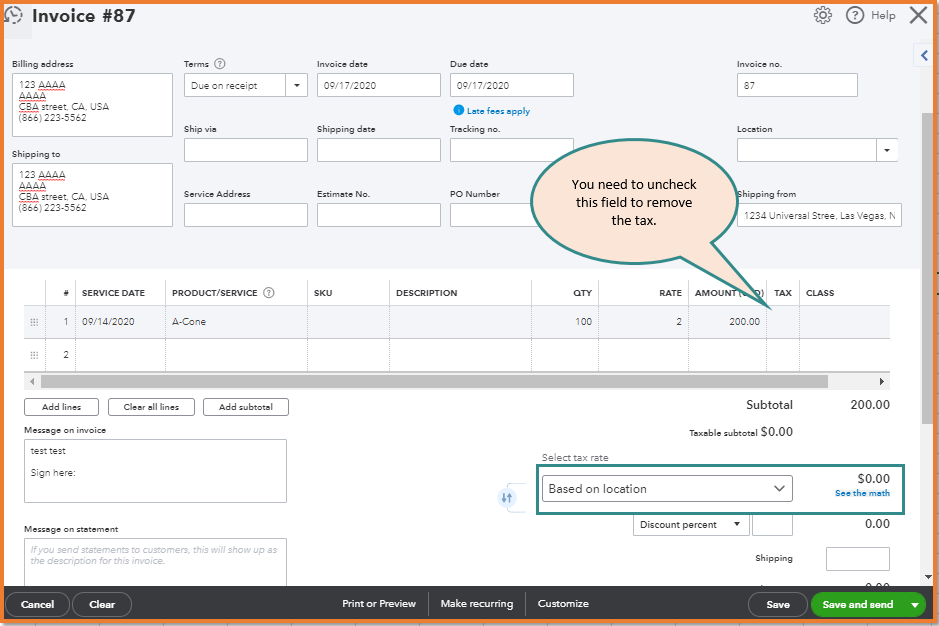

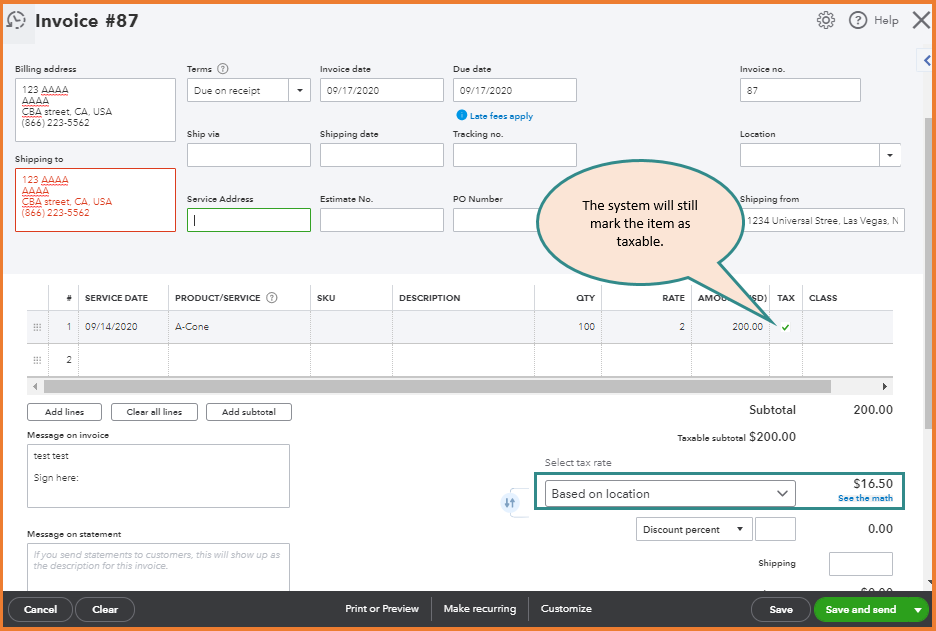

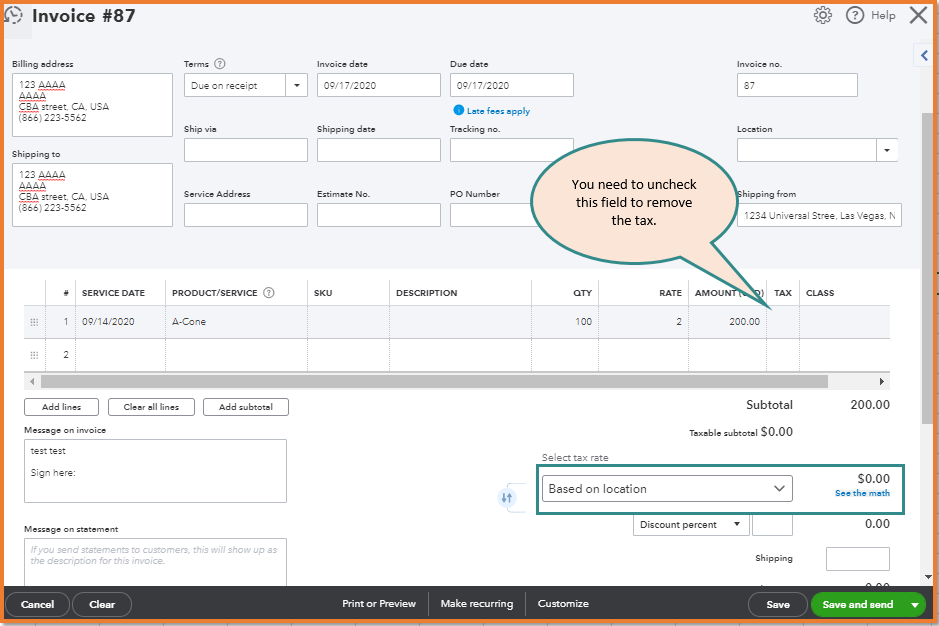

Even if the customer is set up as tax exempt QuickBooks will automatically mark the invoice as taxable. You need to manually uncheck the Tax box before saving the transaction.

See attached screenshots for your reference.

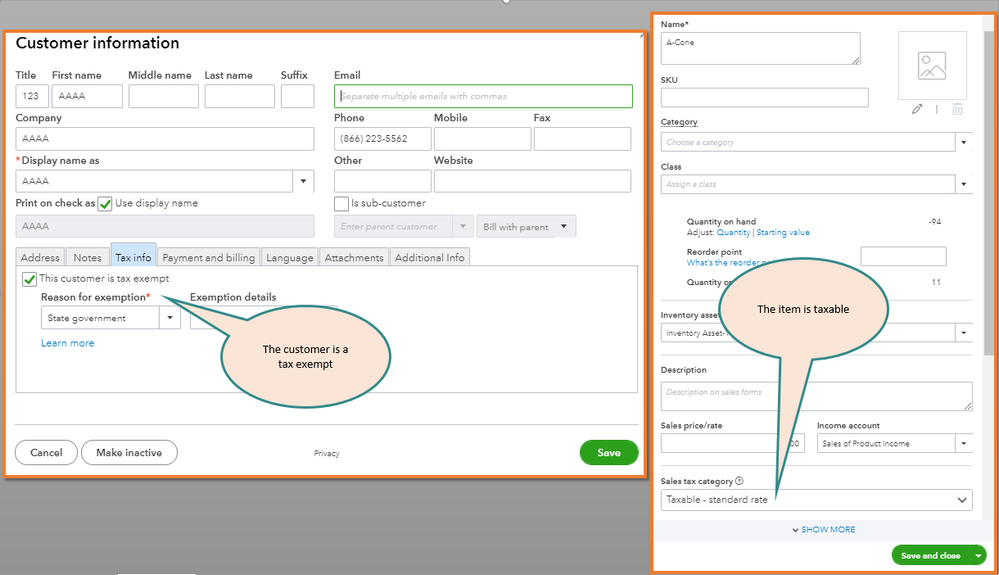

Also, you'll have to make sure that your customers will be fully tax-exempt:

- The product/service is set up correctly with an appropriate tax mapping that would make it eligible to be tax-exempt.

- Verify if the customer has a valid address. A missing or invalid one will let QBO use a default tax rate for the company.

You can check these articles for more information:

I'm always here if you have questions about your customers or anything else. Let me know in the Reply section below. Take care and have a wonderful day!