Hello there, @NF9Bed.

We do have a way for you to make journal entries in QuickBooks Desktop to add back your money from 2023. However, we always advise speaking with your accountant or a tax professional. This is because journal entries can significantly impact your financial and tax reporting.

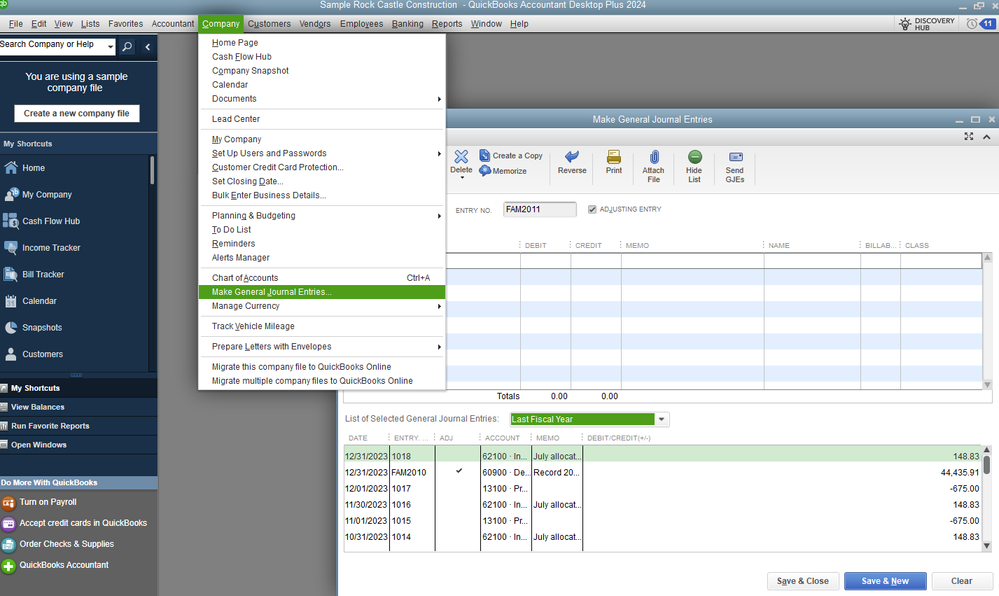

Here's how to create a journal entry:

- Click on the Company menu, then choose Make General Journal Entries.

- Verify the date field to ensure it aligns with the date you want to account for the funds from 2023.

- Fill it out to create your journal entry, and ensure your debits equal your credits when you’re done.

Each non-profit has unique accounting needs and requirements, so it's essential to find an accountant before making this change.

Feel free to reply if you have any more questions. I'm here to assist you.