Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I ran reports to pay my state sales tax today. I ran the Sales Tax Liability report at 10:58. I couldn't get my numbers to balance on the sales report so I went back to into QuickBooks to make sure I didn't have anything coded wrong. At 11:09, I pulled the Sales Tax Liability report back up so that I could check the transactions for each column. This report had different numbers.

10:58

Total Sales = $10591.73

Non-Taxable Sales = $7980.74

11:09

Total Sales = $11651.73

Non-Taxable Sales = $9040.74

No other columns had changed information. Both of these reports are done on an accrual basis. No one else was in this company file and I never even opened the invoice area so I know I didn't make a change. This is the second month this has happened and we're a little concerned as to what the problem might be. If anyone could recommend some things to check, I would appreciate it.

Thank you.

Solved! Go to Solution.

Hi there, @jstabler.

It's possible that date was different from the first time you've check your transaction to the moment you get back to it. We can go back to your Sales Tax Liability report and check if the dates are similar.

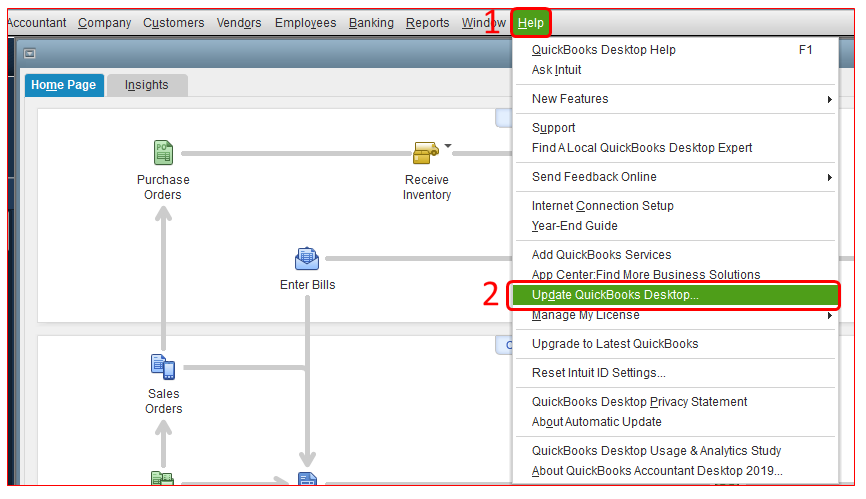

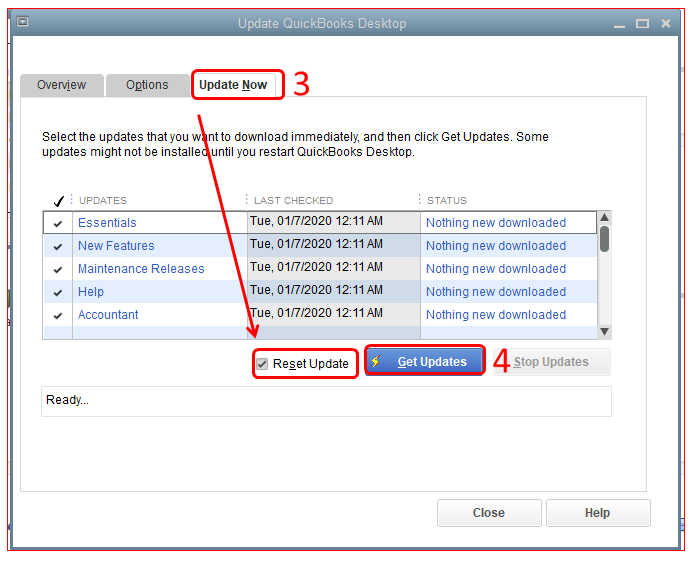

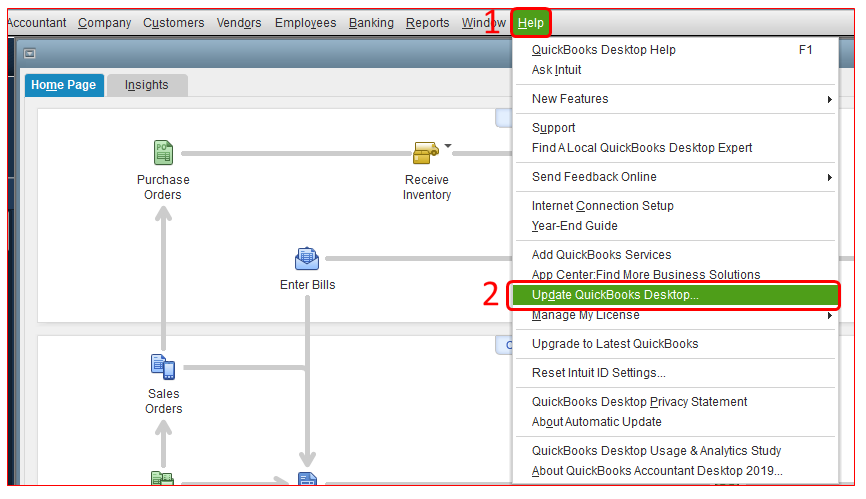

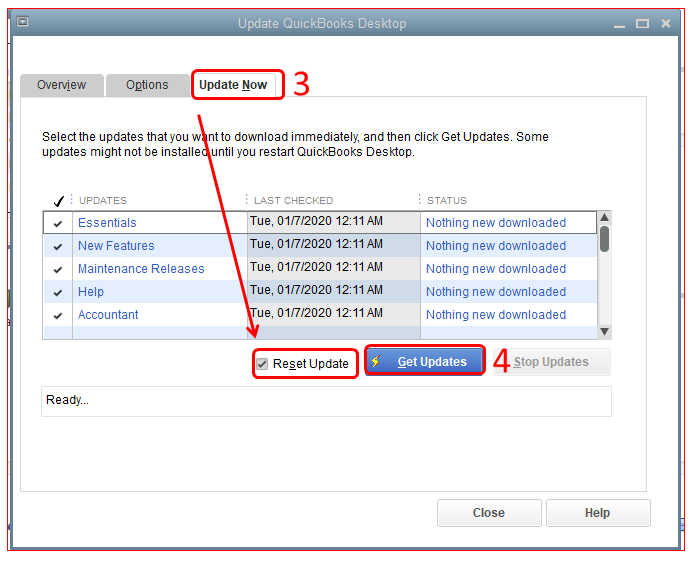

If this isn't the case, I recommend resetting QuickBooks update. This can help fix minor bugs or unexpected behavior with the product. Here's how:

You can also review your sales tax reports to make sure everything is accurate before paying VAT.

I've also added an article on how to troubleshoot unexpected errors you may encounter while managing your sales tax in QuickBooks Desktop: How to resolve common sales tax issues.

I'm always here to help if you have any other concerns or questions. Just tag my name in the comment section and I'll get back to you as soon as I can.

Hi there, @jstabler.

It's possible that date was different from the first time you've check your transaction to the moment you get back to it. We can go back to your Sales Tax Liability report and check if the dates are similar.

If this isn't the case, I recommend resetting QuickBooks update. This can help fix minor bugs or unexpected behavior with the product. Here's how:

You can also review your sales tax reports to make sure everything is accurate before paying VAT.

I've also added an article on how to troubleshoot unexpected errors you may encounter while managing your sales tax in QuickBooks Desktop: How to resolve common sales tax issues.

I'm always here to help if you have any other concerns or questions. Just tag my name in the comment section and I'll get back to you as soon as I can.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here