Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI found my way here looking for a simple system for using QB for rental property accounting. I have a 2012 ver of QB and I have used it in the past for a construction co. I think I could go through the steps to set up a simple company with each rental as a customer/job and work out all of the expense accounts as needed but I'm a bit rusty in my QB skills and it would be time consuming. I'm guessing someone must have worked this all out before and I'd be happy to pay a reasonable amt for the pre-set template. I don't need to invoice tenants, write payroll or anything complicated... just wanting to use it for bookkeeping and to be able to send my tax accountant a P&L report at the end of the year.

Does what I'm looking for exist?

Thanks!

Customer:Job, such as Property address:Tenant, allows you to track prior tenant, current tenant, moving in tenant, using Job start, projected end and end dates, job status, security deposits by Job (tenant), etc.

Don't overlook Items. Rent, Security Deposit, pet deposit, utilities, etc would be charged to the tenant.

You didn't mention if you are managing from the perspective of landlord or property manager for property owned by others. The differences include if this rent is your income or owed to others as your liability, for instance. You would need to understand your needs from the perspective of the accounting and reporting requirements.

QB 2012 is not meant to run on W8 or newer; it reached end of life in May 2015. If you are using Windows 7 or higher, it would be time to move to QB 2019 for compatibility and security reasons; for the ability to email invoices and reports and handle electronic banking activities directly in the QB program. You have none of this in QB 2012. QB Pro costs about $150, typically, and would be a business expense on the tax forms you file. You risk the data file can become corrupt and/or not even updated or accessible, the longer you use incompatible software or unsupported (reached end of life and no longer updated) programs.

We had an All Star, Gita Faust, here who has books for QB and Property Management.

Greetings, @localHero.

Thanks for taking the time to post in the Community space. I’m here to share some information about running property management business in QuickBooks Desktop.

I can see that you’re actually skilled when it comes to setting up each rental as a Customer:Job in your company file. With QuickBooks Desktop, you don’t only set up a company file, you can as well perform tasks such as run your property management business, track and receive rent from tenants, paying property owners and management companies, record fees and overhead charges for property maintenance.

If you’re asking for a pre-set template for rental property accounting, I’d suggest reaching out to your local accountant. Your local accounting professional can provide advice tailored to your situation since laws and regulations relating to property management may vary based on the state, industry or specific facts and circumstances involved.

If you need additional information in creating a property management company in QuickBooks Online, you may refer to this helpful article: https://community.intuit.com/articles/1764942.

Please let me know if you have any questions or if I can be of additional assistance. Wishing you all the best and Happy Thanksgiving!

Thanks for the replies! I'm a landlord/owner and while I'm also a Realtor, I don't manage properties for others. Simple bookkeeping is all I'm looking for. I already have an online system in place for collecting rents and keeping track of what's due when. I just need a system to keep track of my income/expenses on an ongoing basis instead of trying to figure it all out at the end of the year (as I am now) :-/

I'll check out that article and talk to my accountant though I've asked him for something like this before and he didn't have much to offer.

Happy Thanksgiving to all!

Good day, localHero.

Thanks for turning to the Community. I’d be glad to help and ensure you can efficiently track these transactions.

To stay on top with your financial records, make sure the data from the current online system is also recorded into QuickBooks. Doing so will help manage your business time.

If the current online program is capable of importing these transactions, then you’ll be able to bring the data directly into QBDT. However, if your accounting system is unable to automatically bring the transactions into QuickBooks, you may want to consider using a third-party application.

The Intuit Marketplace is a one stop shop where you'll find third-party apps that integrate with QuickBooks Desktop. I've added articles that will guide you through the steps on how to record income and expenses:

If there's anything else that I can help you with, drop a comment below. Please know that I'm here to make running your business more simple. Wishing you continued success.

Hi, I am also an owner of a rental property and I need a simple way to keep up with income/expenses.

I have them all written down on paper, I just have to transfer them to QB. Is there a tutorial for that?

thanks

Good day, Isa144.

It’s nice to see you in the QuickBooks Community. I can help you in tracking the income and expenses from your rental property.

Currently, we don't have a video tutorial on how to input these transactions. As mentioned by @KhimG, the Create a property management company article will guide you through the steps on how to set up property management and track income and expenses.

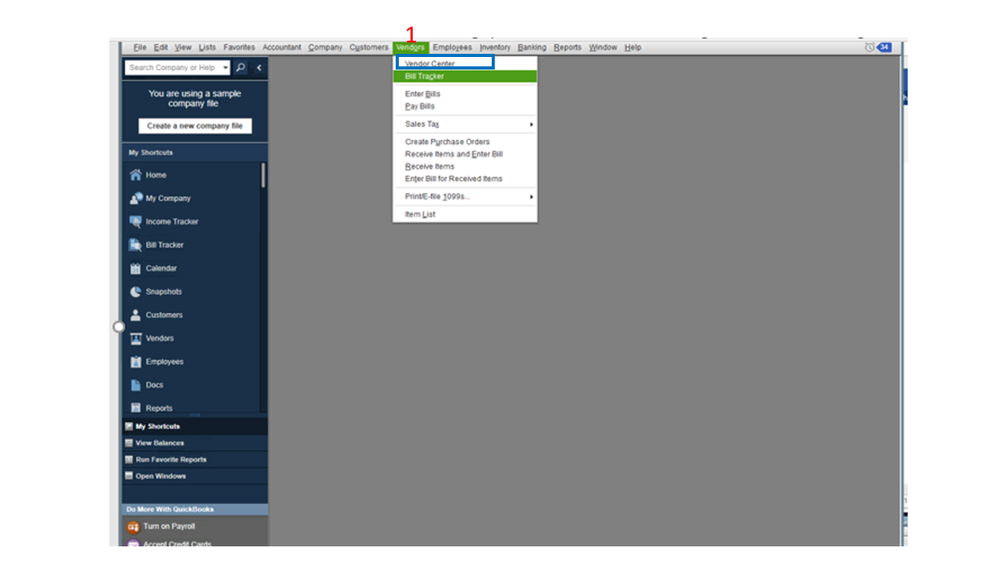

If the property management is already set up in QuickBooks, you can start with recording the payments by property. I'll guide you through the step by step process.

To receive payments:

To make deposits in QuickBooks:

For the detailed instructions on how to input income and expenses, click on this link and going directly to the Record transactions and complete other tasks section.

That's it. The following steps will help get you moving today.

If there's anything else that I can help you with, leave me a comment. I'll be glad to assist you further. Wishing you the best.

I have been using quicken for over 25 years with my rental properties. At one time I had over 125 units. I set up rental income, under category, then tag it with the property address and then sub expense account like this "Rental income" then under tag "157 Highlander:Rent" If you have an expense it just as easy Or category "Utilities" then under tag "157 highlander:Water".. Reports are ease to filter out to each property, category or tag.. Tried to do this on quick books and found it so much more involved.. They have a new Quicken with rentals, but like my method better.

Hi there! I have done quite a few of these and it seems that it will be a pretty simple set up as you mentioned. We can easily set this up for you in an hour or so. All but one of our clients are real estate investors and vacations rental companies. First a couple of questions and recommendations of the best way to help you and a reasonable cost as well. How do you want to track expenses for each property? This is simple to set up and maintain. Just a mouse click to assign any expenses to a particular property. To track your income, (without sending any invoices to tenants...that's just silly) I'd create a memorized transaction for the invoice (of the rental rate) that is never printed or sent out unless you wanted to for a particular issue. Otherwise it will just live in your QBooks account. When you receive the rent each month, you post the payment to the already created invoice. To assist you in desktop, I could log in remotely and set it all up for you.. As an alternative option, since you are rusty anyway and your QBooks is not supported by Intuit any longer you may consider making a move over to QuickBooks Online? The reconciliations are super easy, completed in minutes and you never have to enter anything manually except possibly a cash receipt for some thing. Those can also be done with a click on a smart phone. All transactions in and out are on the bank feed. You can also allow tenants to click & pay by ACH and their rent is in your bank the following business day! You can access QBO from anywhere, never need to buy new versions (it's always updating) and instead of the retail price of up to $70 per month (most people find 1/2 price deals for 6 or 12 months) , we can add you under BizPro's, ProAdvisor Accountant account and it will be at no charge through 12/31/2020. That can be changed anytime you like simply by calling Intuit and changing over to your own plan. I fought QBooks Online for years but have been a ProAdvisor now for 3 years and finding it's pretty simple, provides everything I need for most clients and it's a huge time saver. At the end of each year, it's very easy to provide your tax professional with whatever you need. Why not let technology do most of the work? I would be happy to do your set up for an $88 Flat Fee. Food for thought. Please get in touch and I'll be glad to assist. (We are in California on Pacific Standard Time...just our phone is a Pennsylvania number) Michelle Hunnewell, BizPro Accounting & Financial Services [removed] [removed]) [email address removed]

Hey there.

I have 26 properties under management.

I export the data from the manager's software into EXCEL.

I wonder if you could help me set up QB Desktop to import the property specific transactions 1:1 or consolidated by QUARTER, from a pivot table. . . .

The current QB File has P&L and BS, but is not yet set up to track the individual properties. . . .

Since rent collection and such is done by the property manager, I just need to be able to get reports on a house by house basis. . . . instead of using QB as only the consolidation of activity.

Your thougghts?

Thanks for joining this thread, TN-landlord.

If the exported file is your tenants’ profile, import them as customers’ or jobs. However, if these are transactions, convert the Excel file to an IIF format.

The ability to change a CSV file to IIF is currently unavailable in QuickBooks. You can consider visiting Intuit Marketplace for the list of applications that can help convert the file.

When you're ready, please import the data into your company file. Once done, let's go ahead and set up the properties.

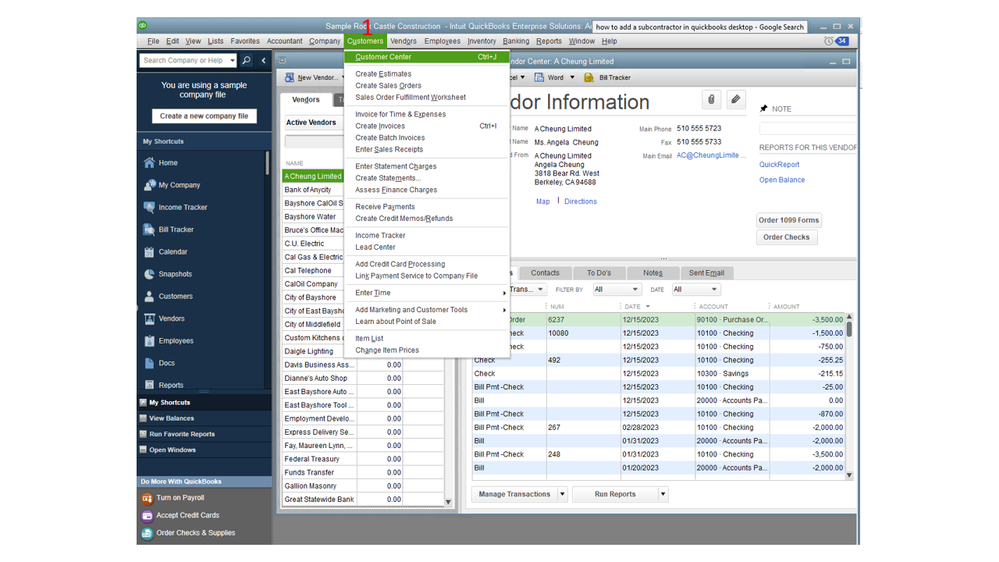

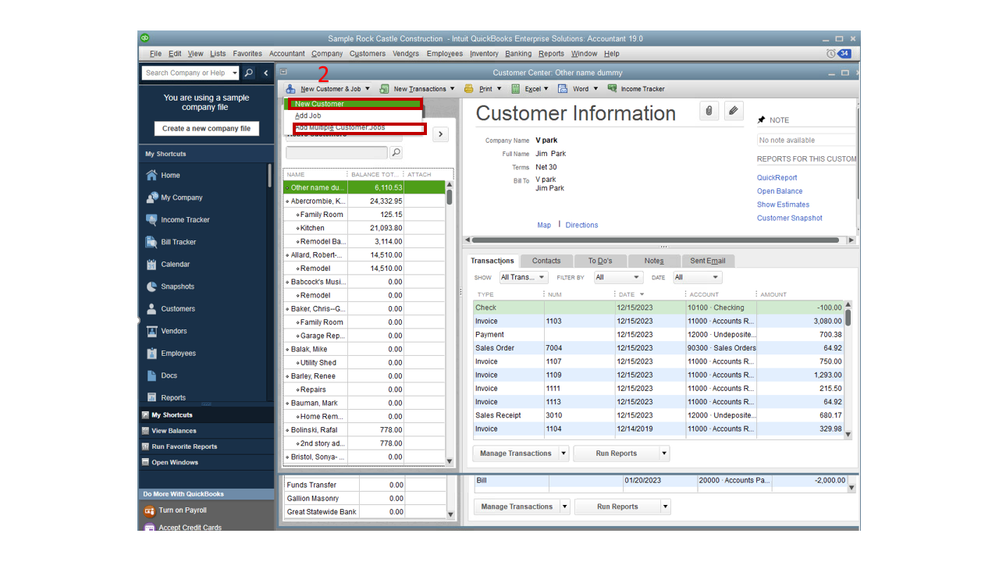

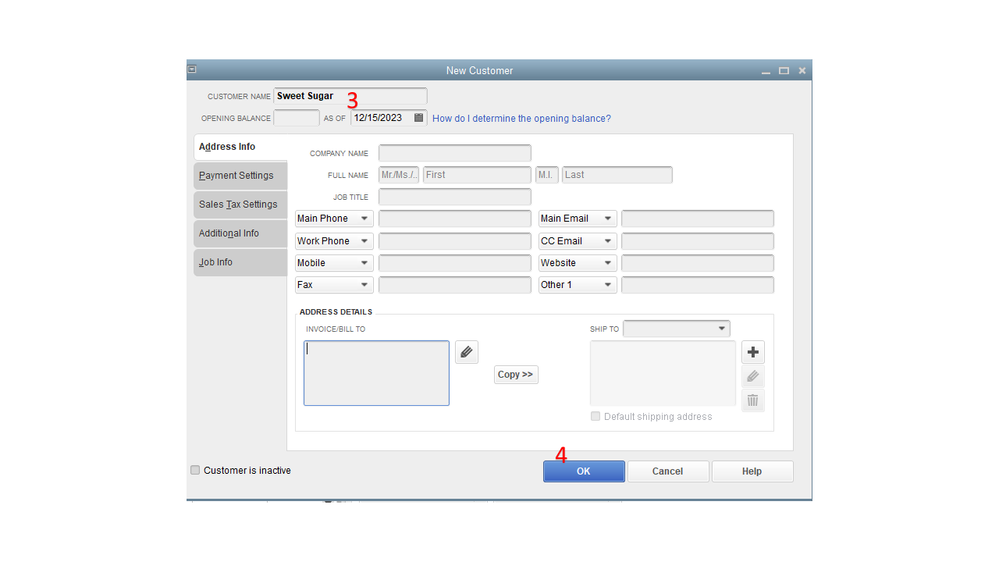

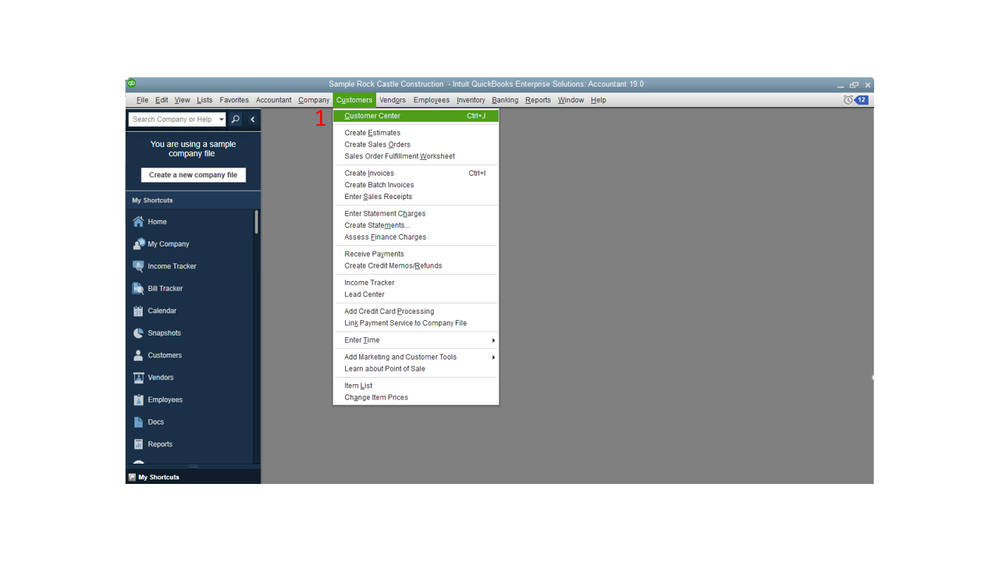

In QuickBooks, you’ll have to set up the owners as customers and then enter tenants as jobs. Please follow the steps below.

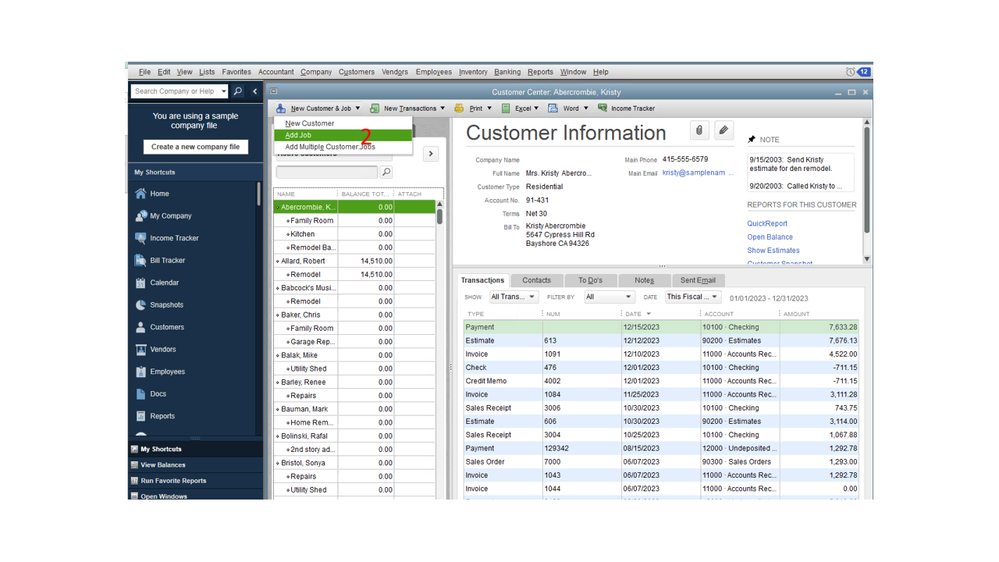

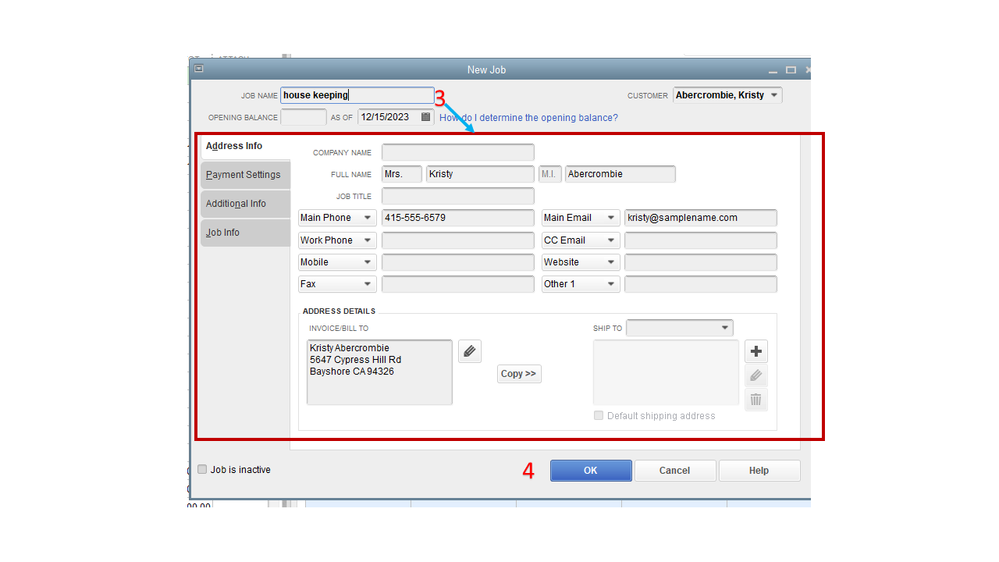

If you haven’t created the jobs, let’s go ahead and enter them. Here’s how:

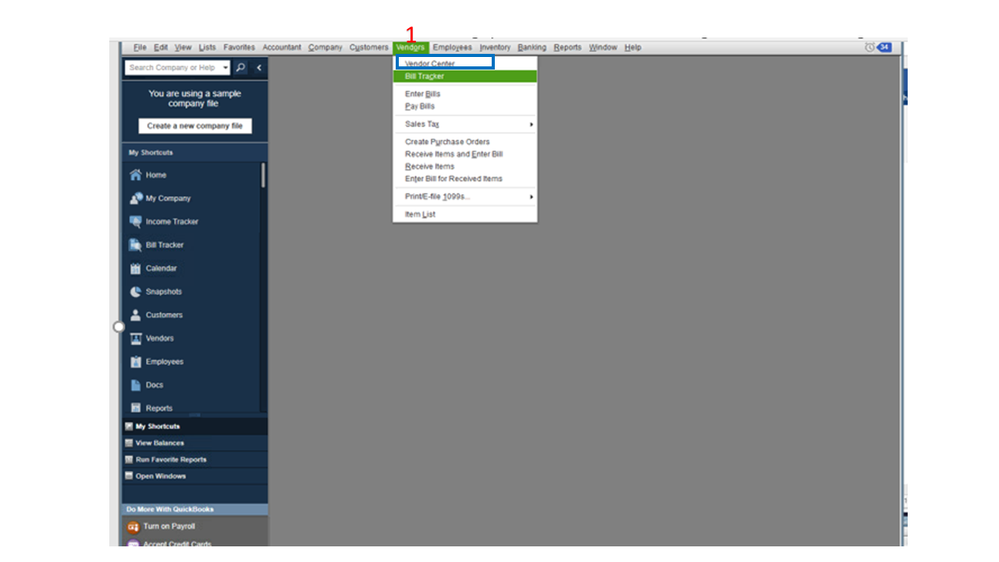

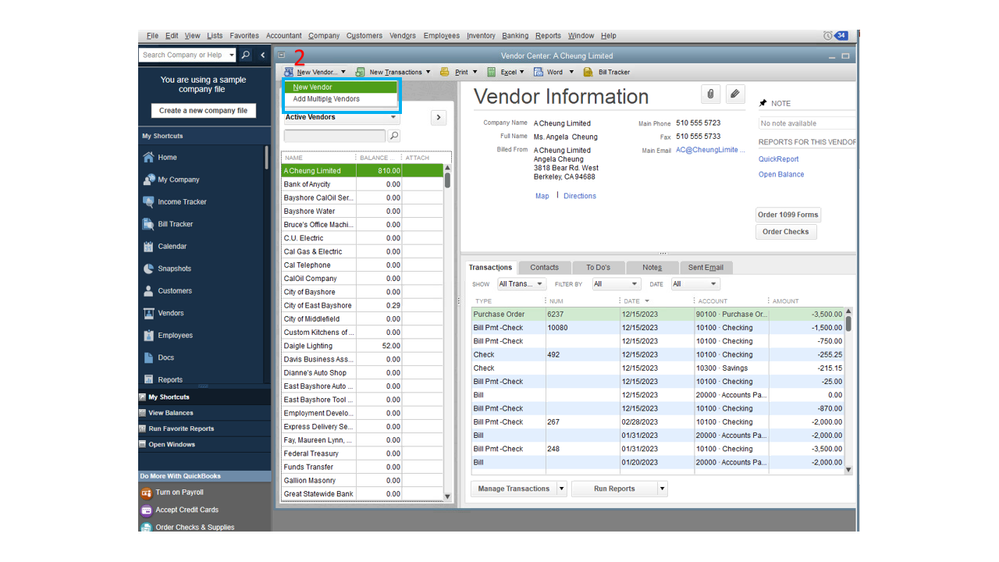

Please follow the same procedure for the remaining jobs you want to add. Next, enter your vendors and subcontractors.

The list will include your own property management company, and any other businesses you need to pay from the rental property company. For example, items such as taxes, mortgage, insurance, repairs, janitor, landscaping, and homeowner associations.

To continue setting up the properties, follow the steps in this article and go directly to the Create your billable services section: Create a property management company.

If you have any clarifications or questions while working in QuickBooks, post a comment below. I’ll jump right back in to assist further. Wishing you the best.

hi @TN-landlord ,

You may utilize the trial period of TP Importer for your needs.

https://transactionpro.grsm.io/fl-qbd

Hope it helps.

Hey there Rasa,

Thanks for the very personal response.

In my case I am importing transactions from my property manger, (so multiple accounts, mutiple properties) and then blending them with my own bank account transactions (multiple bank accounts and same properties. . .) This will allow me to have one P&L and one Balance Sheet, since my property manager does not have a balance sheet set up and I have some work done directly such as roofing etc.

I read the article about setting up a property company, but can you clarify some stuff for me?

(Note: I am really good with Quicken and have used 'tags' to identify properties for years. . . )

I need a discussion of how to separate these dimensions. (My accountant has the QB desktop at the office, but their office has no idea about how to set this up!!)

A) Property owning entities - Most landlords will have a one or two LLCs or partnerships which need to be tracked separately.B) Assigning costs to properties - I am confused about CLIENTS, JOBS, or CLASSES!! Different articles recommend different things. There is no overview about which to use when, i.e. the pros and cons. . .

Finally, my true request is on how to upload an excel file best. In quicken, I would have to upload the cost category concatenated with a "/" and then the tag. . . . Does Quickbooks have a separate field which I can map to, or will I also have a special concatenation needed?

Your discussion will certainly be worthy of a post to a QB user forum or a download. I am sure I am not the only person dealing with this quandry . . . .

Perhaps a TABLE showing precisely for

Reporting: Which reports will allow a view of select properties, select companies, or ALL?

In an ideal world, a report allowing one property per column. . . in a table. . . and rows for each cost type. . . .

Thanks for getting so specific and getting back to me. I an upload a sample file if needed.

TN-Landlord

Could you let me know the fee that you charge to set up a QBO for a landlord like me who hired a property management company to take care of the daily operation, advertising, send rent minus their fee to my account? I want to be able to send information for tax purposes to my accountant at the end of the year.

Hi there, @BellinghamLandlord.

Thank you for posting in the Community. There is a various fee to set up in QuickBooks Online. You can check out this link below for more detailed information that fits your business.

You can also check this: QuickBooks Online Compare. This tackle about feature comparison of all the QBO versions.

Just post in the Community if you have further questions about the QBO product. Have a great day!

Did you find this answer? I would find it helpful as well:

Perhaps a TABLE showing precisely for

QUICKEN for RENTAL was written by very young programmers without any adult supervision. It has very pretty but absolutely useless (whiz bang) pie charts of your expenses - fluff, but is totally ZERO at managing multiple tenants and properties in a structured form.

OR, it could be that their instructions and help on how to use it are totally ZERO and ti works just fine.

In any case my Vanderbilt degree in Computer Science and 20 years of management consulting in IT systems could not figure out how it can save me time and money. (or even report numbers which are important to me.)

VERDICT: Totally useless. I would gladly pay a premium for a QUICKEN product with real property management features.

TRUE, so TRUE.

Accountants are not 'wired' to set up systems, but they follow rules well.

Sort of like Lawyers, they will tell you, "Well, how would you like it?" And then leave the systems design to you and blame you if you don't like the results.

Pretty lame response which did not address the questions I was asking. I will probably continue using QUICKEN which does not charge me monthly for the software. It has all the features needed to manage property.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here