Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI'm new to QB Online and just set it up at the end of December. I setup my bank account so it would sync with QB and it pulled in transactions from 2022. I've been using QB Desktop for 10 years on another computer and all of my history through 2022 is there so I don't really need the 2022 data in the new QB Online. Is there a method for getting rid of the 2022 history so I can start fresh with 2023. I don't want to open up a can of worms but don't really want to see 2022 data in my reports either.

Thanks in advance for any suggestions

Ryan

Hello there, @CCT-Ryan. I'm here to help you remove the 2022 transactions in your QuickBooks Online (QBO) account.

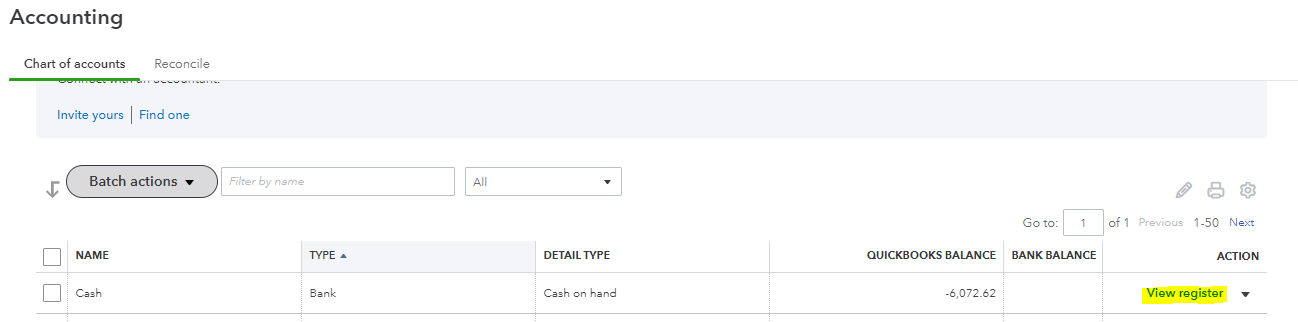

I appreciate you choosing QBO as your accounting partner and thanks for sharing detailed information about your concern. There are several ways you can perform to delete transactions in your company file. One way is to delete them manually, in the bank's register. But before that, I recommend exporting the 2022 data to Excel and saving it on your desktop or hard drive so you'll have a handy copy that you can use as a reference in the future.

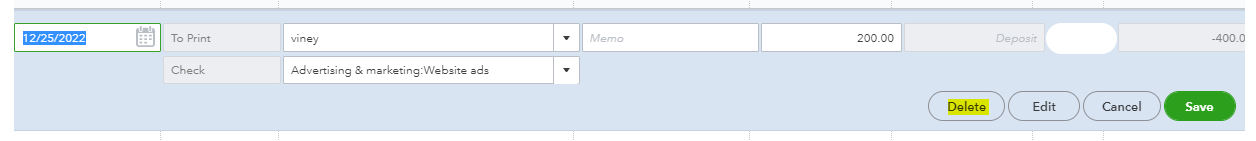

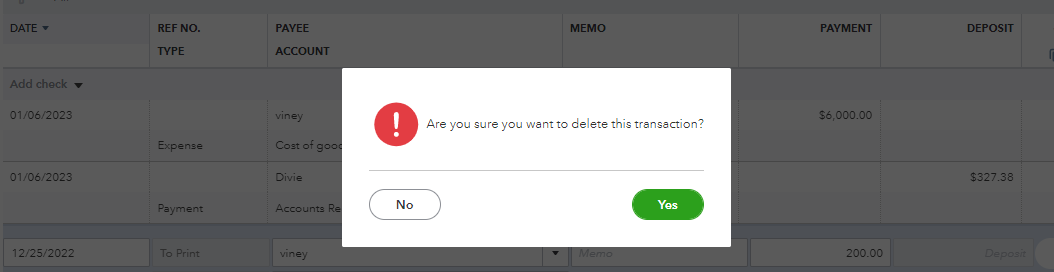

Once finished, follow the steps below to remove transactions in the bank register:

I also suggest reaching out to your accountant to ask for guidance if these transactions are already reconciled. It can affect your reconciliation reports and balances. For reference about the conversion process, check out this link: Learn about converting from QuickBooks Desktop to QuickBooks Online.

Another option is to export your report and list to Excel for the year you want to start your books and open a new QBO account. Then, import the data and input the opening balance for each account. You can also utilize the third-party application to migrate the transactions.

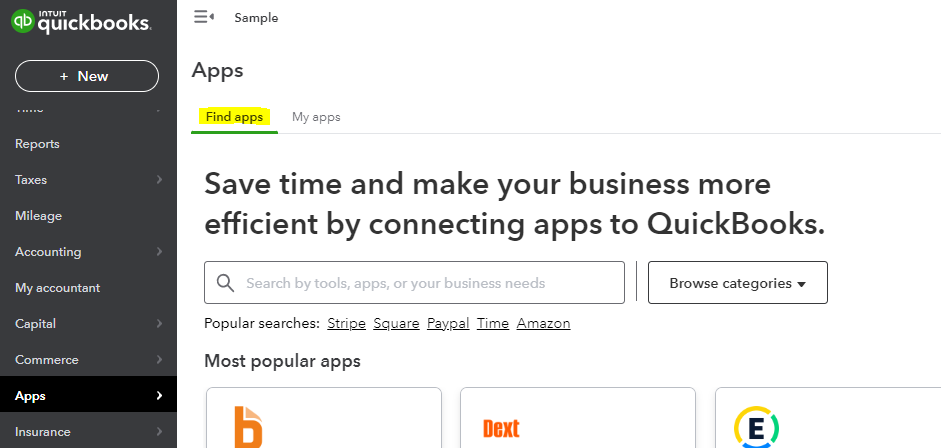

On the other hand, you can look for a 3rd party application that will help you delete the 2022 transactions and lists in bulk. To look for one, please head to our QuickBooks Apps Store or go to the Apps menu within your QBO account.

I've attached this helpful resource that you can use as a guide in setting up your QBO company file: Getting Started in QuickBooks Online.

Keep me posted if you have any other concerns about managing your transactions. I'll be always here to help. Have a good one.

Thank you for the reply, as mentioned in my previous post I have a full backup of the 2022 data in a separate QB Desktop. I'm starting brand new with QB Online as of Jan 1, 2023. I just set it up 2 weeks ago and when I setup my bank account for syncing transactions it pulled in transactions for the last fiscal year (2022). I don't need 2022 data though, just 2023.

I've not done any reconciling in the new QB Online because I literally just started using it 2 weeks ago and I'm really only interested in capturing data from Jan 1st 2023 and forward.

I just want to make sure I understand correctly. I can delete previous 2022 transactions from within my COA Bank Account register. But I can only delete items 1 at a time?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here