Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have received a number of shopify orders on my website, and I receive payments via credit card through shopify, and also Paypal.

My question is, let's say I have 5 orders that all paid through credit card on my website. I create individual invoices for each customer in QuickBooks Online. Then a few days later, Shopify will ACH transfer the amount received from these 5 orders(minus shopify fee) into my checking account.

How can I apply this transfer as received payment for the 5 orders, and then also what do I do with the fee? Or is it better to just mark each invoice as paid right away and the money is set to "undeposited funds" until I get the ACH from shopify.

I want to ensure I am handling these payments/invoices correctly.

Hello there, @BiggerFishing.

Let's ensure the invoice and payment for Shopify Orders are handled properly in QuickBooks.

Yes, you're correct. It would be better to mark each invoice as paid and set it to Undeposited funds. It's a holding account that tracks all the payments you receive by cash, check, and credit card before they are deposited into your bank account. Follow these steps:

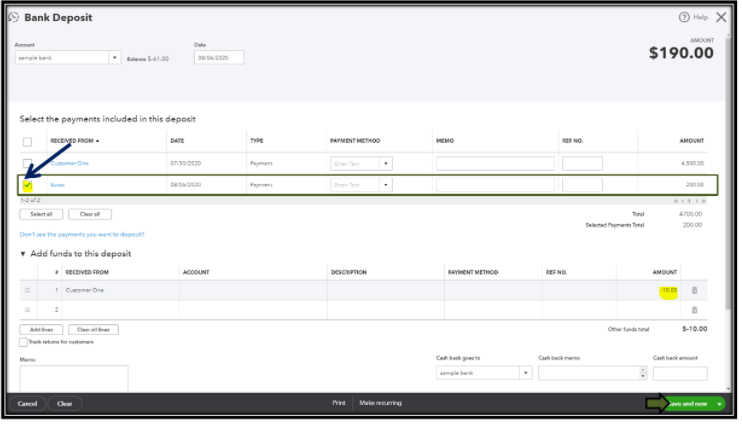

Then, what you can do with the fee is record a bank service charge as a negative amount using the Bank Deposit feature. Here's how:

Once you get the Shopify ACH transfer downloaded from the Banking menu, you can match the existing entries. For more tips and additional information on how you can keep your transactions organize, feel free to check the articles below:

Visit again if you have follow-up questions about handling transactions coming from a third-party merchant service. I'll be around to assist you. Take care always and have a good one!

Another option, consider having a 3rd party app to avoid any duplicate incomes. To reconcile your payouts can be a major time-suck. And when you're having to comb through hundreds or thousands of orders, that becomes a nightmare. You can set it once and the app can post a summary of your store sales. Your fees are split out so you can match your deposits and be done.

Thank you so much for that explanation. I have been able to create the invoice, then receive payment and have it deposit into undeposited funds.

The issue I am running into is that Quickbooks is asking me to review the transaction as well, and no option when I review to match any payments.

Let me give an example that may make my question clearer:

A customer named Bob places an order on my website for $15.00, pays credit card through shopify. I create an invoice in QB, and then immediately after I receive payment in QB for that invoice, I mark as 'shopify payment' as payment method I created, and I have funds deposit into category 'Undeposited Funds'

A few days later, Shopify transfers $14.25 to my bank(sale - fee). When I login to quickbooks, it already notices the transfer and asks me to review the transaction to log, which I can record as transfer, from undeposited funds but no option to link that payment from Bob, to mark his payment as deposited?

If I just go to new deposit and create manually I think I've got it, but the whole matching and review is confusing me thinking I may be accidentally duplicating it?

Let me shed a light on that process, BiggerFishing.

You'll have to deposit the payment first from the Undeposited Fund account to your bank account. This way, QuickBooks will be able to show that payment when matching the downloaded transaction.

Moreover, creating a bank deposit won't generate any duplicates since you're just moving the funds to the appropriate bank account. When you're ready, here's how to do it:

Lastly, I recommend reading this article to speed up the reviewing process of your downloaded online banking transactions: Set up bank rules in QuickBooks Online.

Feel welcome to tag me in your comments and posts if you need more help in handling your other transactions. Have a pleasant day ahead.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here